A) $32.12

B) $35.33

C) $38.87

D) $40.15

E) $42.16

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows,with one outflow followed by a series of inflows.

A) If Project A has a higher IRR than Project B, then Project A must also have a higher NPV.

B) The IRR calculation implicitly assumes that all cash flows are reinvested at the WACC.

C) The IRR calculation implicitly assumes that cash flows are withdrawn from the business rather than being reinvested in the business.

D) If a project has normal cash flows and its IRR exceeds its WACC, then the project's NPV must be positive.

E) If Project A has a higher IRR than Project B, then Project A must have the lower NPV.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) For mutually exclusive projects with normal cash flows, the NPV and MIRR methods can never conflict, but their results could conflict with the discounted payback and the regular IRR methods.

B) Multiple IRRs can exist, but not multiple MIRRs. This is one reason some people favor the MIRR over the regular IRR.

C) If a firm uses the discounted payback method with a required payback of 4 years, then it will accept more projects than if it used a regular payback of 4 years.

D) The percentage difference between the MIRR and the IRR is equal to the project's WACC.

E) The NPV, IRR, MIRR, and discounted payback (using a payback requirement of 3 years or less) methods always lead to the same accept/reject decisions for independent projects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows,with one outflow followed by a series of inflows.

A) One drawback of the regular payback for evaluating projects is that this method does not properly account for the time value of money.

B) If a project's payback is positive, then the project should be rejected because it must have a negative NPV.

C) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

D) If a company uses the same payback requirement to evaluate all projects, say it requires a payback of 4 years or less, then the company will tend to reject projects with relatively short lives and accept long-lived projects, and this will cause its risk to increase over time.

E) The longer a project's payback period, the more desirable the project is normally considered to be by this criterion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

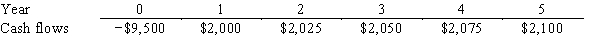

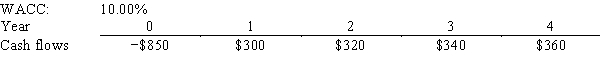

Pet World is considering a project that has the following cash flow data.What is the project's IRR? Note that a project's IRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 2.08%

B) 2.31%

C) 2.57%

D) 2.82%

E) 3.10%

Correct Answer

verified

Correct Answer

verified

True/False

Because "present value" refers to the value of cash flows that occur at different points in time,a series of present values of cash flows should not be summed to determine the value of a capital budgeting project.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

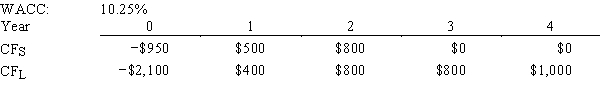

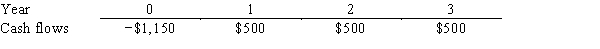

Farmer Co.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the shorter payback,some value may be forgone.How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost.

A) $24.14

B) $26.82

C) $29.80

D) $33.11

E) $36.42

Correct Answer

verified

Correct Answer

verified

Multiple Choice

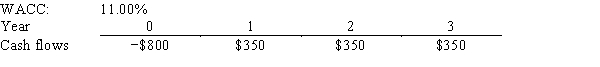

Wiley's Wire Products is considering a project that has the following cash flow and WACC data.What is the project's MIRR? Note that a project's MIRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 8.86%

B) 9.84%

C) 10.94%

D) 12.15%

E) 13.50%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects A and B are mutually exclusive and have normal cash flows.Project A has an IRR of 15% and B's IRR is 20%.The company's WACC is 12%,and at that rate Project A has the higher NPV.Which of the following statements is CORRECT?

A) Assuming the timing pattern of the two projects' cash flows is the same, Project B probably has a higher cost (and larger scale) .

B) Assuming the two projects have the same scale, Project B probably has a faster payback than Project A.

C) The crossover rate for the two projects must be 12%.

