A) It is a list of all persons and companies that the company pays money during a period.

B) It is a report that becomes published with other financial reports.

C) It is a worksheet that accountants use to ensure payroll accuracy.

D) It is an individual register maintained for each employee, listing of all the payroll information.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

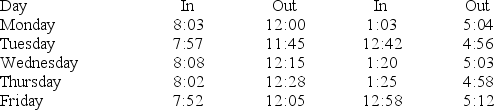

Brandie is an hourly worker whose employer uses the hundredth-hour method. During a one-week period, she worked the following hours:  Using the hundredth-hour method, how many hours did she work that week? (Do not round interim calculations. Round final answer to two decimal places.)

Using the hundredth-hour method, how many hours did she work that week? (Do not round interim calculations. Round final answer to two decimal places.)

A) 40.17 hours

B) 40.21 hours

C) 40.27 hours

D) 41.26 hours

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nicholas is the driver for a company executive. He is paid $13.50 per hour for his services and overtime only for hours worked in excess of 40 hours per week. His actual driving time varies, depending on the needs of the executive. Which of the following is true about Nicholas's compensation?

A) Nicholas must maintain a log of miles driven to document his activities.

B) Nicholas will be compensated only for the hours during which he is driving.

C) Nicholas will receive compensation for wait time when it is for the firm's benefit.

D) Nicholas will not receive compensation for idle times when is waits for the executive to conduct business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of using combination pay methods is to:

A) Reduce salary expenses by offering variable compensation.

B) Cross-train employees in various company functions.

C) Offer employees an incentive for increased performance.

D) Meet minimum wage requirements and offer pay for performance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

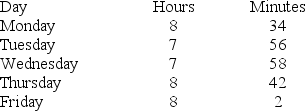

Quinn works the following hours during a one-week period:  Under the hundredth-hour method, how many hours has he worked?

Under the hundredth-hour method, how many hours has he worked?

A) 41.25 hours

B) 41.85 hours

C) 41.53 hours

D) 41.20 hours

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a class of worker that may receive an hourly rate below the Federal minimum wage?

A) Disabled employees in occupations unrelated to their disability.

B) Full-time college students in agricultural occupations.

C) A 16 year-old employee in the first 90 days of work.

D) A student learner currently enrolled in a vocational education program.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following automatically exempts an employer from FLSA provisions? (Select all that apply.)

A) The firm has annual volume of less than $500,000.

B) The firm is a school for physically handicapped children.

C) The firm is a governmental agency.

D) The firm conducts no interstate commerce.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grainne is an inside salesperson who earns an annual salary of $32,800 (paid biweekly) plus a commission on quarterly sales that is paid on the first pay date on the next quarter. She receives a 1% commission for quarterly sales totaling $0 to $25,000, a 2% commission for quarterly sales totaling between $25,001 and $50,000, and a 3% commission for quarterly sales totaling over $50,001. During the second quarter, Grainne's quarterly sales totaled $46,750. What is her gross pay for the first pay period in July? (Do not round interim calculations. Round final answer to 2 decimal places.)

A) $1,729.04

B) $2,301.67

C) $2,196.54

D) $2,664.04

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adam is a nonexempt employee who is single with one withholding allowance and earns $15 per hour and has a standard 40-hour workweek. During a weekly pay period, he worked 46 hours. What is Adam's gross pay for the period? (Do not round interim calculations. Round final answer to 2 decimal places.)

A) $600.00

B) $690.00

C) $735.00

D) $1,035.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maribeth is a wedding cake designer who earns $120 per completed cake. She is married with zero withholding allowances and earns minimum wage (i.e., $7.25 per hour) for non-productive time during a 40-hour workweek. During a weekly pay period, she worked 45 hours, 3 of which were non-productive time, and completed 9 cakes. What is Maribeth's gross pay? (Do not round interim calculations. Round final answer to 2 decimal places.)

A) $1,101.75

B) $1,161.75

C) $1,176.25

D) $1,569.38

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the FLSA, when must overtime be paid to nonexempt employees?

A) Any time the employee works more than 8 hours per day.

B) Any time the employee works more than 6-days during a one-week period.

C) Any hours worked in excess of 40 in a 7-day, 168-hour period.

D) Any hours deemed overtime by the employee's supervisor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alix is a salesperson who receives an annual salary of $18,000 paid semimonthly plus commissions of 5% of the retail price of each unit he sells which is paid on the final pay date of the month. During his first month of employment, he sold four units for a total of $1,000 and requested a 5% draw against his $15,000 monthly minimum sales, in accordance with his employment agreement. How much should Alix receive in his gross pay for the end of his first month?

A) $800.00

B) $1,250.00

C) $1,550.00

D) $1,750.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

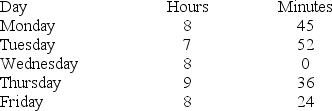

Brendan is an hourly worker. During a week's pay period, he worked the following hours and minutes:  Using the quarter-hour method, how many total hours did Brendan work that week?

Using the quarter-hour method, how many total hours did Brendan work that week?

A) 41.75 hours

B) 42.50 hours

C) 43.25 hours

D) 42.25 hours

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maryann is a salaried exempt worker who earns $45,000 per year for a 35-hour workweek. During a biweekly pay period, she worked 65 hours. What is her gross pay?

A) $1,607.45

B) $1,730.77

C) $1,916.21

D) $1,823.45

Correct Answer

verified

Correct Answer

verified

True/False

Federal policy explains clear differences between exempt and nonexempt employees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

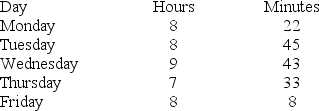

Betsy is a salaried nonexempt worker who earns $39,500 per year for a 40-hour workweek. During a weekly pay period, she worked the following hours:  Her employer uses a hundredth-hour method to computer overtime pay. The employer pays overtime for all time worked in excess of 40 hours per week. What is Betsy's gross pay for the week? (Do not round interim calculations. Round final answer to 2 decimal places.)

Her employer uses a hundredth-hour method to computer overtime pay. The employer pays overtime for all time worked in excess of 40 hours per week. What is Betsy's gross pay for the week? (Do not round interim calculations. Round final answer to 2 decimal places.)

A) $819.44

B) $759.62

C) $799.52

D) $831.30

Correct Answer

verified

Correct Answer

verified

True/False

The hundredth-hour system promotes more accuracy in employee time collection than the quarter-hour system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andre works for a bakery as a cake decorator and receives a base annual salary of $30,000 (paid weekly) as well as piece-rate pay of 25% of the retail price for any wedding cake that he decorates. His piece-rate earnings are totaled on a monthly basis and are paid on the first pay date of the following month. During the month of June, he decorated eight wedding cakes with a total retail value of $2,650. What is Andre's gross pay for the first week in July? (Do not round intermediate calculations. Round final answer to 2 decimal places.)

A) $1,427.53

B) $1,485.96

C) $1,239.42

D) $1,526.78

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joanna, a salaried nonexempt employee, earns a salary of $38,950 for a standard 37.5-hour workweek and is paid weekly. During a weekly period, she worked 6 hours of overtime. Her gross pay for the week would be________. (Do not round interim calculations. Round final answer to two decimal places.)

A) $928.81

B) $936.52

C) $868.88

D) $894.22

Correct Answer

verified

Correct Answer

verified

True/False

To compute the hourly rate for an employee with a 40-hour standard workweek, you would divide the annual salary by 2,080.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 83

Related Exams