A) The expenditure approach.

B) The income approach.

C) The product-market approach.

D) The circular-flow approach.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in the government expenditures component of GDP?

A) The export of 100 fighter jets to Japan

B) Construction costs of a new public school building

C) Food stamps used by the Smith family

D) A $1,000 check issued by the federal government as part of the Pell Grant program to help college students pay for school

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the income approach, an estimate of the value of capital worn out producing GDP is:

A) indirect business taxes.

B) capital consumption allowance or depreciation.

C) gross private domestic investment.

D) capital erosion estimate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross private domestic investment includes business:

A) purchases of capital goods, all new construction, and purchases of consumer durable goods.

B) purchases of capital goods, all new construction, and inventory investment.

C) purchases of capital goods, all new commercial construction, and inventory investment.

D) purchases of all types of durable goods, all new construction, and inventory investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the income approach, net interest is included because

A) households both receive and pay interest.

B) households pay but do not receive interest and firms receive but do not pay interest.

C) firms pay but do not receive interest and households receive but do not pay interest.

D) it is income to the government but not to households nor firms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GDP does not count:

A) the estimated value of homemaker production.

B) state and local government purchases.

C) spending for new homes.

D) changes in inventories.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unreported or illegal production of goods and services in the economy that is not counted in GDP is termed:

A) money laundering.

B) the underground economy.

C) disposable personal income.

D) indirect national income.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

National income is calculated as GDP:

A) plus depreciation.

B) plus exports.

C) minus imports.

D) minus depreciation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If exports rise and imports fall, then:

A) GDP will increase.

B) GDP will decrease.

C) GDP may remain unchanged.

D) net exports will fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

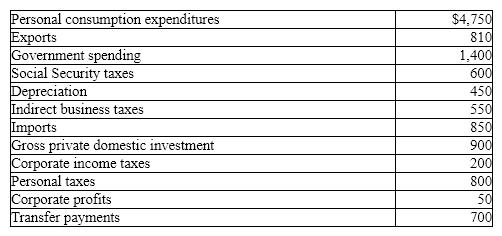

Exhibit 5-11 GDP data (billions of dollars)

In Exhibit 5-11, and using the expenditures approach, gross domestic product (GDP) equals:

In Exhibit 5-11, and using the expenditures approach, gross domestic product (GDP) equals:

A) $7,010 billion.

B) $10,360 billion.

C) $9,660 billion.

D) $7,860 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest component of GDP is:

A) personal consumption expenditures.

B) government spending.

C) durable goods.

D) net exports.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following activities would be calculated as part of GDP accounts?

A) Drug trafficking.

B) Money laundry.

C) Prostitution.

D) Purchasing plastic surgery.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a stock rather than a flow?

A) Ana collects $5,000 per month rent on her property that she leases.

B) Brant mows 25 lawns per week.

C) Connie earns $75,000 per year.

D) Derek has $2,568 in his checking account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Department of Commerce sums the payments made to resources to arrive at GDP in the form of compensation of employees, rents, profits, net interest, indirect taxes, and depreciation. This method of deriving GDP is called the:

A) opportunity cost approach.

B) income approach.

C) expenditure approach.

D) monetarist approach.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the circular flow model, money flows from households to businesses in:

A) factor markets.

B) product markets.

C) neither factor nor product markets.

D) both factor and product markets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

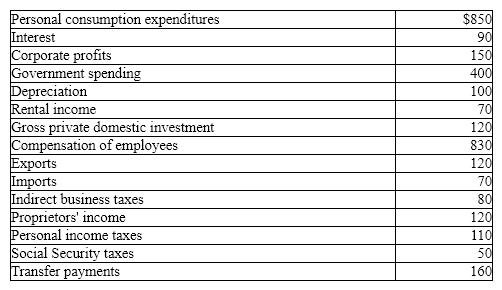

Exhibit 5-8 GDP data (billions of dollars)

In Exhibit 5-8, personal income (PI) equals:

In Exhibit 5-8, personal income (PI) equals:

A) $1,280 billion.

B) $2,290 billion.

C) $1,310 billion.

D) $2,320 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brady pays $37,450 for a new car, including a federal excise tax of $700 and a state sales tax of $1,750. The indirect business tax value added to GDP under the income approach for this purchase is

A) $2,450 because this is income for the government.

B) $2,450 because this is profit for the firm.

C) $700 because only federal taxes are included in indirect business taxes; state taxes are excluded.

D) $1,750 because only state taxes are included in indirect business taxes; federal taxes are excluded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following purchases would be counted as a final good in the GDP calculation?

A) A family's purchase of a used car.

B) A speculator's purchase of 100 shares of Apple Computer stock.

C) A deli's purchase of bread for making its sandwiches.

D) A business's purchase of new office equipment.

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

If a homeowner sells a kitchen table and chairs that she no longer wants to use and does not report the income earned from the sale to the Internal Revenue Service, the value of GDP is

A) understated because this transaction took place in the underground economy.

B) overstated because the sale of the furniture is counted twice in GDP calculations.

C) unaffected by this transaction because the table and chairs were already counted in GDP as final goods when the homeowner bought them new.

D) understated because this purchase was a nonmarket transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

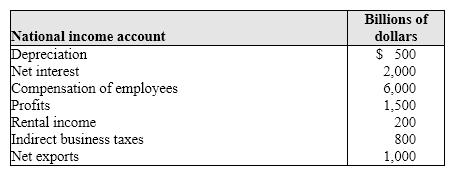

Exhibit 5-5 Gross domestic product data

As shown in Exhibit 5-5, using the income approach, gross domestic product (GDP) is:

As shown in Exhibit 5-5, using the income approach, gross domestic product (GDP) is:

A) $8,000 billion.

B) $8,800 billion.

C) $9,400 billion.

D) $11,000 billion.

Correct Answer

verified

D

Correct Answer

verified

Showing 1 - 20 of 109

Related Exams