A) All people should pay equal taxes

B) Only the "rich" should pay taxes

C) People in the same economic circumstances should pay equal taxes,and people in different economic circumstances should pay unequal taxes

D) The distribution of income after taxes should be equal

E) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The federal income tax system results in a mildly progressive tax structurE.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A progressive tax rate means that the ratio of tax collections to income

A) Falls as income rises

B) Rises as income rises

C) Remains the same as income rises

D) Either (a) and (b)

E) May fall,rise,or remain the same as income rises

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there are two individuals who each earn $25,000 per year.One individual pays $2,500 in taxes and the other pays $2,000.This is a violation of

A) The benefits received principle

B) The ability to pay principle

C) Vertical equity

D) Horizontal equity

E) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The enforcement and collection of the personal income tax is the responsibility of the Internal Revenue ServicE.

Correct Answer

verified

Correct Answer

verified

True/False

Public goods and services can be supplied in the market because they are easily divisible into small units and can be priced to the individual demander.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Where marginal benefits are greater than the marginal costs,government expenditures should

A) Be increased

B) Remain the same

C) Be decreased then increased to their original level

D) Be increased then decreased to their original level

E) Do none of the above

Correct Answer

verified

Correct Answer

verified

True/False

An output tax will be shifted completely forward if demand is price elastiC.

Correct Answer

verified

Correct Answer

verified

True/False

There are currently 14 tax brackets ranging from 11% to 50%.

Correct Answer

verified

Correct Answer

verified

True/False

Bond prices and interest rates are inversely relateD.

Correct Answer

verified

Correct Answer

verified

True/False

According to the equimarginal principle,the efficient level of government expenditures occurs when the benefit of the last dollar spent for each purchase is greater than the last dollar of cost.

Correct Answer

verified

Correct Answer

verified

True/False

Transfer payments are government expenditures for currently produced goods and services.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose one individual earns $25,000 per year and another individual earns $15,000 per year.If the individual earning $25,000 per year pays $750 more per year in taxes than the person earning $15,000,this is an illustration of

A) The benefits received principle

B) The ability to pay principle

C) The equal tax treatment principle

D) The equitable payment doctrine

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An efficient level of government expenditures is that level at which

A) Marginal benefits exceed marginal costs

B) Total benefits equal total costs

C) The net benefits to society are maximized

D) The total costs are minimized

E) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The federal budget has been in deficit each year since the beginning of the 1970s.

Correct Answer

verified

Correct Answer

verified

True/False

A tax levied on each unit produced will likely be shifted forward and backward depending upon the elasticities of demand and supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

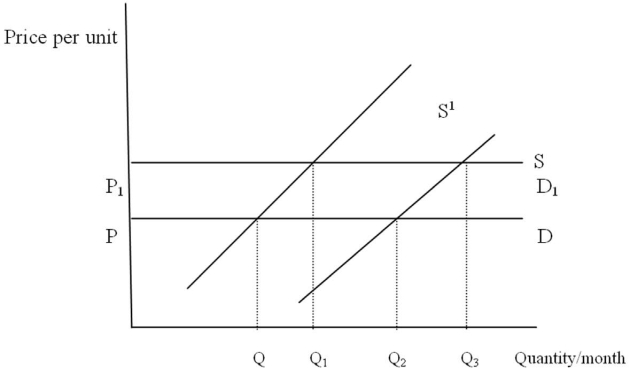

The Following Questions Refer to the graph below.

-Which of the following shifts represents the effect of a tax on this good levied independent of output?

-Which of the following shifts represents the effect of a tax on this good levied independent of output?

A) D to D1

B) D1 to D

C) S to S1

D) S1 to S

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Public goods and services have characteristics that make them

A) Possible to exclude people from consuming them

B) Less available for one person when another consumes them

C) Easy to provide through private markets

D) All of the above

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal government lowered tax rates in

A) 1986 and 2001

B) 1986

C) 2001

D) Neither year

E) 1909 and has raised them ever since

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An output tax will be shifted completely

A) Backward if demand is price inelastic

B) Forward if demand is perfectly price inelastic

C) Forward if demand is price elastic

D) Backward,regardless of elasticity

E) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 125

Related Exams