A) $3.57 per direct labor hour

B) $3.81 per direct labor hour

C) $4.00 per direct labor hour

D) $4.50 per direct labor hour

Correct Answer

verified

Correct Answer

verified

True/False

An unfavorable production volume variance decreases the manufacturing costs shown on the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ is used for external reporting.

A) Absorption costing

B) Variable costing

C) Direct costing

D) Activity-based costing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The proration method of disposing of overhead variances assigns the variance in proportion to the sizes of the ending account balances of ________.

A) work-in-process inventory,finished goods inventory and direct material inventory

B) work-in-process inventory,direct material inventory and cost of goods sold

C) work-in-process inventory and direct materials inventory

D) work-in-process inventory,finished goods inventory and cost of goods sold

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Product costs for variable costing include direct materials,direct labor and ________.

A) variable selling costs

B) fixed manufacturing overhead costs

C) variable manufacturing overhead costs

D) variable manufacturing overhead costs plus variable selling costs

Correct Answer

verified

Correct Answer

verified

Multiple Choice

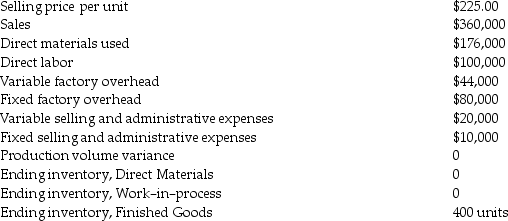

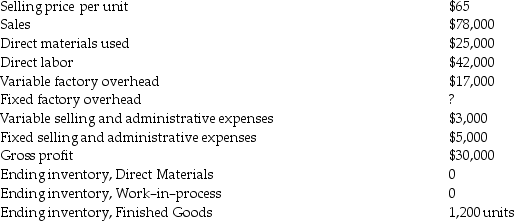

Andersen Industries Inc.reported the following information about the production and sale of its only product during the first month of operations:  Under absorption costing,what is the Gross Profit?

Under absorption costing,what is the Gross Profit?

A) $0

B) $40,000

C) $84,000

D) $104,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

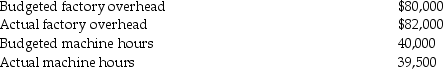

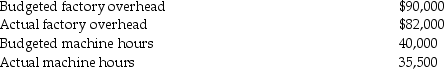

Giants Company had the following information:  Assume the cost driver for factory overhead costs is machine hours and a product uses 10,000 machine hours.What amount of factory overhead is applied to the product?

Assume the cost driver for factory overhead costs is machine hours and a product uses 10,000 machine hours.What amount of factory overhead is applied to the product?

A) $20,000

B) $20,250

C) $20,500

D) $28,750

Correct Answer

verified

Correct Answer

verified

Multiple Choice

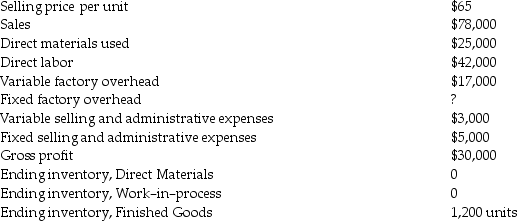

Brucker Industries Inc.reported the following information about the production and sale of its only product during the first month of operations:  Under variable costing,the variable manufacturing cost of goods sold is ________.

Under variable costing,the variable manufacturing cost of goods sold is ________.

A) $42,000

B) $48,000

C) $84,000

D) $96,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What variance(s) is(are) computed for fixed overhead costs?

A) production volume variance

B) flexible budget variance

C) efficiency variance

D) production volume variance and flexible budget variance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

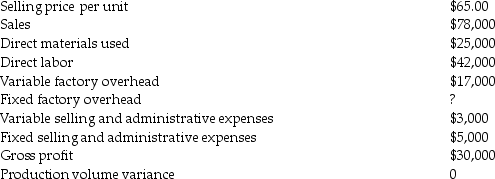

Today Industries Inc.reported the following information about the production and sale of its only product during the first month of operations:  The company sold one-half of the units it produced.The company uses absorption costing.Fixed factory overhead costs included in the ending inventory of finished goods are ________.

The company sold one-half of the units it produced.The company uses absorption costing.Fixed factory overhead costs included in the ending inventory of finished goods are ________.

A) 0

B) $6,000

C) $8,400

D) $12,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The production volume variance appears when ________.

A) the actual production volume equals the expected production volume used in computing the fixed overhead rate

B) the actual production volume deviates from the expected production volume used in computing the fixed overhead rate

C) the actual production volume deviates from the expected production volume used in computing the variable overhead rate

D) the actual production volume equals the expected production volume used in computing the variable overhead rate

Correct Answer

verified

Correct Answer

verified

True/False

Accountants use actual overhead rates when applying overhead costs to jobs as they are completed.

Correct Answer

verified

Correct Answer

verified

True/False

Under absorption-costing,fixed factory overhead costs appear only in cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To compute contribution margin under variable costing,we deduct ________ and ________ from sales.

A) variable manufacturing costs; fixed manufacturing costs

B) variable selling costs; fixed manufacturing costs

C) variable administrative costs; variable selling costs

D) variable manufacturing costs; variable selling and administrative costs

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dodge Company had the following information:  Assume machine hours are the cost driver of factory overhead costs.The budgeted factory overhead rate is ________.

Assume machine hours are the cost driver of factory overhead costs.The budgeted factory overhead rate is ________.

A) $2.025 per machine hour

B) $2.05 per machine hour

C) $2.25 per machine hour

D) $2.875 per machine hour

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Applied fixed overhead is computed using the ________ amount of the cost driver.

A) expected

B) budgeted

C) actual

D) full-capacity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What variance(s) is(are) computed for variable overhead costs?

A) production volume variance

B) flexible budget variance

C) quality variance

D) production volume variance and flexible budget variance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goldberg Industries reported the following information about the production and sale of its only product during the first month of operations:  Under variable costing,the contribution margin is ________.

Under variable costing,the contribution margin is ________.

A) $7,000

B) $21,000

C) $33,000

D) $34,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess of actual overhead costs over the applied overhead costs is called ________.

A) overapplied overhead

B) underapplied overhead

C) underbudgeted overhead

D) overestimated overhead

Correct Answer

verified

Correct Answer

verified

True/False

Differences between variable-costing and absorption-costing operating income can be explained by the change in units in beginning and ending inventory of finished goods.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 127

Related Exams