Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your home insurance provides for replacement value for personal property losses.A microwave is stolen.It cost $300 two years ago and has an expected life of six years.A comparable microwave costs $200 today.What amount will the insurance company pay?

A) $100

B) $150

C) $200

D) $350

E) $300

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ____________ method to settle claims is based on the current replacement cost of a damaged or lost item less depreciation.

A) replacement value

B) actual cash value

C) umbrella

D) endorsement

E) personal articles endorsement

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purchasing a technology stock that may or may not increase in price is an example of ___________ risk.

A) speculative

B) pure

C) commercial

D) personal

E) liability

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peril is defined as

A) the refusal by an insurance company to pay for the covered loss.

B) the cause of risk.

C) the cause of a possible loss.

D) an uncertainty as to loss.

E) risk

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your home insurance provides for replacement value for personal property losses.A television is stolen.It cost $1,000 two years ago and has an expected life of 5 years.A comparable television costs $500 today.What amount will the insurance company pay?

A) $100

B) $150

C) $200

D) $350

E) $500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following insurance policy provisions requires that the insured must pay for part of the loss of a claim if the property is not insured for the specified percentage of replacement value?

A) personal property floater

B) an endorsement

C) assigned risk clause

D) umbrella coverage

E) coinsurance clause

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Georgette Valentine has expensive photography equipment for use in her hobby.Which coverage from the following list would pay for damage or theft of this equipment?

A) an umbrella policy

B) a household inventory

C) additional living expense coverage

D) a personal articles endorsement

E) a coinsurance floater

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Home insurance costs are affected most directly by

A) the number of claims in an area.

B) insurance agents' commission.

C) government regulations that set premiums.

D) processing costs of claims.

E) the profits of the insurance company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors is used to determine a person's driver classification?

A) Age

B) Type and age of vehicle

C) Claims in your geographic area

D) Insurance company claim processing costs

E) State insurance premium regulations

Correct Answer

verified

Correct Answer

verified

True/False

The purpose of a high-risk pool is to assist people with poor driving records in obtaining automobile insurance coverage.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Not driving to work is an example of what risk management technique?

A) Risk avoidance

B) Risk reduction

C) Risk assumption

D) Risk education

E) Self-insurance

Correct Answer

verified

Correct Answer

verified

True/False

Risk management is not an organized strategy for protecting and conserving assets and people.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk of financial loss due to legal expenses, medical expenses, lost wages, and other expenses associated with injuries caused by an automobile accident for which you were responsible are covered by what type of auto insurance?

A) Bodily injury

B) Accident Benefits

C) Uninsured motorist's protection

D) Property damage

E) Comprehensive physical damage

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of a high-risk pool is to

A) provide insurance for poor drivers.

B) reduce medical costs associated with auto accidents.

C) take unsafe drivers off the road.

D) reduce auto insurance premiums with state regulation.

E) offer premium discounts to safe drivers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

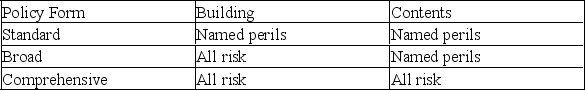

Which of the following home insurance policies will have the highest premium?

A) Standard

B) Broad

C) Comprehensive

D) All forms will have the same cost.

E) Broad and Comprehensive are equally expensive

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Comprehensive coverage would cover financial losses due to

A) injuries caused by a driver without insurance.

B) damage to your car in an accident for which you were at fault.

C) damage to your car caused by wind or hail.

D) legal action against you for an accident.

E) damage to a neighbor's tree with your car.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Auto insurance premiums are not affected by?

A) Make and style of car

B) Use of Vehicle

C) Color of vehicle

D) Driver classification

E) Provincial differences

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wind damage occurs to your car costing $3,000 to repair.If you have a $500 deductible for collision and full coverage for comprehensive, what portion of the claim will the insurance company pay?

A) $500

B) $1,300

C) $2,500

D) $3,000

E) $3,500

Correct Answer

verified

Correct Answer

verified

True/False

Voluntary medical payments coverage in a home insurance policy is designed to pay for legal action taken against a homeowner who may be legally responsible for injury or property damage of others.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 99

Related Exams