A) more frequently under a periodic inventory system than a perpetual inventory system.

B) using the wholesale inventory method.

C) more frequently under a perpetual inventory system than the periodic inventory system.

D) using the net method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

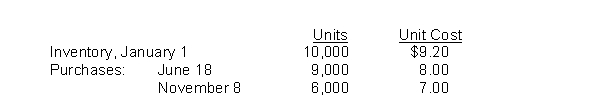

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.What is the cost of goods available for sale?

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.What is the cost of goods available for sale?

A) $169,200

B) $178,000

C) $206,000

D) $325,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lower-of-cost-or-net realizable value basis of valuing inventories is an example of

A) comparability.

B) the historical cost principle.

C) conservatism.

D) consistency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

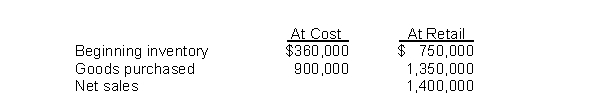

Clooney Department Store estimates inventory by using the retail inventory method.The following information was developed:  The estimated cost of the ending inventory is

The estimated cost of the ending inventory is

A) $280,000.

B) $336,000.

C) $420,000.

D) $466,667.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies adopt different cost flow methods for each of the following reasons except

A) balance sheet effects.

B) cost effects.

C) income statements effects.

D) tax effects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory items on an assembly line in various stages of production are classified as

A) Finished goods.

B) Work in process.

C) Raw materials.

D) Merchandise inventory.

Correct Answer

verified

Correct Answer

verified

True/False

If inventories are valued using the LIFO cost flow assumption, they should not be classified as a current asset on the balance sheet.

Correct Answer

verified

Correct Answer

verified

True/False

The first-in, first-out (FIFO) inventory method results in an ending inventory valued at the most recent cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.The weighted-average cost per unit is

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.The weighted-average cost per unit is

A) $8.00.

B) $8.01.

C) $8.24.

D) $9.30.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased inventory as follows:  The weighted-average unit cost for the inventory is

The weighted-average unit cost for the inventory is

A) $5.00.

B) $5.50.

C) $5.70.

D) $6.00.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a period of inflation, the cost flow method that results in the lowest income taxes is the

A) FIFO method.

B) LIFO method.

C) average-cost method.

D) gross profit method.

Correct Answer

verified

Correct Answer

verified

True/False

Inventory turnover is calculated as cost of goods sold divided by ending inventory.

Correct Answer

verified

Correct Answer

verified

True/False

Under generally accepted accounting principles, management has the choice of physically counting inventory on hand at the end of the year or using the gross profit method to estimate the ending inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following inventory methods is often impractical to use?

A) Specific identification

B) LIFO

C) FIFO

D) Average cost

Correct Answer

verified

Correct Answer

verified

True/False

Goods that have been purchased FOB destination but are in transit, should be excluded from a physical count of goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

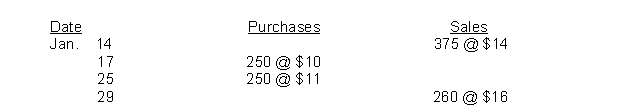

Partridge Bookstore had 500 units on hand at January 1, costing $9 each.Purchases and sales during the month of January were as follows:  Partridge does not maintain perpetual inventory records.According to a physical count, 365 units were on hand at January 31. The cost of the inventory at January 31, under the FIFO method is:

Partridge does not maintain perpetual inventory records.According to a physical count, 365 units were on hand at January 31. The cost of the inventory at January 31, under the FIFO method is:

A) $3,285.

B) $3,650.

C) $3,900.

D) $4,015.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 176 of 176

Related Exams