A) the market value of the stock on the date of declaration.

B) the average price paid by stockholders on outstanding shares.

C) the par or stated value of the stock.

D) zero.

Correct Answer

verified

Correct Answer

verified

True/False

A 10% stock dividend will increase the number of shares outstanding but the book value per share will decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders of a corporation directly elect

A) the president of the corporation.

B) the board of directors.

C) the treasurer of the corporation.

D) all of the employees of the corporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term legal capital is a descriptive term for

A) stockholders' equity.

B) par value.

C) residual equity.

D) market value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When retained earnings are restricted, total retained earnings

A) are unaffected.

B) increase.

C) decrease.

D) may increase or decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not considered a disadvantage of the corporate form of organization?

A) Additional taxes.

B) Government regulations.

C) Limited liability of stockholders.

D) Separation of ownership and management.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability of a corporation to obtain capital is

A) enhanced because of limited liability and ease of share transferability.

B) less than a partnership.

C) restricted because of the limited life of the corporation.

D) about the same as a partnership.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

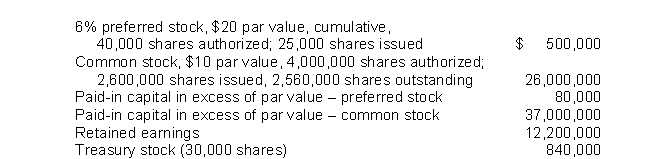

Racer Corporation's December 31, 2017 balance sheet showed the following:  Racer's total stockholders' equity was

Racer's total stockholders' equity was

A) $76,620,000.

B) $63,580,000.

C) $75,780,000.

D) $74,940,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate board of directors does not generally

A) select officers.

B) formulate operating policies.

C) declare dividends.

D) execute policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net effects on the corporation of the declaration and payment of a cash dividend are to

A) decrease liabilities and decrease stockholders' equity.

B) increase stockholders' equity and decrease liabilities.

C) decrease assets and decrease stockholders' equity.

D) increase assets and increase stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nice Corporation issues 40,000 shares of $100 par value preferred stock for cash at $110 per share. The entry to record the transaction will consist of a debit to Cash for $4,400,000 and a credit or credits to

A) Preferred Stock for $4,400,000.

B) Preferred Stock for $4,000,000 and Paid-in Capital in Excess of Par Value-Preferred Stock for $400,000.

C) Preferred Stock for $4,000,000 and Retained Earnings for $300,000.

D) Paid-in Capital from Preferred Stock for $4,400,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The declaration of a small stock dividend will

A) increase paid-in capital.

B) change the total of stockholders' equity.

C) increase total liabilities.

D) increase total assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock is

A) stock issued by the U.S.Treasury Department.

B) stock purchased by a corporation and held as an investment in its treasury.

C) corporate stock issued by the treasurer of a company.

D) a corporation's own stock, which has been reacquired and held for future use.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jahnke Corporation issued 8,000 shares of €2 par value ordinary shares for €11 per share. The journal entry to record the sale will include

A) a debit to Cash for €16,000.

B) a credit to Share Premium-Ordinary for €72,000.

C) a credit to Share Capital-Ordinary for €88,000.

D) a debit to Retained Earnings for €72,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not necessary in order for a corporation to pay a cash dividend?

A) Adequate cash.

B) Approval of stockholders.

C) Declared dividends.

D) Retained earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Freidrichs Company has issued and outstanding 11,000 shares of cumulative, 6%, €50 par value preference shares which it sold for €54 per share at the beginning of 2015. The company has never paid preference dividends. As of December 31, 2017, dividends in arrears are

A) €66,000.

B) €99,000.

C) €121,500.

D) €106,920.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paid-in Capital in Excess of Par Value

A) is credited when no-par stock does not have a stated value.

B) is reported as part of paid-in capital on the balance sheet.

C) represents the amount of legal capital.

D) normally has a debit balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about treasury stock is true?

A) Few corporations have treasury stock.

B) Purchasing treasury stock is done to eliminate hostile shareholder buyouts.

C) Companies acquire treasury stock to increase the number of shares outstanding.

D) Companies acquire treasury stock to decrease earnings per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true of a corporation?

A) It may buy, own, and sell property.

B) It may sue and be sued.

C) The acts of its owners bind the corporation.

D) It may enter into binding legal contracts in its own name.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a right or preference associated with preferred stock?

A) The right to vote.

B) First claim to dividends.

C) Preference to corporate assets in case of liquidation.

D) To receive dividends in arrears before common stockholders receive dividends.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 215

Related Exams