Correct Answer

verified

Correct Answer

verified

Multiple Choice

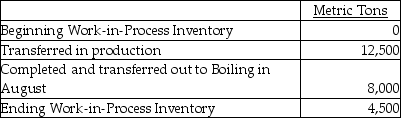

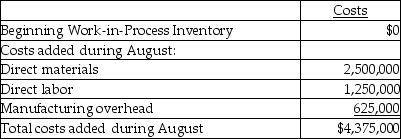

Organic Sugar Inc.at Ohio has six processing departments for refining sugar-Affination,Carbonatation,Decolorization,Boiling,Recovery,and Packaging.Conversion costs are added evenly throughout each process.Data from the month of August for the Decolorization Department are as follows:

The ending Work-in-Process Inventory is 100% and 65% complete with respect to direct materials and conversion costs,respectively.Compute the equivalent units of production (EUP) for direct materials and for conversion costs for the month of August.

The ending Work-in-Process Inventory is 100% and 65% complete with respect to direct materials and conversion costs,respectively.Compute the equivalent units of production (EUP) for direct materials and for conversion costs for the month of August.

A) 10,925 EUP for direct materials and 2,925 EUP for conversion costs

B) 12,500 EUP for direct materials and 10,925 EUP for conversion costs

C) 2,925 EUP for direct materials and 10,925 EUP for conversion costs

D) 12,500 EUP for direct materials and 2,925 EUP for conversion costs

Correct Answer

verified

Correct Answer

verified

True/False

In a process costing system,equivalent units must be calculated separately for materials and conversion costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The beginning inventory costs and current period costs are combined to determine the average cost of equivalent units of production under the ________.

A) equivalent units method

B) conversion costs method

C) first-in-first-out method

D) weighted-average method

Correct Answer

verified

Correct Answer

verified

True/False

Cost amounts that are transferred out of one process become the transferred in cost for the next process.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following formulae is used to calculate the cost per equivalent unit of production (EUP) for direct materials?

A) Cost per EUP for direct materials = Total conversion costs ÷ Equivalent units of production for direct materials

B) Cost per EUP for direct materials = Total direct materials costs ÷ Equivalent units of production for direct materials

C) Cost per EUP for direct materials = Total transferred in costs ÷ Equivalent units for transferred in

D) Cost per EUP for direct materials = Total direct materials costs ÷ Equivalent units of production for conversion costs

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes the term equivalent units?

A) partially completed units expressed in terms of fully complete units of output

B) partially completed units of output that will be sold as is

C) substitute of units that are partially completed

D) different types of units that have same selling price

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct labor costs and manufacturing overhead costs required to produce finished goods from raw materials are called ________.

A) transferred in costs

B) cost of sales

C) finished goods costs

D) conversion costs

Correct Answer

verified

Correct Answer

verified

True/False

The adjusting entry for overallocated or underallocated manufacturing overhead is usually prepared at the beginning of the accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Morewell Inc.has two processes-Coloring Department and Mixing Department.The company assigned $385,000 to the 5,500 gallons of paint transferred from Mixing Department to Finished Goods Inventory.The journal entry to record completion of processing is ________.

A) debit Work-in-Process Inventory-Mixing,$385,000; credit Finished Goods Inventory,$385,000

B) debit Finished Goods Inventory,$385,000; credit Cost of Goods Sold,$385,000

C) debit Cost of Goods Sold,$385,000; credit Finished Goods Inventory,$385,000

D) debit Finished Goods Inventory,$385,000; credit Work-in-Process Inventory-Mixing,$385,000

Correct Answer

verified

Correct Answer

verified

True/False

Production cost reports prepared using first-in-first-out (FIFO)method assumes that the first units started in the production process are the last units completed and sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

