A) $21 200; $6 200

B) $21 200; ($6 200)

C) $23 200; $8 200

D) $23 200; ($8 200)

E) None of the given answers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Entity A contributes to a defined benefit superannuation plan for its employees. It calculates the following: Present value of the obligation 12,286 Fair value of plan assets 11,500 786 The $786 represents:

A) The expense to be recognised in the income statement.

B) The asset to be recognised in the balance sheet.

C) The liability to be recognised in the balance sheet.

D) The revenue to be recognised in the income statement.

E) The cash flow pertaining to the contributions made for the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a step in accounting for contributions to a defined benefit superannuation plan?

A) Determine the fair value of any plan.

B) Discount any benefit employees have earned.

C) Estimate the amount of benefits the employees have earned in return for their service in the current and prior periods.

D) Establish the numbers of years until retirement for each employee to accurately calculate their likely benefit.

E) Determine the total amount of actuarial gains and losses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Danish Ltd has an average weekly payroll of $200,000. The employees are entitled to 2 weeks', non-vesting sick leave per annum. Past experience suggests that 56 per cent of employees will take the full 2 weeks' sick leave and 22 per cent will take 1 week's leave each year. The rest of the employees take no sick leave. In the current week an employee with a weekly salary of $600 has been off sick for the first time this year. The employee took 2 days off out of her normal 5-day working week. Assuming that a weekly entry has been made to record the accumulated liability for sick leave and that PAYG tax is deducted at 30 per cent, what would the entry be to record the employee's weekly salary (round amounts to the nearest dollar) ?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

AASB 119 requires which items to be recorded at their discounted amounts?

A) Annual leave and sick leave if they are expected to be settled after 12 months have elapsed from reporting date.

B) Cumulative sick leave that has accrued for longer than 12 months.

C) Wages and salaries.

D) Annual leave that has accrued for longer than 12 months.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

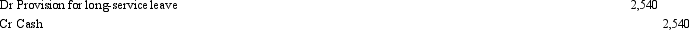

The following journal entry shows:

A) An (some) employee(s) may have taken long-service leave.

B) An (some) employee(s) may have been paid out their long-service leave entitlement upon resignation.

C) An employer is building up a provision account for long-service to enable it to account for leave taken in the future.

D) An (some) employee(s) may have taken long-service leave and an (some) employee(s) may have been paid out their long-service leave entitlement upon resignation

E) An (some) employee(s) may have taken long-service leave and an employer is building up a provision account for long-service to enable it to account for leave taken in the future.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A defined contribution superannuation plan is one in which:

A) The contributions to the plan only are paid out to members on retirement.

B) The benefits paid out by the plan are based on the average salary of an employee over a period of years as a reflection of the employee's contribution to the employer.

C) The contributions are defined by the amount needed to pay out benefits to the members at a specified level on retirement.

D) The benefits paid out by the plan depend on the contributions made to the plan and the earnings of that plan.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 67 of 67

Related Exams