A) variable variance

B) controllable variance

C) price variance

D) volume variance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

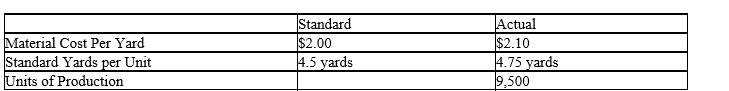

0 Calculate the Direct Materials Quantity variance using the above information:

0 Calculate the Direct Materials Quantity variance using the above information:

A) $4,512.50 Unfavorable

B) $4,512.50 Favorable

C) $4,750 Unfavorable

D) $4,750 Favorable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

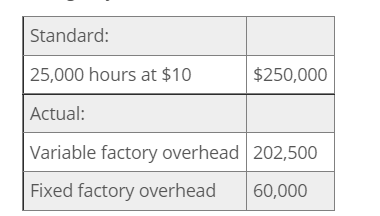

The standard factory overhead rate is $10 per direct labor hour ($8 for variable factory overhead and $2 for fixed factory overhead) based on 100% capacity of 30,000 direct labor hours. The standard cost and the actual cost of factory overhead for the production of 5,000 units during May were as follows:  0 What is the amount of the factory overhead controllable variance?

0 What is the amount of the factory overhead controllable variance?

A) $10,000 favorable

B) $2,500 unfavorable

C) $10,000 unfavorable

D) $2,500 favorable

Correct Answer

verified

Correct Answer

verified

True/False

The variance from standard for factory overhead cost resulting from operating at a level above or below 100% of normal capacity is termed volume variance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The formula to compute direct materials price variance is to calculate the difference between

A) actual costs - (actual quantity * standard price)

B) actual cost + standard costs

C) actual cost - standard costs

D) (actual quantity * standard price) -standard costs

Correct Answer

verified

Correct Answer

verified

Essay

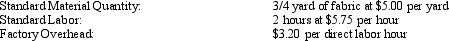

Compute the standard cost for one hat, based on the following standards for each hat:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

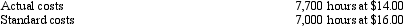

The following data relate to direct labor costs for February:  What is the direct labor time variance?

What is the direct labor time variance?

A) $7,700 favorable

B) $7,700 unfavorable

C) $11,200 unfavorable

D) $11,200 favorable

Correct Answer

verified

Correct Answer

verified

True/False

Since the controllable variance measures the efficiency of using variable overhead resources, if budgeted variable overhead exceeds actual results, the variance is favorable.

Correct Answer

verified

Correct Answer

verified

True/False

If the standard to produce a given amount of product is 1,000 units of direct materials at $11 and the actual was 800 units at $12, the direct materials price variance was $800 unfavorable.

Correct Answer

verified

Correct Answer

verified

True/False

A variable cost system is an accounting system where standards are set for each manufacturing cost element.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard costs are divided into which of the following components?

A) Variance Standard and Quantity Standard

B) Materials Standard and Labor Standard

C) Quality Standard and Quantity Standard

D) Price Standard and Quantity Standard

Correct Answer

verified

Correct Answer

verified

Multiple Choice

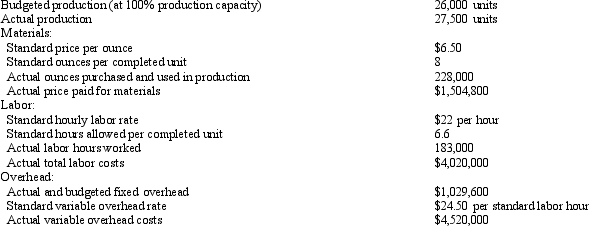

The following data is given for the Zoyza Company:  Overhead is applied on standard labor hours.

The factory overhead volume variance is:

Overhead is applied on standard labor hours.

The factory overhead volume variance is:

A) $73,250U

B) $73,250F

C) $59,400F

D) $59,400U

Correct Answer

verified

Correct Answer

verified

True/False

Standard costs can be used with both the process cost and job order cost systems.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The St. Augustine Corporation originally budgeted for $360,000 of fixed overhead at 100% production capacity. Production was budgeted to be 12,000 units. The standard hours for production were 5 hours per unit. The variable overhead rate was $3 per hour. Actual fixed overhead was $360,000 and actual variable overhead was $170,000. Actual production was 11,700 units. Compute the factory overhead controllable variance.

A) $9,000F

B) $9,000U

C) $5,500F

D) $5,500U

Correct Answer

verified

Correct Answer

verified

True/False

The most effective means of presenting standard factory overhead cost variance data is through a factory overhead cost variance report.

Correct Answer

verified

Correct Answer

verified

True/False

Non-financial measures are often lined to the inputs or outputs of an activity or process.

Correct Answer

verified

Correct Answer

verified

Essay

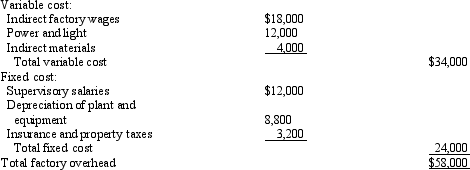

The Finishing Department of Pinnacle Manufacturing Co. prepared the following factory overhead cost budget for October of the current year, during which it expected to operate at a 100% capacity of 10,000 machine hours:

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.

Prepare a factory overhead cost variance report for October. (The budgeted amounts for actual amount produced should be based on 9,000 machine hours.)

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.

Prepare a factory overhead cost variance report for October. (The budgeted amounts for actual amount produced should be based on 9,000 machine hours.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Variances from standard costs are usually reported to:

A) suppliers

B) stockholders

C) management

D) creditors

Correct Answer

verified

Correct Answer

verified

True/False

If the standard to produce a given amount of product is 2,000 units of direct materials at $12 and the actual was 1,600 units at $13, the direct materials quantity variance was $5,200 favorable.

Correct Answer

verified

Correct Answer

verified

True/False

If the standard to produce a given amount of product is 1,000 units of direct materials at $11 and the actual was 800 units at $12, the direct materials quantity variance was $1,000 unfavorable.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 160

Related Exams