Correct Answer

verified

Correct Answer

verified

True/False

A separate capital account is maintained for each partner in a partnership.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blair Scott started a sole proprietorship by depositing $75,000 cash in a business checking account.During the accounting period,the business borrowed $30,000 from a bank,earned $18,000 of net income,and Scott withdrew $12,000 cash from the business.Based on this information,what is the balance in Scott's capital account at the end of the accounting period?

A) $93,000

B) $111,000

C) $72,000

D) $81,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entities would report income tax expense on its income statement?

A) Sole proprietorship.

B) Corporation.

C) Partnership.

D) All of these answer choices are correct.

Correct Answer

verified

Correct Answer

verified

True/False

A purchase of treasury stock is an asset use transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not considered an advantage of the corporate form of business organization?

A) Ability to raise capital

B) Continuity of existence

C) Ease of transferability of ownership

D) Lack of government regulation

Correct Answer

verified

Correct Answer

verified

True/False

The earnings of sole proprietorships are taxable to the owners rather than the company itself.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following terms designates the maximum number of shares of stock that a corporation may issue?

A) Number of shares issued

B) Number of shares authorized

C) Par value

D) Number of shares outstanding

Correct Answer

verified

Correct Answer

verified

True/False

The stock market crash in 1929 led to the beginning of the extensive regulation of trading stock on stock exchanges.

Correct Answer

verified

Correct Answer

verified

True/False

The class or type of stock that every corporation must have is preferred stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

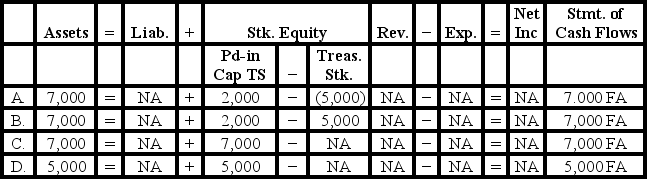

Voiles Company reissued 200 shares of its treasury stock.The treasury stock originally cost $25 per share and was reissued for $35 per share.Select the answer that accurately reflects how the reissue of the treasury stock would affect the elements of Voiles' financial statements.

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

True/False

In a closely held corporation,exchanges of stock are limited to transactions between individuals.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about par value is true?

A) Par value dictates the initial price of the stock.

B) Par value may be revised each time a company issues more shares of stock.

C) Par value is generally greater than market value.

D) Par value has little connection to the market value of the stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the accounting period,Houston Company had $12,000 of common stock,paid-in capital in excess of par value-common of $11,000,retained earnings of $12,000,and $4,000 of treasury stock.What is the total amount of stockholders' equity?

A) $37,000

B) $39,000

C) $19,000

D) $31,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about types of business entities is true?

A) For accounting purposes,a sole proprietorship is not a separate entity from its owner.

B) Ownership in a partnership is represented by having shares of capital stock.

C) One advantage of the corporation form is the ability to raise capital.

D) Sole proprietorships are subject to double taxation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the expected impact of a 2-for-1 stock split?

A) A decrease in the market price of the stock

B) Increased protection of the interest of creditors

C) An increase in the par value of the stock

D) The absorption of treasury stock

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the time that Kirby Company issued a 2-for-1 stock split,the company had 5,000 shares of $6 par value common stock outstanding.Stockholders' equity also included $15,000 of paid in capital in excess of par value-common and $22,000 of retained earnings.Which of the following statements regarding the impact of the stock split is true?

A) The balance of the common stock account will be $30,000.

B) The amount of paid-in capital in excess of par-common will become $150,000.

C) The balance in the retained earnings account will become $11,000.

D) The number of outstanding shares of common stock will be 2,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

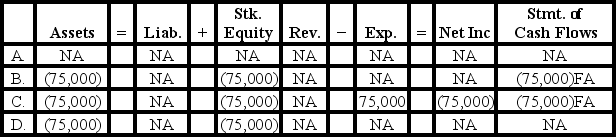

Chadwick Associates retained $850,000 of net income in the business in Year 1.If $75,000 was appropriated to satisfy the restrictive covenant of a loan agreement,what are the effects of the appropriation on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flagler Corporation shows a total of $660,000 in its Common Stock account and $1,600,000 in its Paid-in Capital Excess account.The par value of Flagler's common stock is $8.How many shares of Flagler stock have been issued?

A) 117,500

B) 200,000

C) 82,500

D) The number of shares cannot be determined using the information provided.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

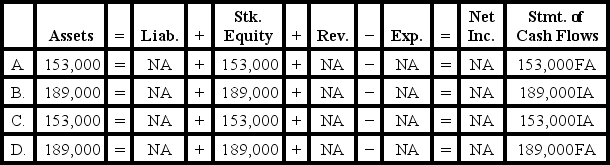

On February 2,Year 1,Farmer Corporation issued 9,000 shares of no-par stock for $17 per share.Within two hours of the issue,the stock's price jumped on the New York Stock Exchange to $21 per share.Which of the following answers describes the effect of the February 2 transaction on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 92

Related Exams