Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which accounting concept can be used by some companies to justify the use of the direct write-off method?

A) The entity concept

B) The materiality concept

C) The going concern concept

D) The monetary principle

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,the Accounts Receivable balance was $37,000 and the balance in the Allowance for Doubtful Accounts was $2,800.On January 15,Year 1,an $800 uncollectible account was written-off.What is the net realizable value of accounts receivable immediately after the write-off?

A) $36,200

B) $33,400

C) $35,000

D) $34,200

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of recording the collection of the reestablished receivable on April 4,Year 2?

![[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of recording the collection of the reestablished receivable on April 4,Year 2? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d7a_803a_a2a1_2949790e4543_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

True/False

The direct write-off method overstates assets on the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] The Miller Company earned $190,000 of revenue on account during Year 1. There was no beginning balance in the accounts receivable and allowance accounts. During Year 1, Miller collected $136,000 of cash from its receivables accounts. The company estimates that it will be unable to collect 3% of its sales on account. -What is the net realizable value of Miller's receivables at the end of Year 1?

A) $54,000

B) $49,920

C) $59,700

D) $48,300

Correct Answer

verified

Correct Answer

verified

True/False

Collecting a credit card receivable is an asset source transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following general journal entries would be used to recognize $7,500 of uncollectible accounts expense under the direct write-off method?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

True/False

Most companies report receivables on their balance sheets at the net realizable value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

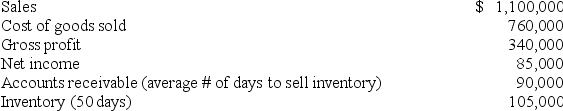

The following information is available for Blankenship Company for the most recent year.

What was Blankenship's operating cycle for the most recent year? (Round to the nearest whole day. )

What was Blankenship's operating cycle for the most recent year? (Round to the nearest whole day. )

A) 30 days

B) 50 days

C) 80 days

D) 120 days

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term used to describe the amount of accounts receivable that is actually expected to be collected?

A) Allowance for doubtful accounts

B) Uncollectible accounts expense

C) The present value of accounts receivable

D) Net realizable value

Correct Answer

verified

Correct Answer

verified

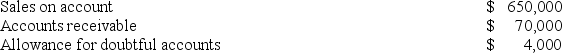

Multiple Choice

Rhodes Company reports the following information for the Year 1 fiscal year:

Determine the average number of days it takes Rhodes to collect its accounts receivable.(Round intermediate calculations to 2 decimal places. )

Determine the average number of days it takes Rhodes to collect its accounts receivable.(Round intermediate calculations to 2 decimal places. )

A) 37

B) 14

C) 39

D) 20

Correct Answer

verified

Correct Answer

verified

True/False

Many businesses find it more efficient to offer credit directly to customers rather than to accept third-party credit cards.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the accounts receivable turnover ratio computed?

A) Sales ÷ Net accounts receivable

B) Net accounts receivable ÷ Sales

C) Cost of goods sold ÷ Inventory

D) 365 days ÷ Net accounts receivable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hoff Company uses the allowance method.An account that had been previously written-off as uncollectible was recovered.How do the two parts of the recovery (reinstate receivable and collect the receivable) affect the elements of the financial statements when the two parts are considered together?

A) Increase total assets and stockholders' equity

B) Increase total assets and decrease total liabilities

C) Decrease total liabilities and increase stockholders' equity

D) Has no effect on total assets,total liabilities or stockholders' equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not an accurate description of the Allowance for Doubtful Accounts?

A) The account is a contra account.

B) The account is a temporary account.

C) The amount of the Allowance for Doubtful Accounts decreases the net realizable value of a company's receivables.

D) The account is increased by an estimate of uncollectible accounts expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Assume that the Loudoun Corporation uses the direct write-off method.Which of the following correctly describes the effect of the write-off of the customer's account on Loudoun's financial statements?

![[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Assume that the Loudoun Corporation uses the direct write-off method.Which of the following correctly describes the effect of the write-off of the customer's account on Loudoun's financial statements? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d7a_a74b_a2a1_a182c91af4fe_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

True/False

For a company that uses the allowance method,the write-off of an uncollectible account receivable is an asset use transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following businesses would most likely have the longest operating cycle?

A) A chain of coffee shops

B) A national sporting goods chain

C) An antiques dealer

D) A Christmas tree farm

Correct Answer

verified

Correct Answer

verified

True/False

A company that uses the direct write-off method must still prepare a year-end adjusting entry to estimate its uncollectible accounts.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 83

Related Exams