Suppose that a university charges students a $100 "tax" to register for business classes. The next year the university raises the "tax" to $150. The deadweight loss from the "tax" triples.

B) False

Correct Answer

verified

Correct Answer

verified

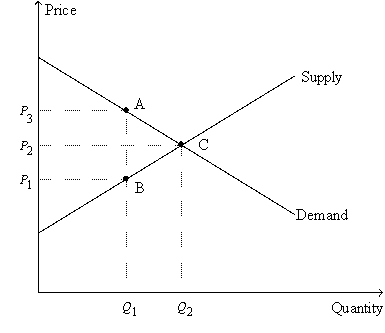

Figure 8-11  -Refer to Figure 8-11. The price labeled as P2 on the vertical axis represents the

-Refer to Figure 8-11. The price labeled as P2 on the vertical axis represents the

A) difference between the price paid by buyers after the tax is imposed and the price paid by buyers before the tax is imposed.

B) difference between the price received by sellers before the tax is imposed and the price received by sellers after the tax is imposed.

C) price of the good before the tax is imposed.

D) price of the good after the tax is imposed.

F) A) and C)

Correct Answer

verified

Correct Answer

verified