A) a fixed exchange rate system.

B) the Bretton Woods system.

C) a fiscal fix.

D) a floating exchange rate system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A hedge is

A) a financial strategy that reduces the change of suffering losses arising from foreign exchange risk.

B) an exchange rate arrangement in which a country pegs the value of its currency to the exchange value.

C) the possibility that changes in the value of a nation's currency will result in variations in the market value of assets.

D) active management of a floating exchange rate on the part of a country's government.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Judy has just bought a car that is made in Germany. As far as the U.S. balance of payments is concerned this purchase is a(n)

A) accounting identity.

B) special draw.

C) surplus item.

D) deficit item.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect that a gift given to a U.S. citizen from a foreign resident will have on the balance of payments is to

A) increase the current account balance.

B) have no effect on the balance of payments if the gift was made in the U.S.

C) have no effect on the balance of payments if the gift was made by a foreign country.

D) decrease the balance of payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance of payments is

A) a summary record of the financial transactions of a country's government with foreign governments.

B) a summary record of a country's imports and exports of goods with foreign residents and governments.

C) a summary record of a country's economic transactions with foreign residents and governments.

D) a summary record of a country's purchases and sales of goods and services in the world market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a flexible exchange rate system, which of the following would NOT cause the U.S. dollar to depreciate relative to the British pound?

A) A decrease in demand for British goods in the United States

B) An increase in demand for British goods in the United States

C) A decrease in British demand for U.S. exports

D) A shift to the left in the supply of British goods to the United States

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the foreign exchange rate is 70 cents for one Swiss franc, then

A) a car that costs 40,000 francs will cost $7,143.00.

B) a wine that costs 200 francs will cost $14.00.

C) a clock that costs 500 francs will cost $350.00.

D) a house that costs 100,000 francs will cost $700,000.00.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a category in the U.S. balance of payments account?

A) Current account

B) Past-due account

C) Capital account

D) Official reserve transactions account

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A market in which businesses, households, and governments buy and sell national currencies is

A) the foreign exchange market.

B) the currency exchange market.

C) the money exchange market.

D) the dollar exchange market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is unrest in the Middle East that threatens the economic stability of Saudi Arabia, the

A) demand for Saudi Arabian currency will fall.

B) demand for Saudi Arabian currency will rise.

C) supply of Saudi Arabian currency will fall.

D) supply of Saudi Arabian currency will rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When there is political instability in another country, the United States can expect

A) an increase in the capital account balance due to an increase in the current account.

B) an increase in the capital account balance due to the movement of assets to the U.S.

C) a decrease in the balance of payments due to a decrease in special drawing rights.

D) a decrease in the balance of payments due to a decrease in the demand for goods and services.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A record of all transactions between households, firms, and the government of one country and the rest of the world is the

A) balance of trade.

B) balance of payments.

C) International Monetary Fund.

D) government budget.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When all currencies are tied directly to gold, then

A) currency exchange rates throughout the world are flexible.

B) currency exchange rates throughout the world are fixed.

C) the world's stock of gold cannot change.

D) the price of each nation's currency in terms of gold is flexible.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

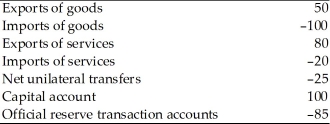

Hypothetical Data for Nation "A" in Billions of Local Currency  -Refer to the above table. The overall balance of payments of Nation "A" is

-Refer to the above table. The overall balance of payments of Nation "A" is

A) +85.

B) - 85.

C) 0.

D) +25.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One problem associated with the gold standard was that

A) nations gave up control of their money supply.

B) there was an incentive for individuals to hold gold at all interest rates.

C) there was no fluctuation in exchange rates.

D) nations could not determine their current account balances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term "flexible exchange rates" refers to

A) a situation in which exchange rates are allowed to fluctuate in the open market in response to changes in supply and demand.

B) the increase in the exchange value of one nation's currency in terms of an other nation.

C) a nation in which households, firms, and governments buy and sell national currencies.

D) the decrease in the exchange value of one nation's currency in terms of another nation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One problem that investors in foreign countries face is the possibility of a decline in the value of that foreign country's currency. Which of the following would be an effective way to offset this problem?

A) Be ready to pull out at the first sign of trouble.

B) Convert as many of your dollars into their dollars as possible.

C) Hedge through currency swaps.

D) Finance your investment outside of that country.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country moves from fixed to flexible exchange rates, its macroeconomic policy

A) is no longer restricted.

B) is restricted, as it can only use fiscal policy to achieve its economic goals.

C) is restricted, as it can only use monetary policy to achieve its economic goals.

D) must follow policy directives from the IMF.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flexible exchange rates are determined by

A) the government of the exporting country.

B) the government of the importing country.

C) the forces of supply and demand.

D) the IMF.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a flexible exchange rate system, an increase in the value of the U.S. dollar in terms of other currencies is referred to as

A) a depreciation of the U.S. dollar.

B) an appreciation of the U.S. dollar.

C) a monetizing of the U.S. dollar.

D) a devaluation of the U.S. dollar.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 300

Related Exams