A) Income statement columns

B) Adjustments columns

C) Trial balance columns

D) Adjusted trial balance columns

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Closing entries are journalized and posted

A) before the financial statements are prepared.

B) after the financial statements are prepared.

C) at management's discretion.

D) at the end of each interim accounting period.

Correct Answer

verified

Correct Answer

verified

True/False

Closing the Dividends account to Retained Earnings is not necessary if net income is greater than dividends paid during the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Correcting entries are made

A) at the beginning of an accounting period.

B) at the end of an accounting period.

C) whenever an error is discovered.

D) after closing entries.

Correct Answer

verified

Correct Answer

verified

True/False

The operating cycle of a company is the average time required to collect the receivables resulting from producing revenues.

Correct Answer

verified

Correct Answer

verified

True/False

After closing entries have been journalized and posted, all temporary accounts in the ledger should have zero balances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The adjustments entered in the adjustments columns of a worksheet are

A) not journalized.

B) posted to the ledger but not journalized.

C) not journalized until after the financial statements are prepared.

D) journalized before the worksheet is completed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income summary account

A) is a permanent account.

B) appears on the statement of financial position.

C) appears on the income statement.

D) is a temporary account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

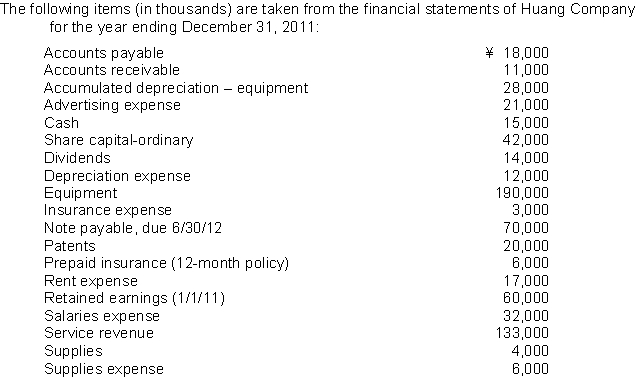

What is total equity and liabilities at December 31, 2011?

What is total equity and liabilities at December 31, 2011?

A) �¥176,000

B) ¥190,000

C) ¥218,000

D) ¥232,000

Correct Answer

verified

Correct Answer

verified

True/False

The Dividends account is closed to the Income Summary account in order to properly determine net income (or loss) for the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liabilities are generally classified on a statement of financial position as

A) small liabilities and large liabilities.

B) present liabilities and future liabilities.

C) tangible liabilities and intangible liabilities.

D) current liabilities and non-current liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

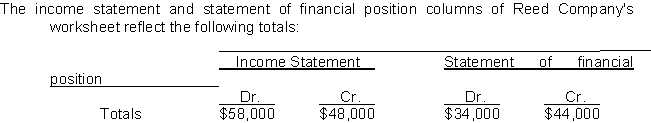

To enter the net income (or loss) for the period into the above worksheet requires an entry to the

To enter the net income (or loss) for the period into the above worksheet requires an entry to the

A) income statement debit column and the statement of financial position credit column.

B) income statement credit column and the statement of financial position debit column.

C) income statement debit column and the income statement credit column.

D) statement of financial position debit column and the statement of financial position credit column.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balances that appear on the post-closing trial balance will match the

A) income statement account balances after adjustments.

B) statement of financial position account balances after closing entries.

C) income statement account balances after closing entries.

D) statement of financial position account balances after adjustments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an optional step in the accounting cycle of a business enterprise?

A) Analyze business transactions

B) Prepare a worksheet

C) Prepare a trial balance

D) Post to the ledger accounts

Correct Answer

verified

Correct Answer

verified

True/False

Correcting entries are made any time an error is discovered even though it may not be at the end of an accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preparing a worksheet involves

A) two steps.

B) three steps.

C) four steps.

D) five steps.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

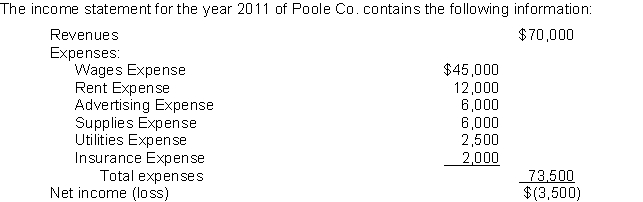

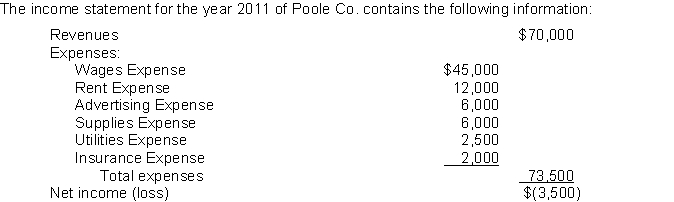

At January 1, 2011, Poole reported Retained Earnings of $50,000.Dividends for the year totalled $10,000.At December 31, 2011, the company will report Retained Earnings of

At January 1, 2011, Poole reported Retained Earnings of $50,000.Dividends for the year totalled $10,000.At December 31, 2011, the company will report Retained Earnings of

A) $13,500.

B) $36,500.

C) $40,000.

D) $43,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to close the expense accounts includes a

The entry to close the expense accounts includes a

A) debit to Income Summary for $3,500.

B) credit to Income Summary for $3,500.

C) debit to Income Summary for $73,500.

D) debit to Wages Expense for $2,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the total debits exceed total credits in the statement of financial position columns of the worksheet, equity

A) will increase because net income has occurred.

B) will decrease because a net loss has occurred.

C) is in error because a mistake has occurred.

D) will not be affected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most efficient way to accomplish closing entries is to

A) credit the income summary account for each revenue account balance.

B) debit the income summary account for each expense account balance.

C) credit the dividends account balance directly to the income summary account.

D) credit the income summary account for total revenues and debit the income summary account for total expenses.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 167

Related Exams