A) $1,378,000.

B) $772,000.

C) $606,000.

D) $166,000.

Correct Answer

verified

Correct Answer

verified

Essay

The table shows financial data for Purrfect Pets,Inc.as of June 30,Year 3. Required: Prepare a balance sheet using these data.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the financial statements is correct?

A) The "change in cash" reported on the statement of cash flows is also reported on the statement of retained earnings.

B) Both the income statement and the statement of cash flows show the result of a company's operating activities.

C) The statement of cash flows is for a period of time while the income statement is for a point in time.

D) The statement of cash flows is for a point of time while the income statement is for a period of time.

Correct Answer

verified

Correct Answer

verified

True/False

Dividends are subtracted from revenues on the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the accounting standards used in other countries is correct?

A) U.S.GAAP is used worldwide.

B) IFRS are used by all countries.

C) More and more countries are using IFRS.

D) There are no plans to converge U.S.GAAP with IFRS.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

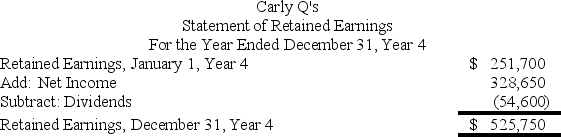

Which of the following statements about this statement of retained earnings is not correct?

A) Retained earnings of $525,750 will appear on the balance sheet as of December 31,Year 4.

B) The net income in the above statement came from the income statement for the year ending December 31,Year 4.

C) Dividends are shown in parentheses because they are distributions of earnings to the stockholders.

D) The ending retained earnings amount represents the amount of cash at the end of Year 4.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term to the appropriate definition.(There are more definitions than terms. ) -Retained Earnings

A) A procedure by which independent evaluators assess the accounting procedures and financial reports of a company.

B) An example of external users of financial statements.

C) Activities directly related to running the business to earn a profit.

D) When a company acquires money from investors.

E) A financial statement that summarizes a company's past and current cash situation.

F) Transactions with lenders (borrowing and repaying cash) and stockholders (selling company stock and paying dividends) .

G) The total amount of profits that are kept by the company.

H) The idea that the financial statements of a company include the results of only that company's business activities.

I) The idea that a company should report its financial data in the relevant currency.

J) Borrowing money from lenders.

K) A financial statement showing a company's assets,liabilities and stockholders' equity.

L) A financial statement that shows a company's revenues and expenses.

M) An example of an internal user of financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assets:

A) represent the amounts earned by a company.

B) must equal the liabilities of a company.

C) must equal the stockholders' equity of the company.

D) represent the resources presently controlled by a company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lolly's Sparkling Waters delivered $380 of drinks to the local high school,but hasn't received payment yet.Lolly will report:

A) nothing,because payment hasn't been received yet.

B) Cash of $380,because the school will pay for the drinks eventually.

C) Accounts payable of $380.

D) Accounts receivable of $380.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning financial reporting is not correct?

A) Accounting rules in the U.S.are called GAAP.

B) Accounting rules developed by the IASB are called IFRS.

C) Both GAAP and IFRS share the same goal,which is to ensure useful information to users of financial statements.

D) There are no differences between the accounting rules developed by FASB and those developed by IASB.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Expenses are reported on the:

A) income statement in the time period in which they are paid.

B) income statement in the time period in which they are incurred.

C) balance sheet in the time period in which they are paid.

D) balance sheet in the time period in which they are incurred.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the acronym with the description that best reflects it.(There are more descriptions than acronyms. ) -AICPA

A) The U.S.agency that must approve mergers between very large publicly owned corporations.

B) The U.S.Board that approves the rules for auditing publicly owned companies.

C) The organization that establishes business laws in the U.S.

D) The Board that establishes the accounting rules that govern American owned corporations.

E) This organization regulates activities associated with the stock market such as the reporting of financial data by publicly owned companies.

F) The national professional organization of accountants.

G) Rules of financial accounting created by the FASB for use in the United States.

H) A set of laws established to strengthen corporate reporting in the United States.

I) The Board that establishes international accounting standards.

J) The U.S.agency that certifies foreign accounting firms to practice in the U.S.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Expenses appear on the:

A) Statement of Retained Earnings.

B) Balance Sheet.

C) Income Statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Golden Enterprises started the year with the following: Assets $50,000;Liabilities $15,000;Common Stock $30,000;Retained Earnings $5,000.During the year,the company earned revenue of $2,500,all of which was received in cash,and incurred expenses of $1,500,all of which were unpaid as of the end of the year.In addition,the company paid dividends of $500 to owners.Assume no other activities occurred during the year. The amount of Golden's liabilities at the end of the year is:

A) $15,000.

B) $16,500.

C) $14,000.

D) $16,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the acronym with the description that best reflects it.(There are more descriptions than acronyms. ) -IASB

A) The U.S.agency that must approve mergers between very large publicly owned corporations.

B) The U.S.Board that approves the rules for auditing publicly owned companies.

C) The organization that establishes business laws in the U.S.

D) The Board that establishes the accounting rules that govern American owned corporations.

E) This organization regulates activities associated with the stock market such as the reporting of financial data by publicly owned companies.

F) The national professional organization of accountants.

G) Rules of financial accounting created by the FASB for use in the United States.

H) A set of laws established to strengthen corporate reporting in the United States.

I) The Board that establishes international accounting standards.

J) The U.S.agency that certifies foreign accounting firms to practice in the U.S.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term to the appropriate definition.(There are more definitions than terms. ) -Audit

A) A procedure by which independent evaluators assess the accounting procedures and financial reports of a company.

B) An example of external users of financial statements.

C) Activities directly related to running the business to earn a profit.

D) When a company acquires money from investors.

E) A financial statement that summarizes a company's past and current cash situation.

F) Transactions with lenders (borrowing and repaying cash) and stockholders (selling company stock and paying dividends) .

G) The total amount of profits that are kept by the company.

H) The idea that the financial statements of a company include the results of only that company's business activities.

I) The idea that a company should report its financial data in the relevant currency.

J) Borrowing money from lenders.

K) A financial statement showing a company's assets,liabilities and stockholders' equity.

L) A financial statement that shows a company's revenues and expenses.

M) An example of an internal user of financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors in stock of a company increase their wealth by receiving dividends and by:

A) receiving interest.

B) an increase in the market value of their stock.

C) studying the company's annual financial statements.

D) insider trading.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investing activities on the statement of cash flows arise from transactions:

A) with lenders,borrowing and repaying cash.

B) with stockholders,selling company stock and paying dividends.

C) directly related to running the business to earn profits.

D) related to buying or selling productive resources with long lives.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not likely to be a consequence of fraudulent financial reporting?

A) The company's stock price drops once the fraud is discovered.

B) Innocent accountants who work for the company's CPA firm lose their jobs.

C) Creditors recover 100% of amounts owed to them.

D) Employees lose their retirement savings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blue Fin started the current year with assets of $840,000,liabilities of $420,000 and common stock of $240,000.During the current year,assets increased by $480,000,liabilities decreased by $60,000 and common stock increased by $330,000.There was no payment of dividends to owners during the year. What was the amount of Blue Fin's net income for the year?

A) $270,000

B) $330,000

C) $210,000

D) $540,000

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 228

Related Exams