A) instructs large commercial banks to sell government securities in the open market.

B) instructs the New York Fed to sell government securities in the foreign exchange market.

C) tells large commercial banks to raise their interest rates.

D) instructs the New York Fed to buy government securities in the open market.

E) instructs the New York Fed to sell government securities in the open market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Control of monetary policy rests with

A) Congress.

B) the Federal Reserve.

C) the Comptroller of the Currency.

D) the U.S. Treasury.

E) the President.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The monetary policy instrument the Federal Reserve choose to use is the

A) quantity of money.

B) monetary base

C) exchange rate.

D) federal funds rate.

E) required reserves rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed raises the federal funds rate, eventually the

A) AD curve shifts leftward, decreasing real GDP and increasing the price level.

B) AD curve shifts leftward, decreasing real GDP and the price level.

C) AS curve shifts rightward, decreasing real GDP and increasing the price level.

D) AD curve shifts rightward, increasing real GDP and the price level.

E) AS curve shifts leftward, decreasing real GDP and increasing the price level.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

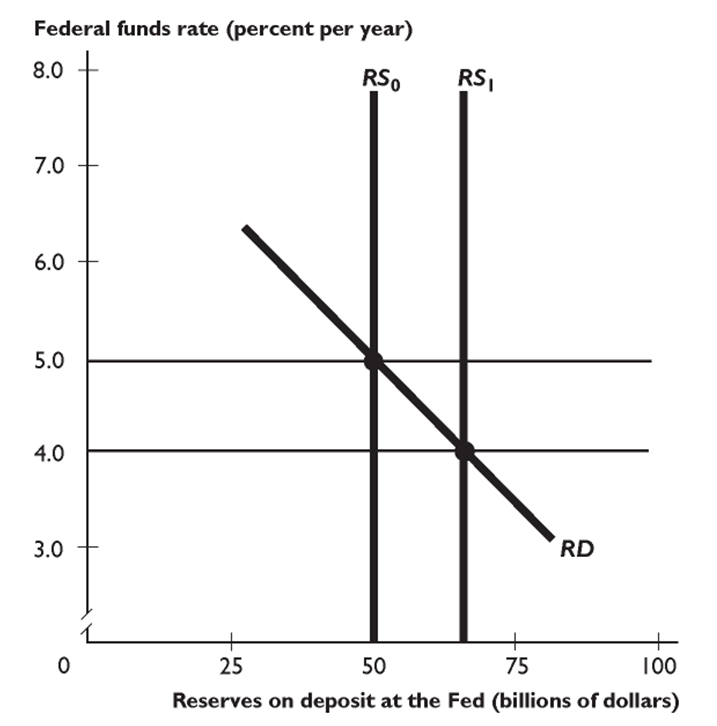

The rightward shift of the RS curve will lead to a-------------------- in the real interest rate,-------------------- in investment, and-------------------- in aggregate demand.

The rightward shift of the RS curve will lead to a-------------------- in the real interest rate,-------------------- in investment, and-------------------- in aggregate demand.

A) fall; an increase; a decrease

B) rise; a decrease; a decrease

C) rise; an increase; a decrease

D) rise; an increase; an increase

E) fall; an increase; an increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed--------------------_, the U.S. foreign exchange rate falls.

A) increases the size of the multiplier

B) raises the interest rate

C) raises taxes on interest income

D) sells government securities

E) buys government securities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An instrument rule is based on --------------------of the economy while a targeting rule is based on-------------------- of the economy.

A) the previous state; the current state

B) the current state; a forecast

C) the current state; the previous state

D) a forecast; the previous state

E) a forecast; the current state

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate banks charge each other on loans of reserves is called the

A) discount rate.

B) real interest rate.

C) coupon rate.

D) required reserve rate.

E) federal funds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A hike in the federal funds rate results in-------------------- in the real interest rate which leads to a-------------------- in investment.

A) a decrease; an increase

B) an increase; a decrease

C) an increase; an increase

D) a decrease; a decrease

E) a decrease; no change

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If real GDP exceeds potential GDP, to move the economy to potential GDP the Fed

A) lowers the federal funds rate to increase potential GDP but not real GDP.

