A) a skilled artisan is needed to duplicate the construction of the damaged property.

B) a labor strike or materials shortage increases construction costs.

C) an ordinance or building code increases the cost of construction.

D) the materials necessary to rebuild the damaged structure are more expensive than ordinary building materials.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Inter-Ocean Transfer owns 12 large cargo ships which transport goods. Inter-Ocean Transfer can obtain physical damage insurance on these vessels by purchasing

A) hull insurance.

B) cargo insurance.

C) protection and indemnity insurance.

D) freight insurance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

XYZ, Inc. would suffer serious financial consequences if either of its two major customers were shut down and could not purchase XYZ products. Which of the following types of consequential loss protection would provide protection against this exposure?

A) leasehold interest

B) extra expense

C) marine insurance

D) business income from dependent properties

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

All of the following statements about inland marine forms are true EXCEPT

A) A mail coverage form covers securities in transit by first-class mail, registered or certified mail, or express mail.

B) A commercial articles coverage form is used to insure photographic equipment and musical instruments.

C) A jewelers block coverage form is used by individuals to insure jewelry limited in coverage by the homeowners form.

D) The signs coverage form covers neon, mechanical, and electrical signs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

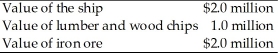

An Inter-Ocean Transfer cargo ship was forced to jettison some cargo in heavy seas. The various interests in the voyage at the time the property was jettisoned were

If $400,000 worth of iron ore was jettisoned, for how much of this amount would Inter-Ocean Transfer be responsible under general average?

If $400,000 worth of iron ore was jettisoned, for how much of this amount would Inter-Ocean Transfer be responsible under general average?

A) nothing

B) $160,000

C) $200,000

D) $400,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The business income and extra expense coverage form covers loss of business income and continuing normal operating expenses. How is business income (revenue) defined?

A) total sales

B) total sales less cost of goods sold

C) pre-tax net profit

D) after-tax net income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements about the businessowners policy are true EXCEPT

A) Coverage for business personal property includes coverage for leased personal property which the named insured has a contractual responsibility to insure.

B) The amount of insurance on the buildings increases by a stated percentage each year.

C) Additional coverages include pollutant cleanup and removal.

D) The policy must be written with a deductible of at least $2,000 for property losses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One inland marine coverage form is the accounts receivable coverage form. In which of the following cases would the purchaser of this form (the insured) be indemnified through the coverage?

A) if the insured cannot pay amounts owed because the purchaser has become insolvent

B) if the insured cannot pay amounts owed because the purchaser has incurred an insured physical damage loss

C) if the insured cannot collect accounts receivable because of the destruction of records

D) if the insured cannot collect accounts receivable because the purchaser extended credit to poor credit risks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements describes a Difference in Conditions (DIC) Policy?

A) It is a type of commercial umbrella liability policy.

B) It is an open perils policy that covers perils not insured by basic property insurance contracts.

C) It is designed to cover indirect losses for which the insured has direct damage coverage.

D) It is used to settle disputes when an insured has more than one insurance policy with differing policy provisions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following perils is not included in the causes-of-loss basic form of the ISO commercial package policy?

A) fire

B) lightning

C) explosion

D) flood

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following forms is used to insure buildings that are under construction?

A) builders risk coverage form

B) floor plan coverage form

C) new construction coverage form

D) labor and materials coverage form

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

The building and personal property coverage form provides several optional coverages. Under one optional coverage, no deduction is taken for depreciation when settling a covered loss. This optional coverage is called

A) extra expense.

B) agreed value.

C) replacement cost.

D) inflation guard.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exterior walls, the roof, and the plumbing, heating and air conditioning systems of a residential condominium can be insured through the purchase of which of the following forms? I.Condominium association coverage form II.Condominium commercial unit-owners coverage form

A) I only

B) II only

C) both I and II

D) neither I nor II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is (are) included in the common declarations page of a commercial package policy? I.A description of the insured property II.A listing of the causes-of-loss that are covered by the policy

A) I only

B) II only

C) both I and II

D) neither I nor II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the equipment breakdown protection coverage form is (are) true? I.The covered cause of loss is a breakdown of covered equipment, including boilers, machinery, and electrical and mechanical equipment. II.It provides coverage for the reasonable cost of expediting permanent repair or replacement of damaged property.

A) I only

B) II only

C) both I and II

D) neither I nor II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Frank's property insurance requires periodic reporting of inventory values. Frank believes he can save money by under-reporting the inventory. Last period, Frank reported $200,000 when the value was really $400,000. Shortly after filing the report, when the value was $500,000, the inventory was destroyed. Ignoring any deductible, how much will Frank's insurer pay?

A) nothing, as underreporting voids coverage

B) $200,000

C) $250,000

D) $400,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning terrorism insurance is (are) true? I. Terrorism insurance covers direct physical damage to the insured's property resulting from an act of terrorism. II. Terrorism insurance and be added through an endorsement to the commercial property insurance policy or purchased as a separate, stand-alone policy.

A) I only

B) II only

C) both I and II

D) neither I nor II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reimbursement for spoilage of frozen food caused by failure of a refrigeration unit at a frozen foods processor can be covered under

A) equipment breakdown insurance.

B) extra expense insurance.

C) builders risk insurance.

D) difference in conditions insurance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the building and personal property coverage form is (are) true? I.A limited amount of coverage is provided for pollutant cleanup and removal at the described premises if the release or discharge of the pollutant results from a covered cause of loss. II.Fire department service charges are specifically excluded because they are a normal cost of doing business.

A) I only

B) II only

C) both I and II

D) neither I nor II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wishing to insure a single shipment of merchandise sent by a common carrier would purchase a(n)

A) annual transit policy.

B) trip transit policy.

C) bailee's liability policy.

D) equipment floater.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 47

Related Exams