A) Net income

B) Foreign-currency translation adjustments

C) Unrealized gains or losses on certain investments

D) Contingent liabilities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rakish Co. purchases 3,500 shares of its own $1 par value common stock for $80 per share. Which of the following is the correct journal entry to record this transaction?

A) Debit Common stock $3,500, debit Paid-in capital $276,500 and credit Cash $280,000.

B) Debit Cash $280,000, credit Common stock $3,500 and credit Paid-in capital $276,500.

C) Debit Cash $280,000 and credit Treasury stock $280,000.

D) Debit Treasury stock $280,000 and credit Cash $280,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

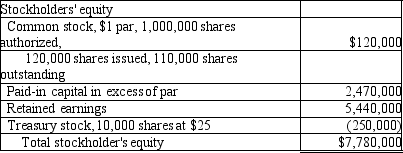

At March 31, 2014, the Park Place Company shows the following data on their balance sheet:  Assume that Park Place sells 900 shares of treasury stock at $32 per share. What will the total equity be after this transaction?

Assume that Park Place sells 900 shares of treasury stock at $32 per share. What will the total equity be after this transaction?

A) $7,751,200

B) $7,808,800

C) $7,780,900

D) $7,730,000

Correct Answer

verified

Correct Answer

verified

True/False

If a company's lenders wanted to ensure that the company maintained adequate levels of equity to pay back their loans, a good strategy would be to impose restrictions on dividend payments and purchases of treasury stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes other gains (losses) on the income statement?

A) The gains and losses from transactions that are not part of the normal operations of the business

B) The income or loss from segments of the business that have been sold or terminated

C) The income or loss generated from unusual and infrequent events

D) The income or loss generated from the normal operations of the business

Correct Answer

verified

Correct Answer

verified

Multiple Choice

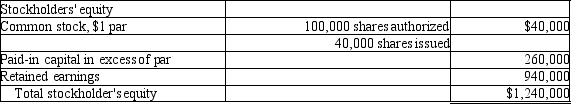

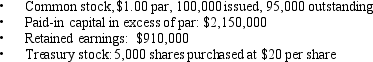

On June 30, 2013, Stephans Company showed the following data on the equity section of their balance sheet:  On July 1, 2013, Stephans distributed a 5% stock dividend. The market value of the stock at that time was $13 per share. Following this transaction, what would be the new balance in Paid-in capital in excess of par?

On July 1, 2013, Stephans distributed a 5% stock dividend. The market value of the stock at that time was $13 per share. Following this transaction, what would be the new balance in Paid-in capital in excess of par?

A) $286,000

B) $284,000

C) $260,000

D) $234,000

Correct Answer

verified

Correct Answer

verified

True/False

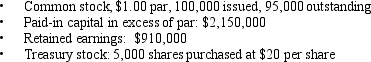

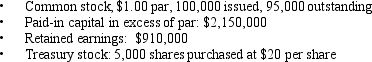

Please refer to the following information for Peartree Company:

If Peartree resold 1,000 shares of treasury stock for $24 per share, the total equity of the company would remain unchanged.

If Peartree resold 1,000 shares of treasury stock for $24 per share, the total equity of the company would remain unchanged.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Please refer to the following information for Peartree Company:  If Peartree purchases an additional 1,000 shares of treasury stock at $18 per share, which of the following statements would be TRUE?

If Peartree purchases an additional 1,000 shares of treasury stock at $18 per share, which of the following statements would be TRUE?

A) The Treasury stock account would go down by $18,000.

B) The Paid-in capital account would not be affected.

C) The Retained earnings account would go down by $2,000.

D) The Paid-in capital account would go down by $2,000.

Correct Answer

verified

Correct Answer

verified

True/False

The entry to record an appropriation of retained earnings requires a debit to Retained earnings and a credit to Cash.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following occurs when the board of directors declares a 2-for-1 stock split on 20,000 outstanding shares of $15 par common stock?

A) The par value of the stock remains the same.

B) The par value of the stock increases to $30 per share.

C) Outstanding shares decrease to 10,000.

D) Outstanding shares increase to 40,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation closes a facility and moves to a new location. How would a loss on the disposal of the equipment at the closed facility be reported on an income statement?

A) As an operating expense in net income from continuing operations

B) As a component of discontinued operations

C) As an extraordinary loss

D) As another loss in net income from continuing operations

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock is a corporation's own stock that it has issued and later reacquired.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Please refer to the following information for Peartree Company:  If Peartree purchases an additional 1,000 shares of treasury stock at $18 per share, what journal entry will be required?

If Peartree purchases an additional 1,000 shares of treasury stock at $18 per share, what journal entry will be required?

A) Debit Treasury stock $18,000 and credit Retained earnings $18,000.

B) Debit Treasury stock $20,000, credit Loss on sale $2,000 and credit Cash $18,000.

C) Debit Treasury stock $18,000 and credit Cash $18,000.

D) Debit Cash $18,000 and credit Treasury stock $18,000.

Correct Answer

verified

Correct Answer

verified

True/False

If a company does not have enough cash to pay out regular dividends, but still wishes to give the shareholders something that they would consider of value, the company should consider doing a stock split.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is TRUE?

A) Treasury stock causes the number of issued shares to go down.

B) Treasury stock causes the number of issued shares to exceed authorized shares.

C) Treasury stock causes the number of outstanding shares to go up.

D) Treasury stock causes the number of outstanding shares to go down.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following occurs due to a 4-for-1 stock split?

A) The par value of each share of common stock is 25% of the par value before the split.

B) The par value of each share of common stock is 200% of the par value before the split.

C) The par value of each share of common stock remains the same as before the split.

D) The par value of each share of common stock is 400% of the par value before the split.

Correct Answer

verified

Correct Answer

verified

True/False

Prior period adjustments are shown as an adjustment to the beginning balance of Retained earnings, as reported on the statement of retained earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

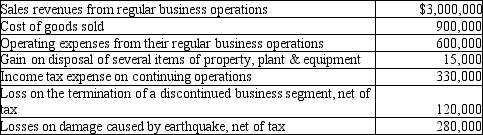

At January 1, 2014, Foxmore Company had 80,000 shares of common stock outstanding and no preferred stock. During the year, they issued 40,000 additional shares of common stock. At December 31, 2014, Foxmore had 120,000 shares of common stock outstanding, and no preferred stock. In addition, Foxmore reported the following results for the year 2014:  At December 31, 2014, how much is the earnings per share for income (loss) from continuing operations?

(Please round all calculations to the nearest cent.)

At December 31, 2014, how much is the earnings per share for income (loss) from continuing operations?

(Please round all calculations to the nearest cent.)

A) $(1.20)

B) $7.85

C) $10.65

D) $11.85

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The treasury stock account is:

A) credited upon purchase of treasury stock.

B) debited upon purchase of treasury stock.

C) treated like a common stock account.

D) deducted from the common stock account and shown as a net amount.

Correct Answer

verified

Correct Answer

verified

True/False

Gains and losses from the disposal of old plant and equipment are reported as other gains or losses in the multi-step income statement.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 164

Related Exams