A) $21,000

B) $19,000

C) $23,000

D) $14,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow may be used for all of the following except to:

A) expand the business.

B) pay off debt.

C) build up the cash balance.

D) pay employees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be reported on the statement of cash flows,using the direct method,as a cash flow from operating activities?

A) Payment of income taxes.

B) Payment of dividends.

C) Purchase of a building.

D) Purchase of treasury stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the calculation of cash flows from operating activities starts with net income,the company:

A) is using the net income method.

B) will remove the effects of all noncash items included in the calculation of net income.

C) is using the direct method.

D) will add all noncash items not included in the calculation of net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the first step in calculating cash flows from operations when the indirect method is used?

A) Find net income on the income statement.

B) Calculate the net change in the cash account.

C) Add the change in accounts receivable to sales revenue.

D) Identify the balance sheet accounts that relate to operating activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

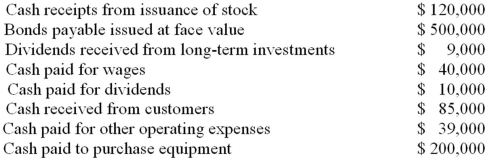

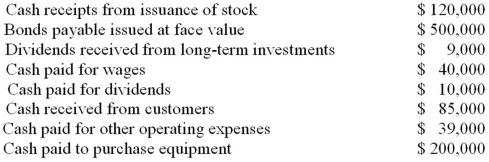

Flynn Corporation had the following cash flows for the current year.The company uses the direct method in preparing the statement of cash flows.Use the information above to answer the following question.What is the net cash provided by (used in) investing activities?

A) ($200,000)

B) $420,000

C) $410,000

D) ($190,000)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in cash flows from financing activities?

A) Cash proceeds from sales.

B) Cash received from a sale of land.

C) Dividends paid to stockholders.

D) Cash used to purchases of equipment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company's sales revenue was $171,356 and cash collected from customers was $167,803,which of the following would be consistent with this difference?

A) Accounts receivable could have decreased.

B) Cash payments could have been larger than the expense accounts.

C) Accounts receivable could have increased.

D) Cash payments could have been smaller than the expense accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the direct method is used to determine the cash flows from operating activities,which of the following adjustments must be made to income tax expense to determine total income tax payments?

A) Add all changes in income taxes and income taxes payable.

B) Add decreases in income taxes payable and subtract increases in income taxes payable.

C) Add increases in income taxes payable and subtract decreases in income taxes payable.

D) Subtract all changes in income taxes payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the reporting of operating cash flows using the direct method is true?

A) Although most U.S.companies use the indirect method,the Financial Accounting Standards Board (FASB) prefers the direct method of accounting for cash flows from operating activities.

B) The FASB prefers the indirect method of calculating cash flows from operations because it gives a more accurate calculation of cash provided by operating activities.

C) The direct method results in a larger amount of cash flow from operating activities than does the indirect method.

D) The direct and indirect methods use different presentations for cash flows from investing and financing activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the calculation of cash flows from operating activities under the direct method is true?

A) When the direct method is used,each revenue and expense account on the income statement is individually examined to calculate the cash flows from operating activities.

B) Noncash revenues and expenses must be included in cash flows from operating activities when preparing a statement of cash flows using the direct method.

C) Depreciation is reported as a cash inflow in the cash flows from operating activities when the direct method is used.

D) A loss on the sale of a long-term asset is subtracted in the cash flows from operating activities when the direct method is useD.The direct method converts revenues to cash receipts and expenses to cash disbursements in order to determine the net cash flow from operating activities.Noncash revenues and expenses,including gains and losses,are not used in the calculation of operating cash flows using the direct method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If wages expense is $450,000 and the beginning and ending balances of wages payable are $18,000 and $16,500,respectively,the cash paid to employees is:

A) $450,000.

B) $433,500.

C) $448,500.

D) $451,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

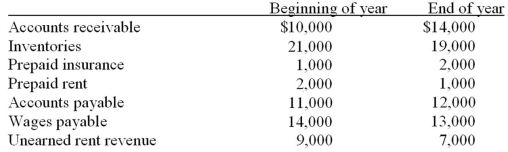

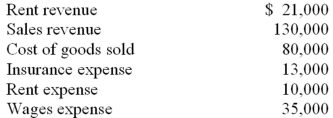

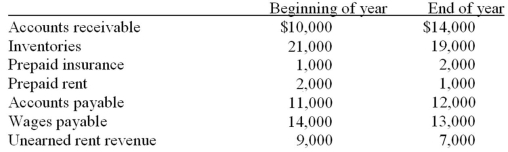

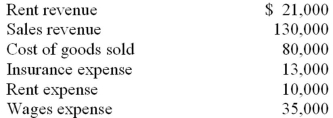

The income statement for the year contains the following: Use the information above to answer the following question.What is the amount of cash collected from customers?

A) $130,000

B) $134,000

C) $126,000

D) $116,000

Correct Answer

verified

Correct Answer

verified

True/False

If a company reports negative net cash flow from operating activities,positive net cash flow from investing activities,and zero net cash flow from financing activities,this suggests that the company is selling its productive assets to cover its operating activities outflows.Positive net cash flow from investing activities indicate sales of productive assets,and negative net cash flow from operating activities indicate a need for another source of cash to cover operating cash outflows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not needed to prepare a statement of cash flows?

A) Statement of retained earnings.

B) Comparative balance sheet.

C) Additional information on financing and investing activities.

D) Income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding financing activities is not true?

A) Cash dividends paid to a company's stockholders are reported as cash outflows from financing activities.

B) When a company issues stock for cash,it reports a cash inflow from financing activities.

C) When a company repurchases stock with cash,it reports a cash outflow for financing activities.

D) When a company repays a loan,it reports a cash inflow from financing activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Almost all U.S.companies have used the indirect method of preparing the statement of cash flows:

A) because most users of the financial statements do not understand the direct method.

B) in spite of the Financial Accounting Standard Board's stated preference for the direct method.

C) because it usually requires less space in the annual report.

D) so that stockholders cannot determine how much cash was spent on executives' salaries.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income statement for the year contains the following: Use the information above to answer the following question.What is the amount of cash paid for wages?

A) $34,000

B) $35,000

C) $36,000

D) $22,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flynn Corporation had the following cash flows for the current year.The company uses the direct method in preparing the statement of cash flows.Use the information above to answer the following question.What is the net cash provided by (used in) operating activities?

A) $15,000

B) $6,000

C) ($4,000)

D) ($75,000)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If interest revenue for the period is $14,000 and the beginning and ending interest receivable balances are $1,320 and $5,900,respectively,cash received for interest is:

A) $14,000.

B) $9,420.

C) $18,500.

D) $8,100.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 138

Related Exams