A) Equity or justice in taxation

B) Ample evidence that there are tax inequities in the tax system at all levels of government

C) The complete lack of understanding that people have about the purpose of taxes

D) Both (a) and (b)

E) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in government borrowing will cause which of the following?

A) A decrease in the demand for loanable funds

B) A decrease in the supply of bonds

C) An increase in the interest rate

D) An increase in the price of bonds

E) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Proportional tax rates mean that the ratio of tax collection to income

A) Falls as income rises

B) Rises,as income rises

C) Remains the same as income rises

D) Rises as income falls

E) Falls as income falls

Correct Answer

verified

Correct Answer

verified

Multiple Choice

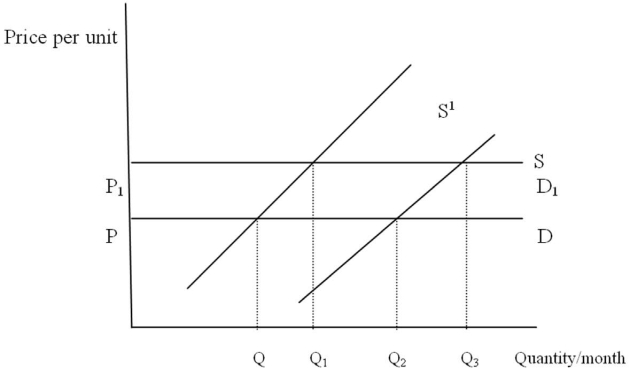

The Following Questions Refer to the graph below.

-Given demand curve D,if a tax independent of output is levied on this good,how much of the tax will be shifted forward?

-Given demand curve D,if a tax independent of output is levied on this good,how much of the tax will be shifted forward?

A) None

B) One-fourth

C) Half

D) All

E) Cannot be determined

Correct Answer

verified

Correct Answer

verified

True/False

In general,a tax levied on net income of a corporation would be shifted to consumers in the short run.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A national crime lab used to prevent criminal activity nationwide is an example of a

A) Negative externality

B) Positive externality

C) Transfer payment

D) Public good

E) Private good

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The highest effective federal tax rate in the United States falls on which income category?

A) The lowest quintile

B) The middle quintile

C) The top 10%

D) The top 5%

E) The top 1%

Correct Answer

verified

Correct Answer

verified

True/False

Government purchases of goods and services have remained a constant percentage of the GDP for the last two decades.

Correct Answer

verified

Correct Answer

verified

True/False

The first budget surplus since 1969 occurred in 1998.

Correct Answer

verified

Correct Answer

verified

True/False

The United States has not had a federal budget surplus since the 1960s.

Correct Answer

verified

Correct Answer

verified

True/False

The federal government uses the tax code to encourage certain behaviors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the US,major sources of tax revenues are:

A) Income taxes at the federal level,property taxes at the state level

B) Sales taxes at the federal level and income taxes and property taxes at the state level

C) Income taxes at the federal level and income and sales taxes at the state level

D) Income taxes at the federal level and payroll taxes at the state level

Correct Answer

verified

Correct Answer

verified

True/False

An increase in government borrowing increases the demand for loanable funds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

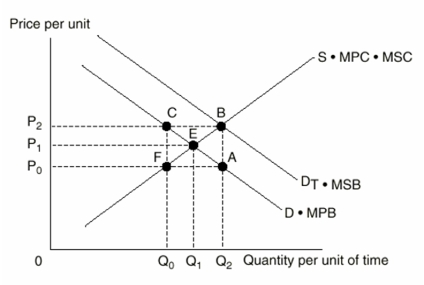

The Following Questions Refer to the graph below.  -Marginal external benefits are represented on the graph as the distance

-Marginal external benefits are represented on the graph as the distance

A) AB

B) Q2A

C) EA

D) CF

E) AF

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following countries has the lowest taxes collected (as a percent of GDP) ?

A) The United States

B) Germany

C) Italy

D) France

E) The United Kingdom

Correct Answer

verified

Correct Answer

verified

True/False

In the absence of externalities,government actions are needed to ensure the efficiency of the market system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a public good or service?

A) A public highway

B) Free cheese offered by the government

C) Food stamps

D) Social security

E) Automobiles

Correct Answer

verified

Correct Answer

verified

True/False

A budget deficit occurs when tax revenues exceed government spending.

Correct Answer

verified

Correct Answer

verified

True/False

The Economic Growth and Taxpayer Relief Reconciliation Act,the Job Creation and Worker Assistance Act,and the Jobs and Growth Tax Relief Act each reduced effective tax rates on incomE.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Economic Growth and Taxpayer Relief Reconciliation Act passed by Congress and signed by President George W.Bush did which of the following?

A) Immediately cut federal tax rates by one-third

B) Gave a $300 check to each taxpayer

C) Decreased the tax on income from financial investments

D) Decreased the federal budget deficit

E) Increased the number of personal income tax brackets

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 125

Related Exams