A) return on assets

B) times-interest-charges

C) average collection period

D) current ratio

Correct Answer

verified

Correct Answer

verified

Short Answer

The average collection period measures how many days it takes for ________________________ to pay their bills.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is most likely to have a ratio of 1.86 times?

A) the current ratio

B) the profit margin on revenue

C) the return on revenue ratio

D) the average collection period

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is related to a company's performance under the DuPont financial system?

A) gross profit

B) revenue

C) total assets

D) equity

Correct Answer

verified

Correct Answer

verified

Short Answer

-The profit margin on revenue ratio is: _________________

-The profit margin on revenue ratio is: _________________

Correct Answer

verified

Correct Answer

verified

True/False

Minimizing liquidity is an excellent way to meet a company's short-term financial obligations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio measures how well a company can pay its interest on debt plus lease payments?

A) inventory turnover

B) average collection period

C) capital assets turnover

D) fixed-charges coverage

Correct Answer

verified

Correct Answer

verified

True/False

Vertical analysis shows the similar type of information as the technique used for horizontal analysis.

Correct Answer

verified

Correct Answer

verified

Short Answer

-Debt-to-equity is: _____________

-Debt-to-equity is: _____________

Correct Answer

verified

Correct Answer

verified

Short Answer

-Average collection period is: _____________

-Average collection period is: _____________

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the words with the term. -average collection period

A) cost of sales

B) trade receivables

C) operating income

D) current liabilities

E) profit for the year

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-measures ROA

-measures ROA

A) horizontal analysis

B) comparison

C) vertical analysis

D) Du Pont

E) solvency

Correct Answer

verified

Correct Answer

verified

Multiple Choice

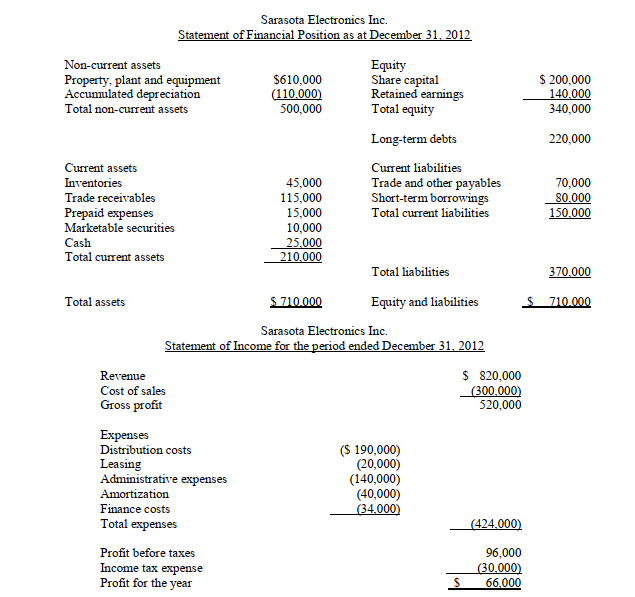

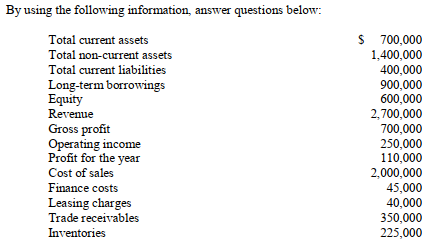

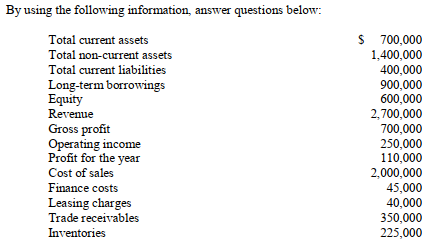

What is the current ratio based on these numbers?

What is the current ratio based on these numbers?

A) The current ratio is 1.33.

B) The current ratio is 0.74.

C) The current ratio 135%.

D) The current ratio 150%.

Correct Answer

verified

Correct Answer

verified

True/False

Ratio analysis helps readers of financial statements assess the financial structure and profitability performance of businesses.

Correct Answer

verified

Correct Answer

verified

Short Answer

Maintaining ___________________________ is a financial objective that can help businesses service or pay all debts (short and long-term).

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the words with the term. -fixed-charges coverage ratio

A) liquidity

B) debt/coverage

C) asset-management

D) profitability

E) market-value

Correct Answer

verified

Correct Answer

verified

Short Answer

By dividing the profit for the year number by total assets, you obtain the ratio called _________________ on total assets.

Correct Answer

verified

Correct Answer

verified

Short Answer

-The profit margin on revenue ratio is: _________________

-The profit margin on revenue ratio is: _________________

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios tells us how management is managing the largest current asset in a company such as Future Shop or Best Buy?

A) The quick ratio.

B) The current ratio.

C) The debt-to-total assets ratio.

D) The inventory turnover.

Correct Answer

verified

Correct Answer

verified

Short Answer

___________________________ ratio indicates how much investors are willing to pay per dollar of reported profits.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 256

Related Exams