A) debit of $425

B) debit of $7,650

C) credit of $700

D) credit of $6,375

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 1, 2017, Miniature Company has bonds with balances as shown below.  If the company retires the bonds for $72,150, what will be the effect on the income statement?

If the company retires the bonds for $72,150, what will be the effect on the income statement?

A) loss on retirement of $7,150

B) gain on retirement of $7,150

C) sales revenue of $65,000

D) no effect on net income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond is issued at premium ________.

A) when a bond's stated interest rate is equal to the market interest rate

B) when a bond's stated interest rate is less than the effective interest rate

C) when a bond's stated interest rate is less than the market interest rate

D) when a bond's stated interest rate is higher than the market interest rate

Correct Answer

verified

Correct Answer

verified

True/False

The balance sheet shows the balance in Bonds Payable plus any discount or minus any premium.

Correct Answer

verified

Correct Answer

verified

True/False

On March 1, 2016, Vantage Services issued a 9% long-term notes payable for $30,000. It is payable over a 14-year term in $2,143 principal installments on March 1 of each year, beginning March 1, 2017. Each yearly installment will include both principal repayment of $2,143 and interest payment for the preceding one-year period. The journal entry to pay the first installment will include a debit to Interest Expense for $2,700.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Going Places Adventure Travel signed a 14%, 10-year note for $160,000. The company paid an installment of $2,600 for the first month. After the first payment, what is the principal balance? (Do not round any intermediate calculations, and round your final answer to the nearest dollar.)

A) $157,400

B) $158,133

C) $159,267

D) $162,600

Correct Answer

verified

Correct Answer

verified

Essay

In order to expand its business, the management of Vereos, Inc. issued a long-term notes payable for $50,000. The note will be paid over a 10-year period with equal annual principal payments, beginning in one year. The annual interest rate is 12%. Prepare the journal entry for the issuance of the note.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2016, Alldredge Company purchased equipment and signed a six-year mortgage note for $194,000 at 15%. The note will be paid in equal annual installments of $51,262, beginning January 1, 2017. Calculate the portion of interest expense paid on the third installment. (Round your answer to the nearest whole number.)

A) $51,262

B) $21,953

C) $29,100

D) $171,838

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 1, 2016, Fine Dining Products borrowed $86,000 on a 5%, 10-year note with annual installment payments of $8,600 plus interest due on December 1 of each succeeding year. On December 1, the principal amount was recorded as a long-term note payable. What amount of the note payable will be shown as current portion of Long-Term Note Payable on the balance sheet as of December 31, 2016? (Round your answer to nearest whole number.)

A) $8,600

B) $12,900

C) $4,300

D) $17,200

Correct Answer

verified

Correct Answer

verified

True/False

The balance in the Bonds Payable account is a credit of $24,500. The balance in the Premium on Bonds Payable account is a credit of $1,000. The balance sheet will report the bond balance as $23,500.

Correct Answer

verified

Correct Answer

verified

True/False

Using the effective-interest amortization method, the calculation for the amount of premium amortization is the difference between the cash paid and the calculated interest expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

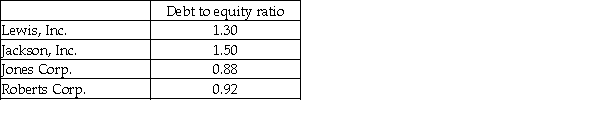

The debt to equity ratio of four companies is given below.  Based on the debt to equity ratio, which of the following companies has the least financial risk?

Based on the debt to equity ratio, which of the following companies has the least financial risk?

A) Lewis, Inc.

B) Jackson, Inc.

C) Jones Corp.

D) Roberts Corp.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hillsborough Glassware Company issues $1,061,000 of its 11%, 10-year bonds at 96 on February 28, 2017. The bonds pay interest on February 28 and August 31. Assume that Hillsborough uses the straight-line method for amortization. What net amount will be reported for the bonds on the August 31, 2017 balance sheet?

A) $1,020,682

B) $1,061,000

C) $1,016,438

D) $1,018,560

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 1, 2016, Gardner Products borrowed $83,000 on a 8%, 10-year note with annual installment payments of $8,300 plus interest due on December 1 of each subsequent year. Which of the following describes the first installment payment made on December 1, 2017? (Round your answer to the nearest whole number.)

A) $8,300 principal plus $6,640 interest

B) $8,300 principal plus $664 interest

C) $8,300 principal plus $8,300 interest

D) $6,640 interest only

Correct Answer

verified

Correct Answer

verified

True/False

When a bond is issued at a premium, the interest expense calculation using the effective-interest amortization method uses the carrying amount of the bonds and the market rate of interest.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes a serial bond?

A) a bond that matures in installments at regular intervals

B) a bond that gives the bondholder a claim for specific assets

C) a bond that matures at one specified time

D) a bond that is not backed by specific assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On March 1, 2016, Mandau Services issued a 7% long-term notes payable for $21,000. It is payable over a 3-year term in $7,000 principal installments on March 1 of each year, beginning March 1, 2017. Each yearly installment will include both principal repayment of $7,000 and interest payment for the preceding one-year period. What is the amount of total cash payment that Mandau will make on March 1, 2017?

A) $7,000

B) $8,470

C) $21,000

D) $7,735

Correct Answer

verified

Correct Answer

verified

True/False

The issue price of a bond-whether it is issued at par, premium, or discount-has an effect on the principal repayment at maturity.

Correct Answer

verified

Correct Answer

verified

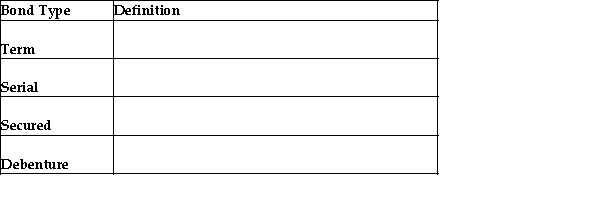

Essay

Provide a definition of each of the following types of bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Lakeland Company issues $515,000 of its 9%, 10-year bonds at 102 on March 31, 2017. The bond pays interest on March 31 and September 30. On September 30, 2017, how much cash did the company pay to the bondholders?

A) $2,318

B) $46,350

C) $23,175

D) $11,588

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 192

Related Exams