A) domestic consumption.

B) foreign borrowing from the home country.

C) foreign investment in the home country.

D) foreign consumption.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

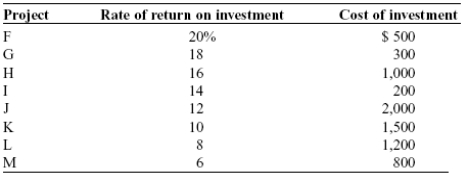

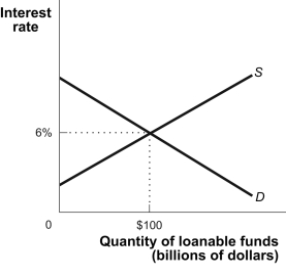

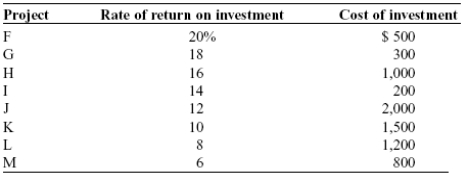

Use the following to answer questions:  -(Table: Investment Projects) Use Table: Investment Projects. If the market interest rate is 13%, the amount of planned investment spending is:

-(Table: Investment Projects) Use Table: Investment Projects. If the market interest rate is 13%, the amount of planned investment spending is:

A) $200.

B) $800.

C) $1,000.

D) $2,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a simple closed economy, all investment spending must come from:

A) savings.

B) money creation.

C) debt issuance.

D) foreign borrowing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the savings-investment spending identity:

A) savings and investment spending are always equal for the economy as a whole.

B) for long-run economic growth, savings must be more than investment spending.

C) for long-run economic growth, savings must be less than investment spending.

D) the identity of savers and investors is important for encouraging long-run economic growth.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

MOST physical capital, except for infrastructure, is provided by: I. governments through public education. II) investment spending by private sector firms.

A) I only

B) II only

C) both I and II

D) neither I nor II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions:  -(Table: Investment Projects) Use Table: Investment Projects. If the market interest rate is 9%, the amount of planned investment spending is:

-(Table: Investment Projects) Use Table: Investment Projects. If the market interest rate is 9%, the amount of planned investment spending is:

A) $1,800.

B) $2,000.

C) $4,000.

D) $5,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes equal:

A) government spending plus private savings.

B) total spending minus consumption minus investment minus private savings.

C) total income minus consumption minus private savings.

D) consumption plus private savings plus total income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

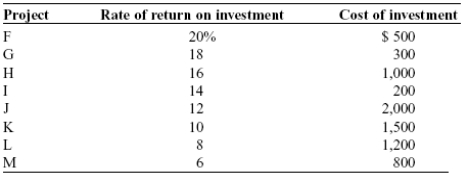

Use the following to answer questions:  -(Figure: Loanable Funds) Use Figure: Loanable Funds. Which scenario might produce a new equilibrium interest rate of 4% and a new equilibrium quantity of loanable funds of $75 billion?

-(Figure: Loanable Funds) Use Figure: Loanable Funds. Which scenario might produce a new equilibrium interest rate of 4% and a new equilibrium quantity of loanable funds of $75 billion?

A) Profit expectations for business investments become less optimistic.

B) Capital inflows from foreign citizens decline.

C) The federal government runs a budget deficit, rather than a surplus.

D) The government eliminates taxes on income from interest earned.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial system performs certain tasks to make the financial market more efficient. These tasks do NOT include:

A) reducing risk.

B) reducing menu costs.

C) reducing transaction costs.

D) providing liquidity.

Correct Answer

verified

Correct Answer

verified

True/False

The savings-investment spending identity says that savings and investment spending are always equal for the economy as a whole.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

National savings is the sum of private savings and:

A) private consumption.

B) government tax revenue.

C) the budget balance.

D) trade surplus.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If in an open economy a country imports more than it exports and the government budget deficit increases, interest rates will _____ and the amount of borrowing will _____.

A) increase; increase

B) decrease; increase

C) increase; change unpredictably

D) change unpredictably; increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given an annual interest rate of 2%, the present value of a future payment of $1,500 to be paid in one year is:

A) $1,250.55.

B) $1,470.59.

C) $1,530.

D) $1,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GDP is $12 trillion this year in a closed economy. Consumption is $8 trillion and government spending is $2 trillion. Taxes are $0.5 trillion. How much is investment spending?

A) $3.5 trillion

B) $3 trillion

C) $2.5 trillion

D) $2 trillion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The main role of financial systems is to:

A) make the capitalist class richer.

B) provide credit cards to as many people as possible.

C) channel goods and services to the people willing to pay for them.

D) channel funds from savers into investments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common strategy to reduce the risk of a large financial loss is to:

A) buy and sell assets through a mutual fund since mutual funds cannot lose money.

B) diversify financial assets so that their risks of failure are unrelated.

C) buy financial assets from developing countries because the rates of return are very high and safe and their national currencies are much more stable than the U.S. dollar.

D) buy real instead of financial assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A financial asset is:

A) a physical asset like a car.

B) a claim that entitles the owner to future income from the seller.

C) the value of accumulated savings.

D) another term for capital.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If interest rates increase, making bonds more attractive, the demand for stock will _____ and the price of stock will _____.

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions:  -(Table: Investment Projects) Use Table: Investment Projects. If the market interest rate is 15%, the last project undertaken is:

-(Table: Investment Projects) Use Table: Investment Projects. If the market interest rate is 15%, the last project undertaken is:

A) F.

B) G.

C) H.

D) I.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Transactions costs are likely to be the HIGHEST for:

A) loans.

B) bonds.

C) stocks.

D) bank deposits.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 355

Related Exams