Filters

Question type

A) 1.33%

B) 4.00%

C) 8.67%

D) 31.43%

E) 37.14%

Correct Answer

verified

Correct Answer

verified

Question 52

Multiple Choice

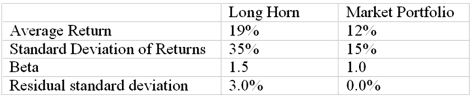

The following data are available relating to the performance of Long Horn Stock Fund and the market portfolio:  The risk-free return during the sample period was 6%. Calculate the Jensen measure of performance evaluation for Long Horn Stock Fund.

The risk-free return during the sample period was 6%. Calculate the Jensen measure of performance evaluation for Long Horn Stock Fund.

A) 1.33%

B) 4.00%

C) 8.67%

D) 31.43%

E) 37.14%

Correct Answer

verified

Correct Answer

verified

Question 53

Multiple Choice

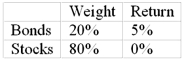

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:  The return on a bogey portfolio was 2%, calculated from the following information.

The return on a bogey portfolio was 2%, calculated from the following information.  The contribution of selection within markets to the Razorback Fund's total excess return was

The contribution of selection within markets to the Razorback Fund's total excess return was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 83 of 83

Related Exams