A) With regard to uncertain tax positions, under IFRS, all potential liabilities must be recognized.

B) The tax effects related to certain items are reported inequity under U.S.GAAP, under IFRS the tax effects are charged or credited to home.

C) U.S.GAAP uses an impairment approach for deferred tax assets.The deferred tax assets.The deferred tax asset is recognized in full and reduced by a valuation account if it is more likely than not all or a portion of the deferred tax asset will not be realized.

D) U.S.GAAP classifies deferred taxes based on the classification of the assets or liability to which it relates.

Correct Answer

verified

Correct Answer

verified

Short Answer

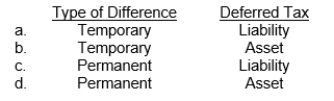

A company records an unrealized loss on short-term securities.This would result in what type of difference and in what type of deferred income tax?

Correct Answer

verified

Correct Answer

verified

True/False

A deferred tax liability represents the increase in taxes payable in future years as a result of taxable temporary differences existing at the end of the current year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions. Lyons Company deducts insurance expense of $84,000 for tax purposes in 2010, but the expense is not yet recognized for accounting purposes.In 2011, 2012, and 2013, no insurance expense will be deducted for tax purposes, but $28,000 of insurance expense will be reported for accounting purposes in each of these years.Lyons Company has a tax rate of 40% and income taxes payable of $72,000 at the end of 2010.There were no deferred taxes at the beginning of 2010. -Assuming that income tax payable for 2011 is $96,000, the income tax expense for 2011 would be what amount?

A) $129,600

B) $107,200

C) $96,000

D) $84,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

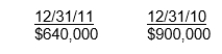

Fleming Company has the following cumulative taxable temporary differences:

The tax rate enacted for 2011 is 40%, while the tax rate enacted for future years is 30%.Taxable income for 2011 is $1,600,000 and there are no permanent differences.Fleming's pretax financial income for 2011 is:

The tax rate enacted for 2011 is 40%, while the tax rate enacted for future years is 30%.Taxable income for 2011 is $1,600,000 and there are no permanent differences.Fleming's pretax financial income for 2011 is:

A) $960,000

B) $1,340,000

C) $1,730,000

D) $2,240,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deferred taxes should be presented on the statement of financial position

A) as one net debit or credit amount.

B) as a net amount in the non-current section.

C) in two amounts: one for the net debit amount and one for the net credit amount.

D) as reductions of the related asset or liability accounts.

Correct Answer

verified

Correct Answer

verified

True/False

Companies must consider presently enacted changes in the tax rate that become effective in future years when determining the tax rate to apply to existing temporary differences.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

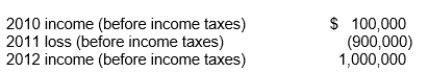

Wilcox Corporation reported the following results for its first three years of operation:

There were no permanent or temporary differences during these three years.Assume a corporate tax rate of 30% for 2010 and 2011, and 40% for 2012.

-Assuming that Wilcox elects to use the carryforward provision and not the carryback provision, what income (loss) is reported in 2011?

There were no permanent or temporary differences during these three years.Assume a corporate tax rate of 30% for 2010 and 2011, and 40% for 2012.

-Assuming that Wilcox elects to use the carryforward provision and not the carryback provision, what income (loss) is reported in 2011?

A) $(900,000)

B) $(540,000)

C) $ -0-

D) $(870,000)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tax rates other than the current tax rate may be used to calculate the deferred income tax amount on the statement of financial position if

A) it is probable that a future tax rate change will occur.

B) it appears likely that a future tax rate will be greater than the current tax rate.

C) the future tax rates have been enacted or substantially enacted.

D) it appears likely that a future tax rate will be less than the current tax rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

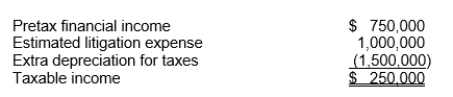

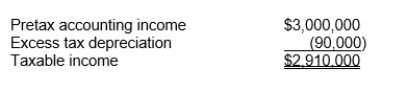

Mitchell Corporation prepared the following reconciliation for its first year of operations:

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%.The enacted tax rate for 2011 is 35%.

-What amount should be reported in its 2011 income statement as the deferred portion of income tax expense?

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%.The enacted tax rate for 2011 is 35%.

-What amount should be reported in its 2011 income statement as the deferred portion of income tax expense?