D) Since B has the higher IRR, then it must also have the higher NPV if the crossover rate is less than the WACC of 12%.

E) The crossover rate for the two projects must be less than 12%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Markman & Sons is considering Projects S and L.These projects are mutually exclusive,equally risky,and not repeatable and their cash flows are shown below.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV,i.e.,no conflict will exist.

A) $5.47

B) $6.02

C) $6.62

D) $7.29

E) $7.82

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects S and L are equally risky,mutually exclusive,and have normal cash flows.Project S has an IRR of 15%,while Project L's IRR is 12%.The two projects have the same NPV when the WACC is 7%.Which of the following statements is CORRECT?

A) If the WACC is 6%, Project S will have the higher NPV.

B) If the WACC is 13%, Project S will have the lower NPV.

C) If the WACC is 10%, both projects will have a negative NPV.

D) Project S's NPV is more sensitive to changes in WACC than Project L's.

E) If the WACC is 10%, both projects will have positive NPVs.

Correct Answer

verified

Correct Answer

verified

True/False

When considering two mutually exclusive projects,the firm should always select the project whose internal rate of return is the highest,provided the projects have the same initial cost.This statement is true regardless of whether the projects can be repeated or not.

Correct Answer

verified

Correct Answer

verified

True/False

The regular payback method is deficient in that it does not take account of cash flows beyond the payback period.The discounted payback method corrects this fault.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

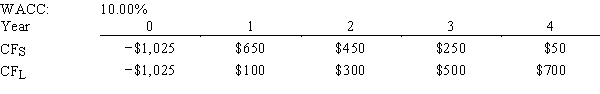

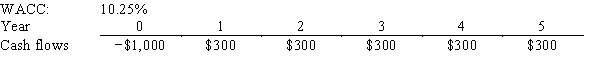

Watts Co.is considering a project that has the following cash flow and WACC data.What is the project's MIRR? Note that a project's MIRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 14.08%

B) 15.65%

C) 17.21%

D) 18.94%

E) 20.83%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider projects S and L.Both have normal cash flows,and the projects have the same risk,hence both are evaluated with the same WACC,10%.However,S has a higher IRR than L.Which of the following statements is CORRECT?

A) If Project S has a positive NPV, Project L must also have a positive NPV.

B) If the WACC falls, each project's IRR will increase.

C) If the WACC increases, each project's IRR will decrease.

D) If Projects S and L have the same NPV at the current WACC, 10%, then Project L, the one with the lower IRR, would have a higher NPV if the WACC used to evaluate the projects declined.

E) Project S must have a higher NPV than Project L.

Correct Answer

verified

Correct Answer

verified

True/False

Under certain conditions,a project may have more than one IRR.One such condition is when,in addition to the initial investment at time = 0,a negative cash flow (or cost)occurs at the end of the project's life.

Correct Answer

verified

Correct Answer

verified

True/False

Assuming that their NPVs based on the firm's cost of capital are equal,the NPV of a project whose cash flows accrue relatively rapidly will be more sensitive to changes in the discount rate than the NPV of a project whose cash flows come in later in its life.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a project has "normal" cash flows, then its MIRR must be positive.

B) If a project has "normal" cash flows, then it will have exactly two real IRRs.

C) The definition of "normal" cash flows is that the cash flow stream has one or more negative cash flows followed by a stream of positive cash flows and then one negative cash flow at the end of the project's life.

D) If a project has "normal" cash flows, then it can have only one real IRR, whereas a project with "nonnormal" cash flows might have more than one real IRR.

E) If a project has "normal" cash flows, then its IRR must be positive.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McGlothin Inc.is considering a project that has the following cash flow data.What is the project's payback?

A) 1.86 years

B) 2.07 years

C) 2.30 years

D) 2.53 years

E) 2.78 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robbins Inc.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that if a project's expected NPV is negative,it should be rejected.

A) $105.89

B) $111.47

C) $117.33

D) $123.51

E) $130.01

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 107

Related Exams