A) The Federal Open Market Committee

B) The chairman of the Federal Reserve

C) The Board of Governors

D) The Cabinet

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, the dollar was commodity backed by:

A) gold.

B) silver.

C) oil.

D) diamonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, the central bank is the:

A) Federal Reserve.

B) Congressional Budgeting Office.

C) Treasury.

D) National Bank of the United States.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a good with intrinsic value loses value as money, the good:

A) is still useful for other reasons.

B) loses its intrinsic value.

C) is no longer useful for other reasons.

D) tends to gain in intrinsic value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

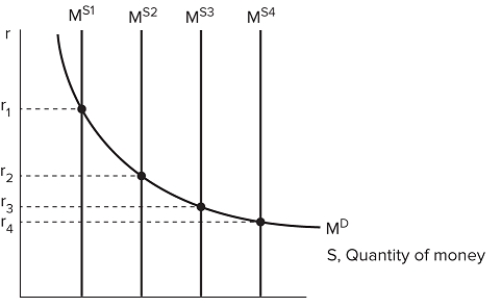

The graph shown displays the relationship between money and the interest rate..  If the money supply in the economy is currently at MS2, to engage in contractionary policy the Fed would use open market operations to move the money supply to which point?

If the money supply in the economy is currently at MS2, to engage in contractionary policy the Fed would use open market operations to move the money supply to which point?

A) M S1

B) M S3

C) M S4

D) The money supply would remain at M S2.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tools is used most often by the Fed to change the supply of money?

A) Open market operations

B) Reserve requirement

C) Discount window

D) Interest rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The chair of the Federal Reserve is considered one of the most important economic positions in the world because this person has significant direct control over the conduct of _______ in the United States.

A) fiscal policy

B) monetary policy

C) international trade policy

D) the government budget

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A certificate of deposit would be counted in which measure of money?

A) M1

B) M2

C) The monetary base

D) Both M1 and M2

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liquidity refers to how:

A) easy an asset is to convert immediately to cash without losing value.

B) quickly the same dollar changes hands in the economy.

C) quickly the average household spends its disposable income.

D) easy money converts to assets in an economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which money measure is helpful for understanding liquidity in the economy?

A) Monetary base

B) M1

C) M2

D) M3

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 5 percent, the money multiplier will be:

A) 20.

B) 5.

C) 10.

D) 2.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money can serve as a:

A) store of value.

B) valuation tool.

C) less efficient alternative to bartering.

D) completely fixed unit of measurement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the difficulties the Fed experiences when implementing monetary policy is:

A) frequent shifts in the economy, which make it difficult to choose between expansionary and contractionary policy.

B) the time it takes for monetary policy to affect the economy once enacted.

C) avoiding political interference from Congress.

D) deciding whether to use open market operations, the discount window, or reserve requirements to adjust the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would cause the money demand curve to shift to the left?

A) An increase in interest rates

B) Inflation

C) A technological advance

D) An increase in GDP

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Any amount that a bank chooses to keep on hand beyond what it is required to is called:

A) excess reserves.

B) excess deposits.

C) federal funds.

D) extra holdings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio was 100 percent, then:

A) no lending would occur using deposits.

B) maximum lending would occur.

C) banks would create money in the economy.

D) banks would lend all of their deposits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

We use paper money instead of gold coins in the Unites States today because it:

A) is more convenient.

B) has no intrinsic value.

C) has a worth that is easier to control.

D) has a more stable value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Commodity-backed money is:

A) any form of money that can be legally exchanged into a fixed amount of an underlying commodity.

B) money created by the sale of commodities.

C) money used for the exchange of large commodities.

D) any form of money that also has a role as a commodity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When deciding what to use as money, one characteristic to look for is its:

A) convenience.

B) exchange value.

C) intrinsic value.

D) physical shape.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the simple liquidity preference model, if the money-demand curve is elastic, then:

A) small changes to the money supply will greatly affect interest rates.

B) only large changes to the money supply will greatly affect interest rates.

C) small changes to the money supply will minimally affect interest rates.

D) large changes to the money supply will minimally affect interest rates.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 146

Related Exams