Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true ?

A) Deflation is an increase in the general level of prices.

B) The consumer price index (CPI) measures changes in the average prices of consumer goods and services.

C) Disinflation is an increase in the rate of inflation.

D) Real income is the actual number of dollars received over a period of time.

E) The real interest rate equals the nominal rate of interest plus the inflation rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The base year in the consumer price index (CPI) is:

A) given a value of zero.

B) a year chosen as a reference for prices in all other years.

C) always the first year in the current decade.

D) established by law.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following can create demand-pull inflation?

A) Excessive aggregate spending.

B) Sharply rising oil prices.

C) Higher labor costs.

D) Recessions and depressions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose hypothetically that the consumer price index (CPI) was 150 in Year 1 and was 180 in Year 2. What would be the inflation rate for this period?

A) 12 percent.

B) 16.7 percent.

C) 20 percent.

D) 30 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about inflation?

A) Inflation promotes social harmony by uniting people against the government.

B) Inflation is more damaging if it is anticipated.

C) Accurate anticipation of inflation is possible for everyone who is well informed about economic events.

D) Those who lend money at a rate below the rate of inflation suffer economic losses.

E) If people accurately anticipate inflation, their actions will prevent it.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose your nominal income this year is 5 percent higher than last year. If the inflation rate for the period was 3 percent, then your real income was:

A) increased by 1.67 percent.

B) increased by 2 percent.

C) increased by 8 percent.

D) decreased by 0.6 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the general price level is termed:

A) the Consumer Price Index.

B) inflation.

C) deflation.

D) stagflation.

E) nominal pricing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Disinflation means a decrease in:

A) the rate of inflation.

B) the general level of prices in the economy.

C) the prices of all products in the economy.

D) the circular flow.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a market basket of goods and services costs $1,000 in the base year and the consumer price index (CPI) is currently 110. This indicates the price of the market basket of goods and services is now:

A) $110.

B) $1,000.

C) $1,100.

D) $1,225.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The real interest rate can be expressed as the:

A) nominal interest rate minus the real interest rate.

B) inflation rate minus the nominal interest rate.

C) nominal interest rate minus the inflation rate.

D) nominal interest rate plus the inflation rate.

Correct Answer

verified

Correct Answer

verified

True/False

The nominal rate of interest is equal to the real interest rate plus the inflation rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

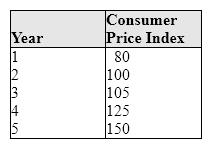

Exhibit 7-2 Consumer Price Index  As shown in Exhibit 7-2, the rate of inflation for Year 2 is:

As shown in Exhibit 7-2, the rate of inflation for Year 2 is:

A) 5 percent.

B) 10 percent.

C) 20 percent.

D) 25 percent.

Correct Answer

verified

Correct Answer

verified

True/False

Inflation was a major problem in the United States during the early years of the Great Depression.

Correct Answer

verified

Correct Answer

verified

True/False

If consumers reduce the purchase of goods whose relative prices rise (substitution bias), the consumer price index (CPI)will tend to have an upward bias over time (overstates inflation).

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During periods of hyperinflation, which of the following is the most likely response of consumers?

A) Save as much as possible.

B) Spend money as fast as possible.

C) Invest as much as possible.

D) Lend money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A worker would be hurt least by inflation when the:

A) worker anticipates inflation and increases savings at the bank.

B) worker is protected by a cost-of-living adjustment clause in an employment contract.

C) price level increases but at a decreasing rate.

D) worker is protected by fixed annual increases in wages and benefits in an employment contract.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the consumer price index (CPI) in Year X was 300 and the CPI in Year Y was 325, the rate of inflation for Year Y was:

A) 325 percent.

B) 25 percent.

C) 5 percent.

D) 8 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the price of gasoline rises and consumers cut back on their use of gasoline relative to other consumer goods. This situation would contribute to which bias in the consumer price index?

A) Substitution bias.

B) Transportation bias.

C) Quality bias.

D) Indexing bias.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A reduction in the rate of inflation is called:

A) deflation.

B) disinflation.

C) hyperinflation.

D) cost-push inflation.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 126

Related Exams