A) real GDP

B) the price level

C) nominal GDP

D) the demand for money

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the Bank of Canada wants to stimulate the economy.Which of the following strategies might the Bank use?

A) buy bonds to lower the money supply

B) sell bonds to lower the money supply

C) raise the bank rate to increase the money supply

D) lower the bank rate to increase the money supply

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When would an increase in aggregate demand have a small long-run effect on real GDP?

A) when the aggregate demand curve is flat

B) when the short-run aggregate supply curve is horizontal

C) when the economy is well below potential output

D) when the economy is already at potential output

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For interest rates to remain stable during economic expansions, what should happen to the growth rate of the money supply in relation to the demand for money?

A) The growth rate of the money supply should exceed the growth in the demand for money.

B) The growth rate of the money supply should just match the growth in the demand for money.

C) The growth rate of the money supply should be less than the growth in the demand for money.

D) The growth rate of the money supply should be zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the effect of an expansionary monetary policy on the demand for investment curve?

A) The curve will shift to the left.

B) The curve will shift to the right.

C) There will be a downward movement along the curve.

D) There will be an upward movement along the curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How will a monetary injection by the Bank of Canada affect interest rates and aggregate demand?

A) Interest rates will increase, and aggregate demand will decrease.

B) Interest rates will increase, and aggregate demand will increase.

C) Interest rates will decrease, and aggregate demand will decrease.

D) Interest rates will decrease, and aggregate demand will increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What would be the ultimate effect of a reduction in the money supply?

A) a leftward shift of the aggregate demand curve

B) a rightward shift of the short-run aggregate supply curve

C) a movement upward along the aggregate demand curve

D) a movement downward along the aggregate demand curve

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is an increase in the money supply, with velocity and real GDP constant.According to the equation of exchange, which of the following variables will likely increase?

A) net exports

B) the price level

C) interest rates

D) the value of Canadian dollar

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does a vertical supply curve of money indicate?

A) It indicates that the lower the interest rate, the higher the opportunity cost of holding assets in the form of money.

B) It indicates that the quantity of money supplied is independent of the interest rate.

C) It indicates that the larger the supply of money, the higher the interest rate, all things equal.

D) It indicates that the quantity of money supplied depends on the interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the economy's real output grows at an average rate of 3 percent per year.And suppose there is a 7 percent average rate of growth in the money supply, and velocity is constant.How would the inflation rate be affected?

A) The inflation rate would be -4 percent.

B) The inflation rate would be 4 percent.

C) The inflation rate would be 7 percent.

D) The inflation rate would be 10 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the economy's velocity is constant and real output grows at an average rate of 4 percent per year.What would be the result of a 4 percent average rate of growth in the money supply?

A) a constant price level

B) a constant real GDP

C) a rapidly increasing price level

D) a slowly increasing price level

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the equation of exchange?

A) money in circulation × prices = velocity × income

B) money in circulation × income = velocity × prices

C) real GDP = money in circulation × velocity

D) nominal GDP = money in circulation × velocity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the demand for money vary with price level and real GDP?

A) directly with the price level, and directly with the level of real GDP

B) inversely with the price level, and directly with the level of real GDP

C) directly with the price level, and inversely with the level of real GDP

D) inversely with the price level, and directly with the level of real GDP

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the velocity of money defined?

A) by the time it takes the average worker to get to the bank with his paycheque

B) by the time it takes banks to clear a cheque

C) by the average number of times per year each dollar is used to purchase final goods and services

D) by the average number of times per year each dollar is spent for goods, payrolls, etc.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the equation of exchange, what are increases in the money supply translated into?

A) into increases in the velocity of money

B) into decreases in real GDP

C) into increases in real GDP

D) into increases in the price level

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the equation of exchange?

A) QS = QD

B) P × V = M × Y

C) M × V = P × Y

D) C × I = Y × G

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions might the Bank of Canada take in order to close a recessionary gap?

A) increase government spending

B) decrease taxes

C) sell Canadian government bonds to banks

D) lower the bank rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the demand for money increases, how will the money demand curve be affected?

A) There will be a movement downward along the money demand curve.

B) There will be a movement upward along the money demand curve.

C) There will be a rightward shift of the money demand curve.

D) There will be a leftward shift of the money demand curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What type of relationship exists between the interest rate and the quantity of money demanded?

A) a direct relationship

B) an inverse relationship

C) a direct relationship when the interest rate is low, and an inverse relationship when the interest rate is high

D) an inverse relationship when the interest rate is low, and a direct relationship when the interest rate is high

Correct Answer

verified

Correct Answer

verified

Multiple Choice

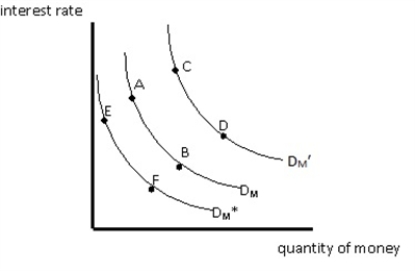

Exhibit 14-1

-Refer to the graph in the exhibit.Suppose there is an increase in level of GDP.What will this increase cause?

-Refer to the graph in the exhibit.Suppose there is an increase in level of GDP.What will this increase cause?

A) a move from B to A

B) a move from A to B

C) a move from DM to DM'

D) a move from DM to DM*

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 130

Related Exams