A) credit to Salaries Payable for $8,150

B) debit to Salaries Expense for $7,902

C) debit to Salaries Payable for $8,150

D) debit to Salaries Payable for $7,902

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scott Company sells merchandise with a one-year warranty. Sales consisted of 2,500 units in Year 1 and 2,000 units in Year 2. It is estimated that warranty repairs will average $10 per unit sold, and 30% of the repairs will be made in Year 1 and 70% in Year 2 for the Year 1 sales. Similarly, 30% of repairs will be made in Year 2 and 70% in Year 3 for the Year 2 sales. In the Year 3 income statement, how much of the warranty expense shown will be due to Year 1 sales?

A) $6,000

B) $14,000

C) $20,000

D) $0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Proper payroll accounting methods are important for a business for all the reasons below except

A) good employee morale requires timely and accurate payroll payments

B) payroll is subject to various federal and state regulations

C) to help a business with cash flow problems by delayed payments of payroll taxes to federal and state agencies

D) payroll and related payroll taxes have a significant effect on the net income of most businesses

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are included in the employer's payroll taxes?

A) SUTA taxes

B) FUTA taxes

C) social security taxes

D) all are included in employer taxes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most employers are levied a tax on payrolls for

A) sales tax

B) medical insurance premiums

C) federal unemployment compensation tax

D) union dues

Correct Answer

verified

Correct Answer

verified

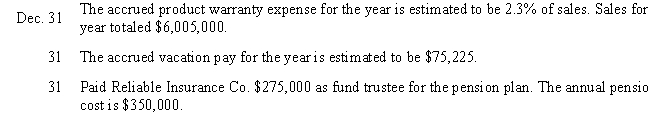

Essay

Journalize the following transactions for Riley Corporation: Dec. 31 The accrued product warranty expense for the year is estimated to be of sales. Sales for the year totaled . 31 The accrued vacation pay for the year is estimated to be . 31 Paid First Insurance Co. as fund trustee for the pension plan. The annual pension cost is .

Correct Answer

verified

11ea84e6_aff0_0aae_9a63_69a8bac9664c_TB2281_00_TB2281_00

Correct Answer

verified

Multiple Choice

On January 1, Gemstone Company obtained a $165,000, 10-year, 7% installment note from Guarantee Bank. The note requires annual payments of $23,492, with the first payment occurring on the last day of the fiscal year. The first payment consists of interest of $11,550 and principal repayment of $11,942. The journal entry to record the payment of the first annual amount due on the note would include a

A) debit to cash for $11,942

B) credit to interest payable for $11,550

C) debit to notes payable for $11,942

D) debit to interest expense for $23,492

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Each year there is a ceiling for the amount that is subject to all of the following except

A) social security tax

B) federal income tax

C) federal unemployment tax

D) state unemployment tax

Correct Answer

verified

Correct Answer

verified

True/False

The discount on a note payable is charged to an account that has a normal credit balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is not a determinate in calculating federal income taxes withheld from an individual's pay?

A) marital status

B) types of earnings

C) gross pay

D) number of withholding allowances

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

On January 1, Year 1, Zero Company obtained a $52,000, 4-year, 6.5% installment note from Regional Bank. The note requires annual payments of $15,179, beginning on December 31, Year 1. The December 31, Year 3 carrying amount in the allocation of periodic payments table for this installment note will be equal to

A) $0

B) $13,000

C) $14,252

D) $6,463

Correct Answer

verified

Correct Answer

verified

Essay

Nelson Industries warrants its products for one year. The estimated product warranty is 4.3% of sales. Sales were $475,000 for September. In October, a customer received warranty repairs requiring $215 of parts and $65 of labor. (a) Joumalize the adjusting entry required at September 30 , the end of the first month of the current year, to record the estimated product warranty expense. (b) Journalize the entry to record the warranty work provided in October.

Correct Answer

verified

Correct Answer

verified

Essay

Kelly Howard has the following transactions. Prepare the journal entries.

Correct Answer

verified

11ea84e6_aff0_0ab0_9a63_1d5f668980cb_TB2281_00_TB2281_00

Correct Answer

verified

Essay

According to a summary of the payroll of Scotland Company, salaries for the period were $500,000. Federal income tax withheld was $98,000. Also, $15,000 was subject to state (5.4%) and federal (0.8%) unemployment taxes. All earnings are subject to social security tax of 6.0% and Medicare tax of 1.5%. (a) Joumalize the entry to record the accrual of payroll. If required, round your answers to the nearest cent. (b) Journalize the entry to record the accrual of payroll taxes. If required, round your answers to the nearest cent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An installment note payable for a principal amount of $94,000 at 6% interest requires Lawson Company to repay the principal and interest in equal annual payments of $22,315 beginning December 31, of the first year, for each of the next five years. After the final payment, the carrying amount on the note will be

A) $1,263

B) $21,053

C) $22,315

D) $0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry used to record the payment of a discounted note is

A) debit Notes Payable and Interest Expense; credit Cash

B) debit Notes Payable; credit Cash

C) debit Cash; credit Notes Payable

D) debit Accounts Payable; credit Cash

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of federal income taxes withheld from an employee's gross pay is recorded as a(n)

A) payroll expense

B) contra account

C) asset

D) liability

Correct Answer

verified

Correct Answer

verified

True/False

Federal income taxes are subject to a maximum amount per employee per year.

Correct Answer

verified

Correct Answer

verified

True/False

Receiving payment prior to delivering goods or services causes a current liability to be incurred.

Correct Answer

verified

Correct Answer

verified

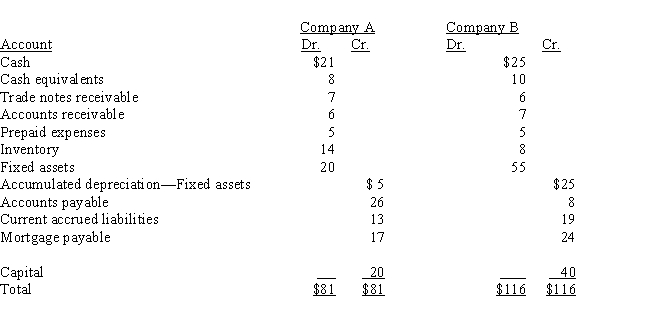

Essay

For Company A and Company B: (a) Calculate the quick ratio for each company. Round ratios to two decimal places.

(b) Comment on which one is more able to meet current liabilities.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 182

Related Exams