Correct Answer

verified

Correct Answer

verified

Multiple Choice

The trade deficit has had the effect of:

A) Decreasing the Federal budget deficit

B) Increasing economic growth in less developed nations

C) Increasing direct foreign investment in the United States

D) Decreasing protectionist pressure among U.S. businesses

Correct Answer

verified

Correct Answer

verified

Multiple Choice

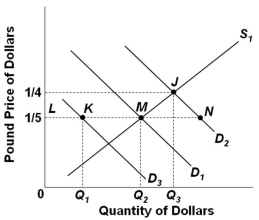

The graph below shows the supply and demand curves for dollars in the pound/dollar market.  Refer to the graph above. Assume that D1 and S1 are the initial demand for and supply of dollars. Suppose that Britain's demand for dollars increases from D1 to D2. If the British government wishes to fix the exchange rate at the initial level, one possible way to do this is for the government to:

Refer to the graph above. Assume that D1 and S1 are the initial demand for and supply of dollars. Suppose that Britain's demand for dollars increases from D1 to D2. If the British government wishes to fix the exchange rate at the initial level, one possible way to do this is for the government to:

A) Buy and add more to its dollar reserves

B) Sell pounds in exchange for U.S. dollars

C) Encourage the British to import more U.S. products

D) Sell some of its dollar reserves

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is not a serious disadvantage associated with freely fluctuating exchange rates?

A) Uncertainty which tends to diminish trade

B) Greater instability in unemployment levels

C) Longer lags in eliminating balance of payments surpluses or deficits

D) Swings in the terms of trade related to currency appreciation or depreciation

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

In using exchange controls, a nation attempts to eliminate a balance of payments deficit by:

A) Limiting its imports to the dollar value of its exports

B) Decreasing the nation's domestic price level

C) Limiting its exports to the dollar value of its imports

D) Appreciating the value of its currency

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The basic type of intervention by central banks under the managed floating exchange rate system is to:

A) Readjust the peg for exchange rates

B) Buy and sell currencies to influence supply and demand for foreign exchange

C) Renegotiate the rate at which foreign currencies can be converted into gold

D) Make pronouncements but then do nothing and let the market set the exchange rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the United States wants to regain ownership of domestic assets sold to foreigners, it will have to:

A) Increase domestic consumption

B) Increase its national debt

C) Export more than it imports

D) Import more than it exports

Correct Answer

verified

Correct Answer

verified

True/False

If a nation has a balance of payments deficit and exchange rates are flexible, the price or value of that nation's currency in the foreign exchange markets will rise.

Correct Answer

verified

Correct Answer

verified

True/False

To keep the exchange rate constant, an increase in the demand for a country's currency should be matched by a corresponding increase in supply to be administered by the government.

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

If the U.S. dollar appreciates relative to the British pound, then:

A) The pound will appreciate relative to the U.S. dollar

B) The pound will depreciate relative to the U.S. dollar

C) British goods will be more expensive for Americans

D) American goods will be less expensive for the British

Correct Answer

verified

Correct Answer

verified

True/False

The U.S. often has a significant surplus in services trade, even though it has a deficit in goods trade.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following statements are true in the current exchange-rate system, except:

A) Major currencies like U.S. dollar, euro, pounds, and yen operate mostly in a flexible system responding to supply and demand forces

B) Some developing nations peg their currencies to the dollar and allow their currencies to fluctuate with it relative to other currencies

C) Each country uses its own unique currency; for example, only the U.S. uses the U.S. dollar as its currency

D) Some nations peg their currencies to a "basket" or group of other currencies, rather than to a single other currency

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Other things being equal, which of the following is a necessary consequence of a depreciation of the U.S. dollar against other currencies?

A) The terms of trade will move in favor of the United States

B) The United States will experience an increase in the volume of imports

C) International speculators will buy U.S. dollars and sell other currencies

D) U.S. exports will become cheaper relative to other nations' products

Correct Answer

verified

Correct Answer

verified

True/False

Improved economic growth in the major trading partners of the United States would reduce its trade deficit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

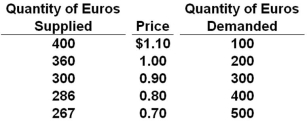

The table below shows the supply and demand schedules for the European euro.  Refer to the table above. If European governments decided to fix the price of a euro at $0.80, they would have to:

Refer to the table above. If European governments decided to fix the price of a euro at $0.80, they would have to:

A) Buy 286 euros

B) Buy 114 euros

C) Sell 114 euros

D) Sell 286 euros

Correct Answer

verified

Correct Answer

verified

True/False

The exchange rate system that we now have for major currencies like the U.S. dollar, yen, and euro is a "managed-floating" system.

Correct Answer

verified

Correct Answer

verified

True/False

In the balance of payments statement, a current account deficit is always matched by a capital and financial accounts surplus.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an American can purchase 40,000 British pounds for $90,000, the dollar rate of exchange for the pound is:

A) $0.44

B) $0.23

C) $2.25

D) $2.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

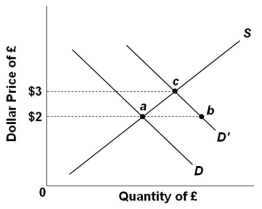

Refer to the graph above, which shows a change in the demand for pounds from D to D'. Under a system of flexible exchange rates, the:

Refer to the graph above, which shows a change in the demand for pounds from D to D'. Under a system of flexible exchange rates, the:

A) Price of a pound will increase to $3

B) Price of a dollar will increase to 3 pounds

C) Shortage equal to ab would be met using international monetary reserves

D) Payment deficit will cause changes in domestic price and income levels, shifting demand to the left, supply to the right, and reestablishing the original exchange rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exchange rate for the Mexican peso changes from $1 = 5 pesos to $1 = 6 pesos. This change will lead to:

A) U.S. goods becoming less expensive for Mexicans

B) Mexican goods becoming more expensive for Americans

C) An increase in U.S. exports to Mexico

D) A decrease in U.S. exports to Mexico

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 152

Related Exams