A) (iii) , (i) , (iv) , (ii) , and (v)

B) (i) , (iii) , (v) , (ii) , and (iv)

C) (vi) , (i) , (iii) , (ii) , and (v)

D) (v) , (ii) , (i) , (iii) , and (iv)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a flexible exchange rate regime, governments can retain monetary policy independence because the external balance will be achieved by

A) the exchange rate adjustments.

B) the price-specie flow mechanism.

C) the Triffin paradox.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that your country officially defines gold as ten times more valuable than silver (i.e. the central bank stands ready to redeem the currency in gold and silver and the official price of gold is ten times the official price of silver) . If the market price of gold is only eight times as much as silver.

A) The central bank could go broke if enough arbitrageurs attempt to take advantage of the pricing disparity.

B) The central bank will make money since they are overpricing gold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Bretton Woods system ended in

A) 1945.

B) 1973.

C) 1981.

D) 2001.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The United States adopted the gold standard in

A) 1776.

B) 1879.

C) 1864.

D) 1973.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prior to the 1870s, both gold and silver were used as international means of payment and the exchange rates among currencies were determined by either their gold or silver contents. Suppose that the dollar was pegged to gold at $30 per ounce, the French franc is pegged to gold at 90 francs per ounce and to silver at 9 francs per ounce of silver, and the German mark pegged to silver at 1 mark per ounce of silver. What would the exchange rate between the U.S. dollar and German mark be under this system?

A) 1 German mark = $2

B) 1 German mark = $0.50

C) 1 German mark = $3

D) 1 German mark = $1

Correct Answer

verified

Correct Answer

verified

Multiple Choice

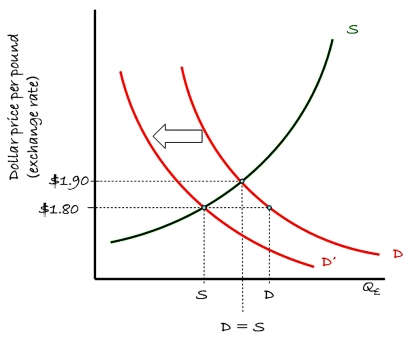

Consider the supply-demand framework for the British pound relative to the U.S. dollar shown in the nearby chart. The exchange rate is currently $1.80 = £1.00. Which of the following is correct?

A) At an exchange rate of $1.80 = £1.00, demand for British pounds exceeds supply.

B) At an exchange rate of $1.80 = £1.00, supply for British pounds exceeds demand.

C) Under a flexible exchange rate regime, the U.S. dollar will depreciate to an exchange rate of $1.90 = £1.00.

D) a and c are correct

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With regard to the current exchange rate arrangement between the U.S. and the U.K., it is best characterized as

A) independent floating (market determined) .

B) managed float.

C) currency board.

D) pegged exchange rate within a horizontal band.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prior to the peso crisis, Mexico depended on foreign portfolio capital to finance its economic development. This foreign capital influx

A) caused higher domestic inflation.

B) led to an overvalued peso.

C) helped Mexico's trade balances.

D) a and b are correct

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The choice between the alternative exchange rate regimes (fixed or floating) is likely to involve a trade-off between

A) national monetary policy autonomy and international economic integration.

B) exchange rate uncertainty and national policy autonomy.

C) Balance of Payments autonomy and inflation.

D) unemployment and inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gold was officially abandoned as an international reserve asset

A) in the January 1976 Jamaica Agreement.

B) in the 1971 Smithsonian Agreement.

C) in the 1944 Bretton Woods Agreement.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The gold standard still has ardent supporters who believe that it provides

A) an effective hedge against price inflation.

B) fixed exchange rates between all currencies.

C) monetary policy autonomy.

D) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To pave the way for the European Monetary Union, the member countries of the European Monetary System agreed to achieve a convergence of their economies. Which of the following is NOT a condition of convergence:

A) keep the ratio of government budget deficits to GDP below 3 percent.

B) keep gross public debts below 60 percent of GDP.

C) achieve a high degree of price stability.

D) maintain its currency at a fixed exchange rate to the ERM.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that both gold and silver are used as international means of payment and the exchange rates among currencies are determined by either their gold or silver contents. Suppose that the dollar was pegged to gold at $20 per ounce, the Japanese yen is pegged to gold at 120,000 yen per ounce and to silver at 8,000 yen per ounce of silver, and the Australian dollar is pegged to silver at $5 per ounce of silver. What would the exchange rate between the U.S. dollar and Australian dollar be under this system?

A) $1 U.S. = $1 Australian

B) $1 U.S. = $2 Australian

C) $1 U.S. = $3 Australian

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Once capital markets are integrated, it is difficult for a country to maintain a fixed exchange rate. Why?

A) The market forces may be stronger than the exchange rate intervention that the government can muster.

B) Portfolio managers will not invest in countries with fixed exchange rates.

C) Because of the Tobin Tax.

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the pound is pegged to gold at £20 per ounce and the dollar is pegged to gold at $35 per ounce. This implies an exchange rate of $1.75 per pound. If the current market exchange rate is $1.60 per pound, how would you take advantage of this situation? Hint: assume that you have $350 available for investment.

A) Start with $350. Buy 10 ounces of gold with dollars at $35 per ounce. Convert the gold to £200 at £20 per ounce. Exchange the £200 for dollars at the current rate of $1.80 per pound to get $360.

B) Start with $350. Exchange the dollars for pounds at the current rate of $1.60 per pound. Buy gold with pounds at £20 per ounce. Convert the gold to dollars at $35 per ounce.

C) a and b both work

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The core of the Bretton Woods system was the

A) World Bank.

B) IMF.

C) United Nations.

D) Interstate Commerce Commission.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The majority of countries got off the gold standard in 1914 when

A) the American Civil War ended.

B) World War I broke out.

C) World War II started.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 1999, an epochal event took place in the arena of international finance when

A) all EU countries adopted a common currency called the euro.

B) eight of 15 EU countries adopted a common currency called the euro.

C) nine of 15 EU countries adopted a common currency called the euro.

D) eleven of 15 EU countries adopted a common currency called the euro.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the theory of optimum currency areas,

A) the relevant criterion for identifying and designing a common currency zone is the degree of factor (i.e. capital and labor) mobility within the zone.

B) exchange rates should reflect the degree to which workers are willing to move to get a better job.

C) exchange rates are determined by portfolio managers seeking the highest return.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 100

Related Exams