A) a $20.00 favorable price variance.

B) a $22.00 favorable price variance.

C) a $6.00 unfavorable quantity variance.

D) a $18.00 favorable price variance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the total standard cost and the total actual cost is the

A) standard cost card amount.

B) labor rate variance.

C) materials price variance.

D) cost variance.

Correct Answer

verified

Correct Answer

verified

Essay

The difference between the actual cost of an item and its standard cost is called a(n)___________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An unfavorable price variance for materials means that

A) the actual cost of the materials was more than the budgeted amount.

B) more materials were used in production than anticipated.

C) more labor hours were required to work with the materials than expected.

D) the actual cost of the materials was more than the standard cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard quantity of materials for a product was 40 pounds per unit at the standard price of $2.00 per pound.The actual price per pound of materials was $1.50,and the actual quantity used was 44 pounds.An analysis would indicate

A) a $20.00 favorable price variance.

B) a $8.00 favorable quantity variance.

C) a $6.00 unfavorable quantity variance.

D) a $8.00 unfavorable quantity variance.

Correct Answer

verified

Correct Answer

verified

Essay

The quantity variance for an item is the difference between its actual quantity and its standard quantity,multiplied by the ____________________ cost of the item.

Correct Answer

verified

Correct Answer

verified

True/False

The setting of standard wage rates is usually a function of the personnel department.

Correct Answer

verified

Correct Answer

verified

Essay

Management expresses its operating plan in monetary units when it completes a(n)____________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a factory,the fixed costs are $6,000 when 600 units are produced.If 900 units are produced,the fixed costs per unit would be

A) $10.00.

B) $9.00.

C) $7.50.

D) $6.67.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

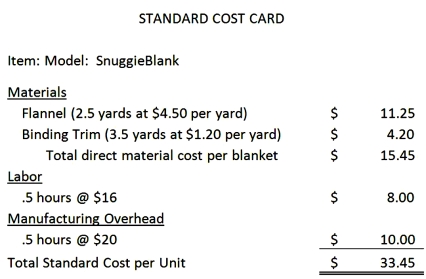

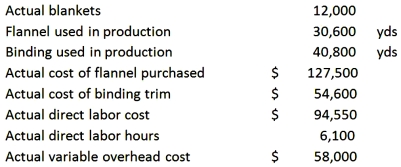

Better Blankets,Inc.makes a SnuggieBlank using flannel material and trim binding.They have instituted a successful JIT system and thus no longer have to stock inventory prior to their production need.The Standard Cost Card for The SnuggieBlank model is shown.  The company reported the following results concerning January results:

The company reported the following results concerning January results:  The labor efficiency variance in January is:

The labor efficiency variance in January is:

A) $3,050 favorable.

B) $3,050 unfavorable.

C) $1,600 favorable.

D) $1,600 unfavorable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Costmore Company uses standard costing and has established the following standards for direct materials and direct labor for each unit it makes:  During July,the company made 4,000 units of product and used 13,000 gallons.The actual price paid for materials was $5.20 per gallon. Direct Labor used was 3,600 hours and workers were paid $11.75 per hour.

An analysis would indicate

During July,the company made 4,000 units of product and used 13,000 gallons.The actual price paid for materials was $5.20 per gallon. Direct Labor used was 3,600 hours and workers were paid $11.75 per hour.

An analysis would indicate

A) a $900 unfavorable labor rate variance.

B) a $900 favorable labor rate variance.

C) a $4,800 unfavorable labor rate variance.

D) a $4,800 favorable labor rate variance.

Correct Answer

verified

Correct Answer

verified

Essay

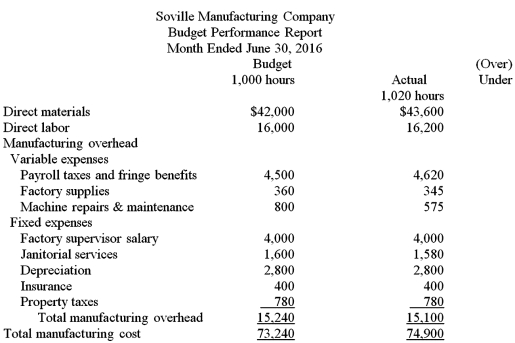

Complete the Budget Performance Report for Soville Manufacturing.Create a flexible budget by adding a budget column at the actual number of labor hours.Compare the actual to the flexible budget numbers you calculated.

Complete the Budget Performance Report for Soville Manufacturing.Create a flexible budget by adding a budget column at the actual number of labor hours.Compare the actual to the flexible budget numbers you calculated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costs that reflect what costs should be for the units of product manufactured during the period under normal efficient operating conditions are known as

A) variable costs.

B) fixed costs.

C) standard costs.

D) semi-variable costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A budget prepared using several differing levels of activity is a

A) fixed budget.

B) flexible budget.

C) manufacturing cost budget.

D) budget performance report.

Correct Answer

verified

Correct Answer

verified

True/False

The controllable overhead variance compares the actual overhead costs incurred with what the costs should have been for the units produced.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

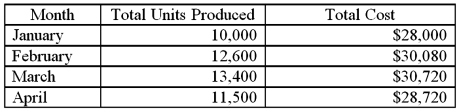

Use the high-low point method to determine total costs if 16,000 units are produced.

Use the high-low point method to determine total costs if 16,000 units are produced.

A) $20,000

B) $22,800

C) $30,000

D) $32,800

Correct Answer

verified

Correct Answer

verified

True/False

Direct materials and direct labor are examples of costs that tend to vary directly with the volume of output.

Correct Answer

verified

Correct Answer

verified

True/False

A fixed budget includes only fixed manufacturing costs.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 118 of 118

Related Exams