A) Amortization Expense.

B) Accumulated Amortization.

C) Accumulated Depreciation.

D) Patents.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recording the acquisition cost of an entire business,

A) goodwill is recorded as the excess of cost over the fair value of identifiable net assets.

B) assets are recorded at the seller's book values.

C) goodwill, if it exists, is never recorded.

D) goodwill is recorded as the excess of cost over the book value of identifiable net assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 1, 2015, Holt Company places a new asset into service. The cost of the asset is $120,000 with an estimated 5-year life and $30,000 salvage value at the end of its useful life. What is the depreciation expense for 2015 if Holt Company uses the straight-line method of depreciation?

A) $4,500

B) $24,000

C) $6,000

D) $12,000

Correct Answer

verified

Correct Answer

verified

True/False

Ordinary repairs should be recognized when incurred as revenue expenditures.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Equipment that cost $420,000 and on which $200,000 of accumulated depreciation has been recorded was disposed of for $180,000 cash. The entry to record this event would include a

A) gain of $40,000.

B) loss of $40,000.

C) credit to the Equipment account for $220,000.

D) credit to Accumulated Depreciation for $200,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sargent Corporation bought equipment on January 1, 2015. The equipment cost $360,000 and had an expected salvage value of $60,000. The life of the equipment was estimated to be 6 years. The depreciable cost of the equipment is

A) $360,000.

B) $300,000.

C) $200,000.

D) $50,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning financial statement presentation is not a true statement?

A) Intangibles are reported separately under Intangible Assets.

B) The balances of major classes of assets may be disclosed in the footnotes.

C) The balances of the accumulated depreciation of major classes of assets may be disclosed in the footnotes.

D) The balances of all individual assets, as they appear in the subsidiary plant ledger, should be disclosed in the footnotes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A gain on sale of a plant asset occurs when the proceeds of the sale are greater than the

A) salvage value of the asset sold.

B) market value of the asset sold.

C) book value of the asset sold.

D) accumulated depreciation on the asset sold.

Correct Answer

verified

Correct Answer

verified

True/False

An exchange of plant assets has commercial substance if the future cash flows change as a result of the exchange.

Correct Answer

verified

Correct Answer

verified

True/False

The asset turnover is calculated as total sales divided by ending total assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

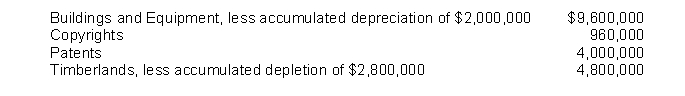

A company has the following assets:  The total amount reported under Property, Plant, and Equipment would be

The total amount reported under Property, Plant, and Equipment would be

A) $19,360,000.

B) $14,400,000.

C) $18,400,000.

D) $15,360,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Losses on an exchange of plant assets that has commercial substance are

A) not possible.

B) deferred.

C) recognized immediately.

D) deducted from the cost of the new asset acquired.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased factory equipment on April 1, 2015 for $160,000. It is estimated that the equipment will have a $20,000 salvage value at the end of its 10-year useful life. Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at December 31, 2015 is

A) $16,000.

B) $14,000.

C) $10,500.

D) $12,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 1, 2015, Jenks Company purchased the copyright to Jackson Computer tutorials for $324,000. It is estimated that the copyright will have a useful life of 5 years with an estimated salvage value of $24,000. The amount of Amortization Expense recognized for the year 2015 would be

A) $64,800.

B) $30,000.

C) $60,000.

D) $32,400.

Correct Answer

verified

Correct Answer

verified

True/False

Land improvements are generally charged to the Land account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true of ordinary repairs?

A) They primarily benefit the current accounting period.

B) They can be referred to as revenue expenditures.

C) They maintain the expected productive life of the asset.

D) They increase the productive capacity of the asset.

Correct Answer

verified

Correct Answer

verified

True/False

A change in the estimated useful life of a plant asset may cause a change in the amount of depreciation recognized in the current and future periods, but not to prior periods.

Correct Answer

verified

Correct Answer

verified

True/False

Capital expenditures are expenditures that increase the company's investment in productive facilities.

Correct Answer

verified

Correct Answer

verified

True/False

The Accumulated Depletion account is deducted from the cost of the natural resource in the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A truck was purchased for $180,000 and it was estimated to have a $36,000 salvage value at the end of its useful life. Monthly depreciation expense of $3,000 was recorded using the straight-line method. The annual depreciation rate is

A) 20%.

B) 2%.

C) 8%.

D) 25%.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 226

Related Exams