B) lowers the federal funds rate to decrease real GDP but not potential GDP.

C) raises the federal funds rate to increase potential GDP but not real GDP.

D) raises the federal funds rate to decrease both real GDP and potential GDP.

E) raises the federal funds rate to decrease real GDP but not potential GDP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a monetary policy goal? I. keeping the inflation rate low Ii. attaining maximum employment Iii. keeping the long-term interest rate at a moderate level

A) i and iii

B) i only

C) iii only

D) i, ii, and iii

E) ii only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the Fed's monetary policy instrument?

A) the supply of reserves

B) the federal funds rate

C) the demand for reserves

D) the output gap

E) the core inflation rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

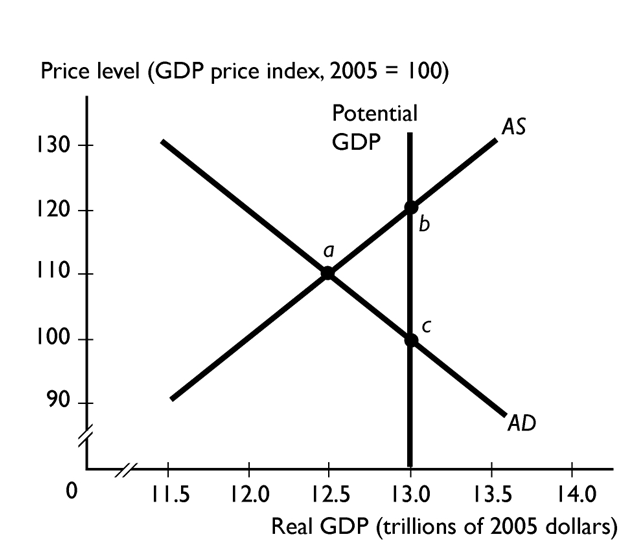

-

The economy is at the equilibrium shown as point a in the above figure. To restore the economy to potential GDP, the Fed should

-

The economy is at the equilibrium shown as point a in the above figure. To restore the economy to potential GDP, the Fed should

A) sell government securities and thereby decrease aggregate demand.

B) sell government securities and thereby increase aggregate demand.

C) buy government securities and thereby increase aggregate demand.

D) buy government securities and thereby decrease aggregate demand.

E) buy government securities and thereby increase aggregate supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed raises the interest rate when it

A) wants to encourage bank lending.

B) fears recession.

C) fears inflation.

D) wants to increase the quantity of money.

E) cannot change the quantity of money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currently the Fed targets

A) the federal funds rate.

B) the exchange rate.

C) both the monetary base and the federal funds rate simultaneously.

D) the inflation rate

E) the price level.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consumer confidence in the economy falls, and as a result, aggregate demand decreases. As real GDP falls below potential GDP, if the Fed followed Friedman's k-percent rule, the Fed would

A) increase government expenditures.

B) continue allowing the quantity of money to grow at "k" percent.

C) increase the quantity of money more than usual.

D) lower the federal funds rate.

E) raise the federal funds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve monetary policy goals of maximum employment means

A) a zero percent natural unemployment rate.

B) cyclical unemployment should not necessarily be minimized.

C) keeping the unemployment rate close to the natural unemployment rate.

D) a zero percent unemployment rate.

E) aiming for an amount of employment that exceeds full employment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT an effect from a change in the federal funds rate?

A) change in the quantity of money

B) change in government expenditures

C) change in the real interest rate

D) change in aggregate demand

E) change in investment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The core inflation rate measures changes in the

A) prices of consumer goods except food and fuel.

B) prices of consumer goods except health care.

C) price of only two consumer goods: food and fuel.

D) prices of all consumer goods.

E) prices of all the "core" goods and services a typical family buys.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed raises the federal funds rate, the exchange rate--------------------and net exports--------------------

A) does not change; does not change

B) increases; increases

C) increases; decreases

D) does not change; decreases

E) decreases; decreases

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 106

Related Exams