A) Accounts Receivable

B) Accumulated Depreciation

C) Supplies Expense

D) Joan Wilson, Capital

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts is not closed?

A) Cash

B) Fees Income

C) Rent Expense

D) Joan Wilson, Drawing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A postclosing trial balance could include all of the following except the

A) owner's capital account.

B) Cash account.

C) Fees Income account.

D) Accounts Receivable account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following has a normal credit balance?

A) Accounts Receivable

B) Accounts Payable

C) Supplies Expense

D) T. Stark, Drawing

Correct Answer

verified

Correct Answer

verified

Essay

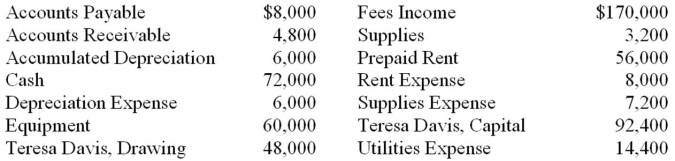

On December 31, the ledger of Davis Company contained the following account balances:  All the accounts have normal balances. Journalize the closing entries. Use 11 as the general journal page number.

All the accounts have normal balances. Journalize the closing entries. Use 11 as the general journal page number.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The Balance Sheet section of the worksheet contains the data that is used to make closing entries.

B) The balance of the owner's drawing account will appear on the postclosing trial balance.

C) Closing entries are entered directly on the worksheet.

D) Preparation of the postclosing trial balance is the last step in the end-of-period routine.

Correct Answer

verified

Correct Answer

verified

Essay

On December 31 the Income Summary account of Cook Company has a debit balance of $18,000 after revenue of $49,000 and expenses of $67,000 were closed to the account. Maria Cook, Drawing has a debit balance of $23,000 and Maria Cook, Capital has a credit balance of $84,000. Record the journal entries necessary to complete closing the accounts. Use 22 as the general journal page number. Then, post the closing entries to the Maria Cook, Capital account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Before the Income Summary account is closed, its balance represents the net income or net loss for the accounting period.

B) The Income Summary account is a temporary owner's equity account.

C) The Income Summary account is used only at the end of an accounting period to help with the closing procedure.

D) The owner's drawing account is closed to the Income Summary Statement.

Correct Answer

verified

Correct Answer

verified

Short Answer

At the end of the accounting period, the balances of the revenue and expense accounts are transferred to the ____________________ account.

Correct Answer

verified

Correct Answer

verified

True/False

Withdrawals by the owner for personal use do not affect net income or net loss of the business.

Correct Answer

verified

Correct Answer

verified

True/False

Interpreting the financial statements is the last step in the accounting cycle.

Correct Answer

verified

Correct Answer

verified

Essay

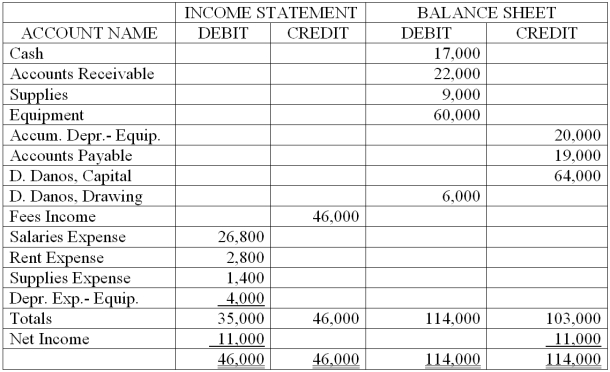

Danos Company's partial worksheet for the month ended December 31, 2013, is shown below. Open the owner's capital account (account number 301) in the general ledger and record the December 1, 2013, balance of $64,000 shown on the worksheet. Journalize the closing entries on page 8 of a general journal. Post the closing entries to the owner's capital account. Prepare a postclosing trial balance.

Correct Answer

verified

Correct Answer

verified

True/False

"Income and Expense Summary" is another name for the Income Summary account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to close the Income Summary account may include

A) a debit to Income Summary and a credit to the owner's capital account.

B) a debit to Income Summary and a credit to Cash.

C) a debit to Cash and a credit to Income Summary.

D) a debit to Income Summary and a credit to the owner's drawing account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner's drawing account is closed by debiting

A) the owner's drawing account and crediting the owner's capital account.

B) the owner's capital account and crediting the owner's drawing account.

C) Income Summary and crediting the owner's drawing account.

D) the owner's drawing account and crediting Income Summary.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The first two closing entries to the Income Summary account indicate a debit of $53,000 and a credit of $64,000. The third closing entry would be

A) debit Capital $11,000; credit Income Summary $11,000

B) debit Income Summary $11,000; credit Capital $11,000

C) debit Revenue $64,000; credit Expenses $53,000

D) debit Income Summary $11,000; credit Drawing $11,000

Correct Answer

verified

Correct Answer

verified

True/False

The postclosing trial balance contains balance sheet accounts only.

Correct Answer

verified

Correct Answer

verified

Essay

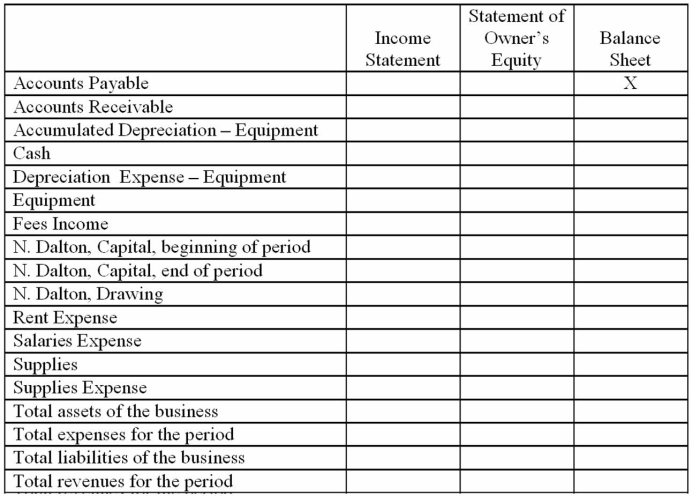

Managers often consult financial statements for specific types of information. Indicate whether each of the following items would appear on the income statement, statement of owner's equity, or the balance sheet. Note that an item may appear on more than one statement. The first item is completed as an example.

Correct Answer

verified

Correct Answer

verified

Essay

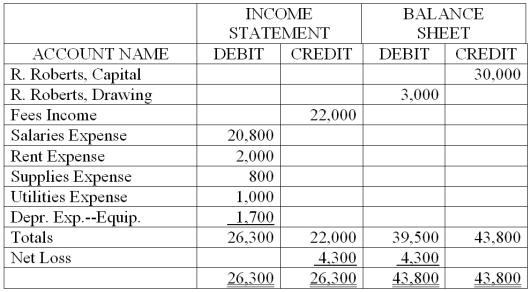

The partial worksheet for the Roberts Company showed the following data on October 31, 2013. Record the closing entries on page 9 of a general journal.

Correct Answer

verified

Correct Answer

verified

Short Answer

The ____________________ is a series of steps performed during each fiscal period to classify and record transactions and summarize financial data for a business.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 83

Related Exams