A) a debit to finished goods inventory for $120,000

B) a credit to materials inventory for $120,000

C) a debit to work in process-Assembly Department for $120,000

D) a debit to work in process-Finishing Department for $120,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ring Company produces two types of product: Small and Large. Two work orders for two batches of the products are shown below, along with some additional cost information: In the Mixing Department,conversion costs are applied on the basis of direct labour hours.Budgeted conversion costs for the department for the year were $50,000 for labour and $125,000 for overhead.Budgeted direct labour hours were 2,500.It takes three minutes to mix the ingredients needed for each bottle. Small (Work Order 10) and Large (Work Order 11) flow through the Mixing Department first,then through the Cooking and Bottling departments. -Refer to the figure.What are Ring Company's conversion costs applied to Small (Work Order 10) from the Mixing Department for each batch?

A) $35

B) $17,500

C) $35,000

D) $175,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is available for Dale, Inc.: -Refer to the figure.What are the conversion costs in the Finishing Department?

A) $35,000

B) $37,500

C) $40,000

D) $57,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Dodd Company uses a weighted average process costing system. The following information was reported for the Assembly process for July. Materials are added at the beginning of the process and are 100%. -Refer to the figure.What are the equivalent units for conversion?

A) 100,000

B) 125,000

C) 133,000

D) 165,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is characteristic of a process costing system?

A) It is more expensive because it has more work-in-process accounts.

B) There is no need to track materials to processes.

C) There is no need to use time tickets to assign costs to processes.

D) It is used for businesses that produce unique products.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Total costs to account for" does NOT include which of the following costs?

A) direct materials requisitioned for the department

B) prior department costs transferred in

C) ending work-in-process balance

D) beginning work-in-process balance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pelosi Company manufactures chairs. The following information was given for the company: Materials in the ending inventory were 100 percent complete and conversion in the ending inventory was 20 percent complete. -Refer to the figure.What cost is assigned to ending work in process?

A) $110,000

B) $114,000

C) $126,000

D) $130,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quinn Corporation produces a product that passes through two processes. During October, the first department transferred 20,000 units to the second department. The cost of the units transferred was $60,000. Materials are added uniformly in the second process. The following information is provided about the second department’s operations during October: Units, beginning work in process (1/3 complete) 6,000 Units, ending work in process ( complete) 4,000 -Refer to the figure.What would be the equivalent units for those transferred in from the prior department using FIFO?

A) 10,000 units

B) 20,000 units

C) 22,000 units

D) 26,000 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kent Company adds materials to production at the beginning of the process in the Production Department.It uses a single-step process.Data on material for this department for October are as follows: The company uses the FIFO inventory method. What is the materials cost in work in process on October 31?

A) $31,000

B) $37,500

C) $39,000

D) $46,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bill Berry, CPA, prepares tax returns. The production costs and the number of tax returns prepared for the month of August are as follows: Number of tax returns 200 -Refer to the figure.What is the unit cost per tax return?

A) $0.50

B) $4.50

C) $10.00

D) $15.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pelosi Company manufactures chairs. The following information was given for the company: Materials in the ending inventory were 100 percent complete and conversion in the ending inventory was 20 percent complete. -Refer to the figure.What are the units started and completed?

A) 10,000

B) 15,000

C) 20,000

D) 40,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Champ Inc. manufactures a product that passes through two processes: mixing and moulding. All manufacturing costs are added uniformly in the Mixing Department. Information for the Mixing Department for October follows: During October,26,750 units were completed and transferred to the Moulding Department.The following costs were incurred by the Mixing Department during October: -Refer to the figure.What is the cost of October's ending work in process for the Mixing Department using the FIFO method?

A) $26,250

B) $50,400

C) $63,000

D) $49,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When products and their costs are moved from one process to the next process,what is the term for these costs?

A) unit costs

B) transferred-in costs

C) WIP inventory costs

D) equivalent unit costs

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ely Company had the following data for the current year: Materials are added at the beginning of the process. Beginning work in process was 40 percent complete as to conversion. Ending work in process was 70 percent complete as to conversion. -What unit-costing method excludes prior-period work and costs in computing current-period unit work and costs?

A) FIFO costing method

B) transferred-in costing method

C) weighted average method

D) LIFO costing method

Correct Answer

verified

Correct Answer

verified

Multiple Choice

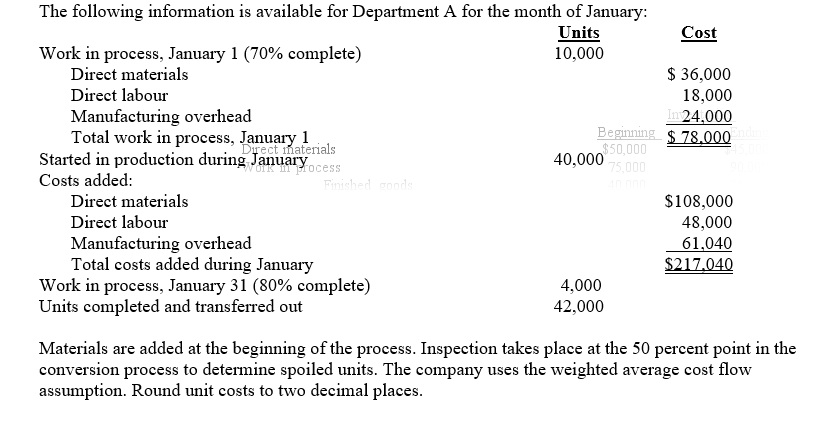

-Refer to the figure.What are Department A's equivalent units of production for materials using the weighted average method?

-Refer to the figure.What are Department A's equivalent units of production for materials using the weighted average method?

A) 44,800

B) 47,200

C) 50,000

D) 54,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

JIT firms are usually structured so they can use a particular type of costing system to determine product costs.What is the system?

A) process costing

B) job-order costing

C) joint costing

D) variable costing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Speakeasy Co. manufactures podiums. Production consists of three processes: cutting, assembly, and finishing. The following costs are given for May: There were no work in process inventories and 1,000 podiums were produced. -Refer to the figure.What is the cost transferred out of the Assembly department?

A) $14,000

B) $29,000

C) $43,000

D) $54,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peck Corporation produces a product that passes through two processes. During October, the first department transferred 20,000 units to the second department. The cost of the units transferred was $30,000. Materials are added uniformly in the second process. The following information is provided about the second department’s operations during October: Units, beginning work in process 4,000 Units, ending work in process 5,500 -Refer to the figure.What is the number of units completed in the second department during October?

A) 9,500 units

B) 18,500 units

C) 24,000 units

D) 27,500 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is available: Materials are added at the beginning of the process. How many equivalent units for conversion would there be in November using the weighted average method?

A) 30,400 units

B) 32,000 units

C) 33,200 units

D) 36,000 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term for a unit-costing method that merges prior-period work and costs with current-period work and costs?

A) FIFO costing method

B) transferred-in cost

C) weighted average method

D) operating costing

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 132

Related Exams