A) $90,000 debit

B) $120,000 debit

C) $90,000 credit

D) $105,000 credit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

-Link Sink Manufacturing has a deferred tax asset account with a balance of $300,000 at the end of 2012 due to a single cumulative temporary difference of $750,000.At the end of 2013, this same temporary difference has increased to a cumulative amount of $1,000,000.Taxable income for 2013 is $1,700,000.The tax rate is 40% for 2013, but enacted tax rates for all future years are 35%.Assuming it's probable that 70% of the deferred tax asset will be realized, what amount will be reported on Link Sink's statement of financial position for the deferred tax asset at December 31, 2013?

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

-Link Sink Manufacturing has a deferred tax asset account with a balance of $300,000 at the end of 2012 due to a single cumulative temporary difference of $750,000.At the end of 2013, this same temporary difference has increased to a cumulative amount of $1,000,000.Taxable income for 2013 is $1,700,000.The tax rate is 40% for 2013, but enacted tax rates for all future years are 35%.Assuming it's probable that 70% of the deferred tax asset will be realized, what amount will be reported on Link Sink's statement of financial position for the deferred tax asset at December 31, 2013?

A) $262,500.

B) $280,000.

C) $245,000.

D) $595,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Larsen Corporation reported $100,000 in revenues in its 2010 financial statements, of which $44,000 will not be included in the tax return until 2011.The enacted tax rate is 40% for 2010 and 35% for 2011.What amount should Larsen report for deferred tax liability in its statement of financial position at December 31, 2010?

A) $15,400

B) $17,600

C) $19,600

D) $22,400

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are procedures for the computation of deferred income taxes except to

A) identify the types and amounts of existing temporary differences and carryforwards.

B) measure the deferred tax liability for taxable temporary differences.

C) measure the deferred tax asset for deductible temporary differences and loss carrybacks.

D) All of these are procedures in computing deferred income taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A reconciliation of Gentry Company's pretax accounting income with its taxable income for 2010, its first year of operations, is as follows:

The excess tax depreciation will result in equal net taxable amounts in each of the next three years.Enacted tax rates are 40% in 2010, 35% in 2011 and 2012, and 30% in 2013.The total deferred tax liability to be reported on Gentry's statement of financial position at December 31, 2010, is

The excess tax depreciation will result in equal net taxable amounts in each of the next three years.Enacted tax rates are 40% in 2010, 35% in 2011 and 2012, and 30% in 2013.The total deferred tax liability to be reported on Gentry's statement of financial position at December 31, 2010, is

A) $36,000.

B) $30,000.

C) $31,500.

D) $27,000.

Correct Answer

verified

Correct Answer

verified

True/False

A company should add a decrease in a deferred tax liability to income tax payable in computing income tax expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The IASB believes that the asset-liability method is the most consistent method for accounting for income taxes.Basic principles of this method include I.A current tax liability or asset is recognized for the estimated taxes payable or refundable on the tax return for the current year. II.A deferred tax liability or asset is recognized for the estimated future tax effects attributable to temporary differences and carryforwards. III.The measurement of current and deferred tax liabilities and assets, is based on provisions of the enacted tax law. IV.The measurement of deferred tax assets is reduced, if necessary, by the amount of any tax benefits that, based on available evidence, are not expected to be realized.

A) I, II and only.

B) II and III only.

C) I, II, and IV only.

D) I, II, III and IV.

Correct Answer

verified

Correct Answer

verified

True/False

Companies classify the balances in the deferred tax accounts on the statement of financial position as non-current assets or non-current liabilities.

Correct Answer

verified

Correct Answer

verified

True/False

Examples of taxable temporary differences are subscriptions received in advance and advance rental receipts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

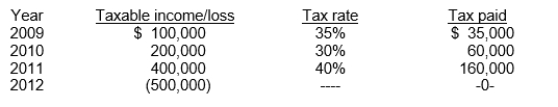

Georgia, Inc.has no temporary or permanent differences.The company experiences the following:

In 2012, Georgia, Inc.decides to carry back its NOL.What amount of income tax refund receivable will Georgia record for 2012?

In 2012, Georgia, Inc.decides to carry back its NOL.What amount of income tax refund receivable will Georgia record for 2012?

A) $200,000

B) $180,000

C) $190,000

D) $ -0-

Correct Answer

verified

Correct Answer

verified

True/False

When a change in the tax rate is enacted, the effect is reported as an adjustment to income tax payable in the period of the change.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 92

Related Exams