A) $28,000

B) $20,000

C) ($28,000)

D) $0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S.GAAP:

A) is another term for IFRS.

B) are the accounting rules developed by the IASB for use in the United States.

C) is the oversight board that supervises auditors.

D) are the accounting rules developed by the FASB for use in the United States.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning financial reporting is correct?

A) The FASB requires all financial decision makers to adhere to a code of professional conduct.

B) The Sarbanes-Oxley Act does not require businesses to maintain an audited system of internal control.

C) A fundamental characteristic of useful financial information is that it fully depicts the economic substance of business activities.

D) There is no attempt to eliminate the difference in accounting rules in the U.S.and elsewhere as this would prevent investors from comparing financial statements of companies from different countries.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The obligations and debts of a business are referred to as:

A) equities.

B) assets.

C) dividends.

D) liabilities.

Correct Answer

verified

Correct Answer

verified

True/False

Amounts reported on financial statements are sometimes rounded to the nearest million.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The WC Company borrowed $26,500 from a bank during the year.This borrowing would be reported on the statement of cash flows as a(n) :

A) investing activity in the amount of ($26,500) .

B) financing activity in the amount of ($26,500) .

C) investing activity in the amount of $26,500.

D) financing activity in the amount of $26,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial reports of a business include only the results of that business's activities.This is:

A) required only for large corporations.

B) the cost principle.

C) the accounting equation.

D) true only for financial statements prepared under IFRS.

E) the separate entity assumption.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

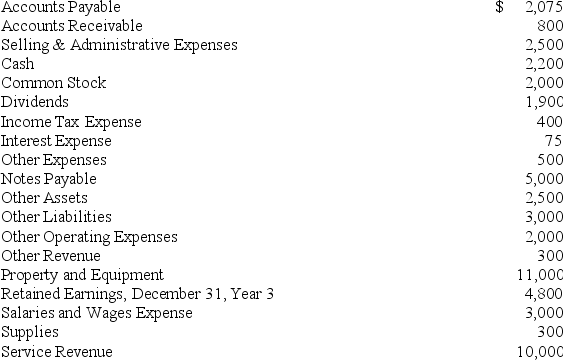

The following accounts are taken from the December 31,Year 4 financial statements of a company.  What is the amount of total liabilities at the end of Year?

What is the amount of total liabilities at the end of Year?

A) $7,075.

B) $10,075.

C) $9,075.

D) $12,975.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors are often interested in the amount of net income distributed as dividends.Where would investors look for this information in the company's annual report?

A) Statement of Retained Earnings

B) Balance Sheet

C) Notes to the financial statements

D) Income Statement

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financing that individuals or institutions have provided to a corporation is:

A) always classified as a liability.

B) classified as a liability when provided by creditors and as stockholders' equity when provided by owners.

C) always classified as equity.

D) classified as a stockholders' equity when provided by creditors and a liability when provided by owners.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the acronym with the description that best reflects it.(There are more descriptions than acronyms. ) -GAAP

A) The U.S.agency that must approve mergers between very large publicly owned corporations.

B) The U.S.Board that approves the rules for auditing publicly owned companies.

C) The organization that establishes business laws in the U.S.

D) The Board that establishes the accounting rules that govern American owned corporations.

E) This organization regulates activities associated with the stock market such as the reporting of financial data by publicly owned companies.

F) The national professional organization of accountants.

G) Rules of financial accounting created by the FASB for use in the United States.

H) A set of laws established to strengthen corporate reporting in the United States.

I) The Board that establishes international accounting standards.

J) The U.S.agency that certifies foreign accounting firms to practice in the U.S.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's quarterly income statements show that in the last three quarters both Sales Revenue and net income have been falling.Given this information,which of the following conclusions drawn by users are valid?

A) Creditors are likely to conclude that the risk of lending to the company is declining and might be willing to accept a lower interest rate on loans.

B) Investors are likely to conclude that the stock price is likely to rise,making the company more attractive as a potential investment.

C) Customers are likely to conclude that the company is struggling;therefore it is permissible to take longer to pay amounts they owe to the company.

D) Owners may conclude that the company will be less likely to distribute dividends.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The first year of operations for a company was Year 1.The net income for Year 1 was $20,000 and dividends of $12,000 were paid.In Year 2,the company reported net income of $34,000 and paid dividends of $5,000.At the end of Year 1,the company had total assets of $150,000.At the end of Year 2,the company had total assets of $240,000. What was the amount of retained earnings at the end of Year 1?

A) $20,000

B) $8,000

C) $150,000

D) $155,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blue Fin started the current year with assets of $840,000,liabilities of $420,000 and common stock of $240,000.During the current year,assets increased by $480,000,liabilities decreased by $60,000 and common stock increased by $330,000.There was no payment of dividends to owners during the year. Based on this information,what was the amount of Blue Fin's retained earnings at the beginning of the year?

A) $180,000

B) $1,020,000

C) $660,000

D) $420,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

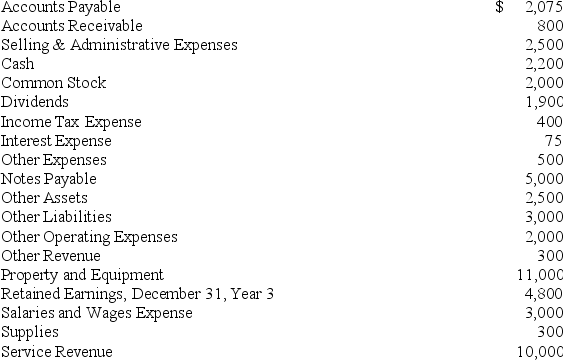

The following accounts are taken from the December 31,Year 4 financial statements of a company.  What is the amount of retained earnings on the Balance Sheet at the end of Year 4?

What is the amount of retained earnings on the Balance Sheet at the end of Year 4?

A) $7,725

B) $6,725

C) $4,800

D) $4,725

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liabilities reported on the balance sheet include:

A) Accounts Payable,Notes Payable,and Common Stock.

B) Accounts Receivable,Supplies Expense,and Retained Earnings.

C) Accounts Payable,Notes Payable,and Salaries and Wages Payable.

D) Common Stock,Retained Earnings,and Notes Payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be acceptable as an alternative name for the income statement?

A) Statement of Profit and Loss

B) Statement of Financial Position

C) Statement of Retained Earnings

D) Statement of Revenues and Expenses

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crystal Lodging recorded $330,000 in revenues,$247,500 in expenses,and $45,000 of dividends for the year.The company began the year with total assets of $285,000 and stockholder's equity of $130,500. What net income (loss) was reported by Crystal Lodging for the year?

A) $37,500

B) $94,500

C) $82,500

D) $49,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial statements are most commonly prepared:

A) daily.

B) monthly,quarterly,and annually.

C) as needed.

D) weekly.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a characteristic of a partnership?

A) The profits,taxes,and legal liability are the responsibility of two or more owners.

B) It is a legal entity separate from its owners.

C) Its income is taxed twice-once on the partnership's income tax return and again on the partners' individual income tax returns.

D) It is the only organizational form appropriate for service businesses.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 228

Related Exams