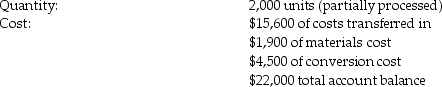

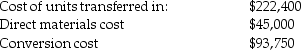

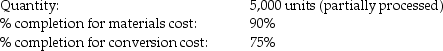

LDR Manufacturing produces a pesticide chemical and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,2012,the Refining Department had 2,000 gallons of partially processed product in production.During January,32,000 gallons were transferred in from the Mixing Department and 29,000 gallons were completed and transferred out.At the end of the month,there were 5,000 gallons of partially processed product remaining in the Refining Department.See additional details below. Refining Department,beginning balance at January 1,2012

Costs added during January

Costs added during January

Refining Department,ending balance at January 31,2012

Refining Department,ending balance at January 31,2012

What was the cost per equivalent unit with respect to conversion costs for the Refining Department in the month of January? (Use the weighted average method and round your calculations to the nearest cent.)

What was the cost per equivalent unit with respect to conversion costs for the Refining Department in the month of January? (Use the weighted average method and round your calculations to the nearest cent.)

A) $1.40

B) $3.00

C) $1.34

D) $2.86

Correct Answer

verified

Correct Answer

verified

True/False

Under a process costing system,direct labor costs are assigned to the Work-in-Process account of the department for which they are incurred.

Correct Answer

verified

Correct Answer

verified

True/False

In a production cost report,the number of units to account for must always be greater than the number of units accounted for.

Correct Answer

verified

Correct Answer

verified

True/False

When finished products are sold,Sales Revenue is debited and Cost of Goods Sold is credited.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jetwell Inc.incurred $7,000 for indirect labor in Department III.The journal entry to record indirect labor utilized is ________.

A) debit Manufacturing Overhead,$7,000; credit Accounts Payable,$7,000

B) debit Accounts Payable,$7,000; credit Manufacturing Overhead,$7,000

C) debit Manufacturing Overhead,$7,000; credit Wages Payable,$7,000

D) debit Wages Payable,$7,000; credit Manufacturing Overhead,$7,000

Correct Answer

verified

Correct Answer

verified

True/False

A production cost report shows only the calculations for the physical flow of products.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

LDR Manufacturing produces a pesticide chemical and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,2014,the first department-Mixing-had no beginning inventory.During January,40,000 fl.oz.of chemicals were started in production.Of these,32,000 fl.oz.were completed and 8,000 fl.oz.remained in process.In the Mixing Department,all direct materials are added at the beginning of the production process and conversion costs are applied evenly through the process. At the end of the month,LDR calculated equivalent units.The ending inventory in the Mixing Department was 60% complete with respect to conversion costs. -With respect to conversion costs,how many equivalent units were calculated for the product that was completed and for ending inventory?

A) Product completed: 32,000 equivalent units; Products in ending inventory: 4,800 equivalent units

B) Product completed: 32,000 equivalent units; Products in ending inventory: 8,000 equivalent units

C) Product completed: 19,200 equivalent units; Products in ending inventory: 4,800 equivalent units

D) Product completed: 40,000 equivalent units; Products in ending inventory: 8,000 equivalent units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

LDR Manufacturing produces a chemical pesticide and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,2012,the first department-Mixing-had a zero beginning balance.During January,40,000 gallons of chemicals were started into production.During the month,32,000 gallons were completed,and 8,000 remained in process,partially completed.In the Mixing Department,all direct materials are added at the beginning of the production process and conversion costs are applied evenly through the process. - During January,the Mixing Department incurred $60,000 in direct materials costs and $230,000 in conversion costs.At the end of the month,the ending inventory in the Mixing Department was 60% complete with respect to conversion costs.First,calculate the equivalent units,then calculate the cost per equivalent unit,and then calculate the total cost of the product that was completed and transferred out during January. The total cost of product transferred out was ________.

A) $304,347

B) $280,000

C) $243,478

D) $248,000

Correct Answer

verified

Correct Answer

verified

Essay

Iowa Inc.purchased raw materials for $6,000 and $25,000 for cash and on account,respectively.Provide the journal entry to record purchase of raw materials.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 144

Related Exams