A) $56.

B) $60.

C) $62.

D) $68.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Switzer, Inc. has 8 computers which have been part of the inventory for over two years. Each computer cost $600 and originally retailed for $900. At the statement date, each computer has a current replacement cost of $400. What value should Switzer, Inc., have for the computers at the end of the year?

A) $2,400.

B) $3,200.

C) $4,800.

D) $7,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Overstating ending inventory will overstate all of the following except

A) assets.

B) cost of goods sold.

C) net income.

D) stockholder's equity.

Correct Answer

verified

Correct Answer

verified

True/False

The retail inventory method requires a company to value its inventory on the balance sheet at retail prices.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The consistent application of an inventory costing method is essential for

A) conservatism.

B) accuracy.

C) comparability.

D) efficiency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The convergence issue that will be most difficult to resolve in the area of inventory accounting is:

A) FIFO.

B) LIFO.

C) ownership of goods.

D) costs to include in inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An auto manufacturer would classify vehicles in various stages of production as

A) finished goods.

B) merchandise inventory.

C) raw materials.

D) work in process.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For companies that use a perpetual inventory system, all of the following are purposes for taking a physical inventory except

A) to check the accuracy of the records.

B) to determine the amount of wasted raw materials.

C) to determine losses due to employee theft.

D) to determine ownership of the goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

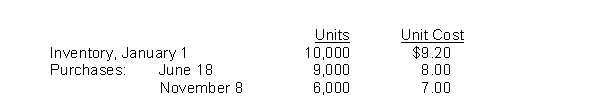

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. Under the LIFO method, cost of goods sold is

A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. Under the LIFO method, cost of goods sold is

A) $28,000.

B) $169,200.

C) $173,040.

D) $178,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lower-of-cost-or-market (LCM) basis may be used with all of the following methods except

A) average cost.

B) FIFO.

C) LIFO.

D) The LCM basis may be used with all of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The specific identification method

A) cannot be used under GAAP.

B) cannot be used under IFRS.

C) must be used under IFRS if the inventory items can be specifically identified.

D) must be used under IFRS if it would result in the lowest net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

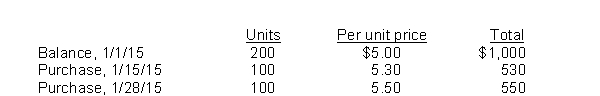

Effie Company uses a periodic inventory system. Details for the inventory account for the month of January, 2015 are as follows:  An end of the month (1/31/15) inventory showed that 160 units were on hand. If the company uses FIFO and sells the units for $10 each, what is the gross profit for the month?

An end of the month (1/31/15) inventory showed that 160 units were on hand. If the company uses FIFO and sells the units for $10 each, what is the gross profit for the month?

A) $1,120

B) $1,188

C) $1,532

D) $1,600

Correct Answer

verified

Correct Answer

verified

True/False

The expense recognition principle requires that the cost of goods sold be matched against the ending merchandise inventory in order to determine income.

Correct Answer

verified

Correct Answer

verified

True/False

In a period of falling prices, the LIFO method results in a lower cost of goods sold than the FIFO method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a period of rising prices, the costs allocated to ending inventory may be understated in the

A) average-cost method.

B) FIFO method.

C) gross profit method.

D) LIFO method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the gross profit method, each of the following items are estimated except for the

A) cost of ending inventory.

B) cost of goods sold.

C) cost of goods purchased.

D) gross profit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

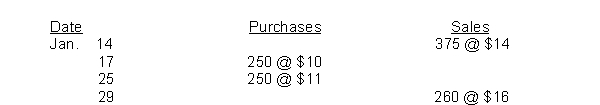

Partridge Bookstore had 500 units on hand at January 1, costing $9 each. Purchases and sales during the month of January were as follows:  Partridge does not maintain perpetual inventory records. According to a physical count, 365 units were on hand at January 31. The cost of the inventory at January 31, under the FIFO method is:

Partridge does not maintain perpetual inventory records. According to a physical count, 365 units were on hand at January 31. The cost of the inventory at January 31, under the FIFO method is:

A) $3,285.

B) $3,650.

C) $3,900.

D) $4,015.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

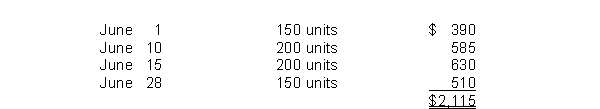

A company just starting business made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand. The inventory method which results in the highest gross profit for June is

A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand. The inventory method which results in the highest gross profit for June is

A) the FIFO method.

B) the LIFO method.

C) the weighted average unit cost method.

D) not determinable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Effie Company uses a periodic inventory system. Details for the inventory account for the month of January, 2015 are as follows:  An end of the month (1/31/15) inventory showed that 160 units were on hand. If the company uses FIFO, what is the value of the ending inventory?

An end of the month (1/31/15) inventory showed that 160 units were on hand. If the company uses FIFO, what is the value of the ending inventory?

A) $800

B) $832

C) $848

D) $868

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term "FOB" denotes

A) free on board.

B) freight on board.

C) free only (to) buyer.

D) freight charge on buyer.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 161

Related Exams