A) Total surplus increases by the amount of the tax.

B) Total surplus increases but by less than the amount of the tax.

C) Total surplus decreases.

D) Total surplus is unaffected by the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Labor taxes may distort labor markets greatly if

A) labor supply is highly inelastic.

B) many workers choose to work 40 hours per week regardless of their earnings.

C) the number of hours many part-time workers want to work is very sensitive to the wage rate.

D) "underground" workers do not respond to changes in the wages of legal jobs because they prefer not to pay taxes.

Correct Answer

verified

Correct Answer

verified

True/False

Taxes on labor tend to increase the number of hours that people choose to work.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10 ![Figure 8-10 -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.With the tax,the total surplus is A) [ 1 / 2 x (P0-P5) x Q5] + [ 1 / 2 x (P5-0) x Q5]. B) [ 1 / 2 x (P0-P2) x Q2] +[(P2-P8) x Q2] + [ 1 / 2 x (P8-0) x Q2]. C) (P2-P8) x Q2. D) 1 / 2 x (P2-P8) x (Q5-Q2) .](https://d2lvgg3v3hfg70.cloudfront.net/TB4793/11ea7a3f_c077_178b_81a2_85956bef03a3_TB4793_00_TB4793_00_TB4793_00_TB4793_00_TB4793_00_TB4793_00_TB4793_00_TB4793_00_TB4793_00_TB4793_00_TB4793_00.jpg) -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.With the tax,the total surplus is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.With the tax,the total surplus is

A) [ x (P0-P5) x Q5] + [ x (P5-0) x Q5].

B) [ x (P0-P2) x Q2] +[(P2-P8) x Q2] + [ x (P8-0) x Q2].

C) (P2-P8) x Q2.

D) x (P2-P8) x (Q5-Q2) .

Correct Answer

verified

Correct Answer

verified

True/False

The more elastic the supply,the larger the deadweight loss from a tax,all else equal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10  -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The tax revenue is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The tax revenue is

A) (P0-P2) x Q2.

B) (P2-P8) x Q2.

C) (P2-P5) x Q5.

D) (P5-P8) x Q5.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10  -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.Without the tax,the producer surplus is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.Without the tax,the producer surplus is

A) (P5-0) x Q5.

B) x (P5-0) x Q5.

C) (P8-0) x Q2.

D) x (P8-0) x Q2.

Correct Answer

verified

Correct Answer

verified

True/False

The Laffer curve is the curve showing how tax revenue varies as the size of the tax varies.

Correct Answer

verified

Correct Answer

verified

Essay

Illustrate on three demand-and-supply graphs how the size of a tax (small,medium and large)can alter total revenue and deadweight loss.

Correct Answer

verified

Correct Answer

verified

True/False

If a tax did not induce buyers or sellers to change their behavior,it would not cause a deadweight loss.

Correct Answer

verified

Correct Answer

verified

True/False

A tax places a wedge between the price buyers pay and the price sellers receive.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

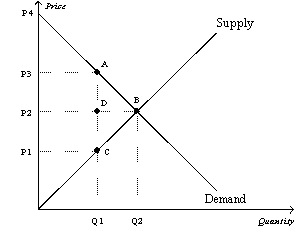

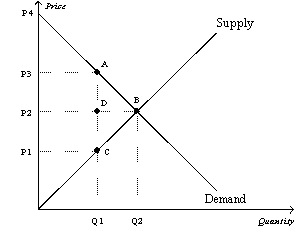

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.The price that sellers effectively receive after the tax is imposed is

-Refer to Figure 8-3.The price that sellers effectively receive after the tax is imposed is

A) P1.

B) P2.

C) P3.

D) P4.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The size of a tax and the deadweight loss that results from the tax are

A) positively related.

B) negatively related.

C) independent of each other.

D) equal to each other.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a good that is taxed,the area on the relevant supply-and-demand graph that represents government's tax revenue is

A) smaller than the area that represents the loss of consumer surplus and producer surplus caused by the tax.

B) bounded by the supply curve,the demand curve,the effective price paid by buyers,and the effective price received by sellers.

C) a right triangle.

D) a triangle,but not necessarily a right triangle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10  -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The price that buyers pay is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The price that buyers pay is

A) P0.

B) P2.

C) P5.

D) P8.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.The per-unit burden of the tax on sellers is

-Refer to Figure 8-3.The per-unit burden of the tax on sellers is

A) P3 - P1.

B) P3 - P2.

C) P2 - P1.

D) P4 - P3.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax shifts the demand curve downward (or to the left) ,we can infer that the tax was levied on

A) buyers of the good.

B) sellers of the good.

C) both buyers and sellers of the good.

D) We cannot infer anything because the shift described is not consistent with a tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefit that government receives from a tax is measured by

A) the change in the equilibrium quantity of the good.

B) the change in the equilibrium price of the good.

C) tax revenue.

D) total surplus.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight loss measures the loss

A) in a market to buyers and sellers that is not offset by an increase in government revenue.

B) in revenue to the government when buyers choose to buy less of the product because of the tax.

C) of equality in a market due to government intervention.

D) of total revenue to business firms due to the price wedge caused by the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed on a good for which the supply is relatively elastic and the demand is relatively inelastic,

A) buyers of the good will bear most of the burden of the tax.

B) sellers of the good will bear most of the burden of the tax.

C) buyers and sellers will each bear 50 percent of the burden of the tax.

D) both equilibrium price and quantity will increase.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 69

Related Exams