A) A nation's imports are limited to the value of its exports

B) A nation's exports and imports are always paid with dollars

C) All international transactions must be settled in one way or another

D) A trade deficit must be matched by an equal surplus of investment income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the financing of international trade is correct?

A) International trade means the trading of financial assets for foreign exchange

B) Most international transactions are made with gold

C) Imports are more important than exports to the economy of a nation

D) Exports provide the foreign currencies needed to pay for imports

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the currency market for British pounds and U.S. dollars. An increase in the demand for British pounds results in:

A) An appreciation of the pound and a depreciation of the dollar

B) A depreciation of the pound and a depreciation of the dollar

C) An appreciation of the pound and an appreciation of the dollar

D) A depreciation of the pound and an appreciation of the dollar

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the Balance of Payments statement, a current account surplus will be matched by a:

A) Capital and financial accounts deficit

B) Capital and financial accounts surplus

C) Trade deficit

D) Trade surplus

Correct Answer

verified

Correct Answer

verified

Multiple Choice

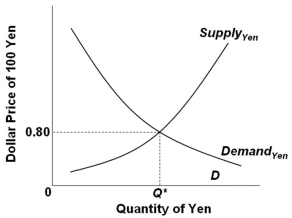

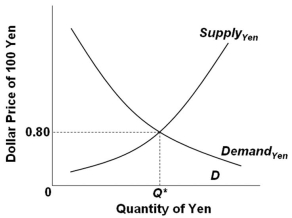

Assume that Japan and the United States are engaged in a system of flexible exchange rates.  Refer to the graph above. An increase in the demand for yen will result in:

Refer to the graph above. An increase in the demand for yen will result in:

A) A depreciation of the Japanese yen

B) An appreciation of the U.S. dollar

C) A depreciation of the U.S. dollar

D) A decrease in the dollar price of yen

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the purchasing power parity theory, the exchange rate would eventually adjust such that they equalize the various:

A) Currencies' values in terms of goods and services

B) Inflation rates in the trading nations

C) Interest rates in the trading nations

D) Supply and demand in the foreign exchange markets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

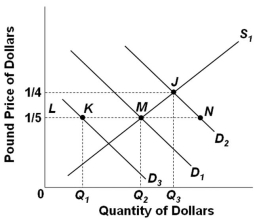

The graph below shows the supply and demand curves for dollars in the pound/dollar market.  Refer to the graph above. Assume that D1 and S1 are the initial demand for and supply of dollars. The exchange rate will be:

Refer to the graph above. Assume that D1 and S1 are the initial demand for and supply of dollars. The exchange rate will be:

A) $5 equals 1 pound

B) $4 equals 1 pound

C) $1 equals 5 pounds

D) $0.20 equals 1 pound

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current account on a nation's balance of payments statement includes all of the following except:

A) The nation's goods exports

B) The nation's goods imports

C) Net investment income

D) Net purchases of assets abroad

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.  Refer to the table above. The balance of trade in goods and services was:

Refer to the table above. The balance of trade in goods and services was:

A) $107 billion surplus

B) $82 billion deficit

C) $115 billion deficit

D) $55 billion surplus

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The so-called G-8 is one group that sometimes influences the exchange rates between major currencies. For example, in 2000 the G-8 governments agreed to sell U.S. dollars in order to:

A) Counter the depreciation of the euro

B) Counter the depreciation of the U.S. dollar

C) Support the appreciation of the Swiss franc

D) Support the appreciation of the Japanese yen

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things being equal, the international value of foreign currencies will increase against the U.S. dollar if:

A) U.S. citizens reduce spending on imports

B) The U.S. Federal Reserve raises real interest rates

C) There is an increase in the number of foreign tourists in the United States

D) There are withdrawals of funds by foreigners from U.S. money markets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

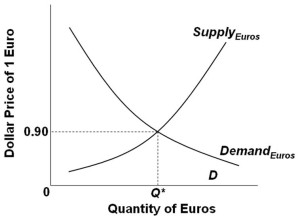

Assume that U.S. and European governments adopt a system of flexible exchange rates, and the figure below shows the market for euros.  Refer to the graph above. If more people in Europe decide to purchase U.S. cars, what effect will this have on the market for euros?

Refer to the graph above. If more people in Europe decide to purchase U.S. cars, what effect will this have on the market for euros?

A) Demand will decrease

B) Demand will increase

C) Supply will increase

D) Supply will decrease

Correct Answer

verified

Correct Answer

verified

True/False

If nations adopt a gold standard where various countries' money supply is tied to gold, then there will in effect be a fixed exchange-rate system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When real interest rates in other countries rise relative to that in the U.S., other things being equal, we would expect the U.S. dollar to:

A) Appreciate

B) Depreciate

C) Inflate

D) Deflate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which transaction represents a debit in the current account section of the U.S. balance of payments?

A) The Arab Capital Investment Corporation makes a loan to a U.S. firm

B) A U.S. subsidiary exports raw materials to the Canadian parent company

C) U.S. tourists in Great Britain purchase pounds with dollars in order to buy souvenirs

D) U.S. firms and individuals receive dividends from their investments in Latin America

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the exchange rate is $1 = 0.7841 euro, then a French DVD priced at 20 euros would cost to an American buyer (excluding taxes and other fees) :

A) $15.68

B) $20.78

C) $25.51

D) $27.84

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Japan and the United States are engaged in a system of flexible exchange rates.  Refer to the graph above. An increase in the supply of yen will result in:

Refer to the graph above. An increase in the supply of yen will result in:

A) An appreciation of the yen

B) An appreciation of the U.S. dollar

C) A depreciation of the U.S. dollar

D) An increase in the dollar price of yen

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A trade deficit for the United States is generally financed by:

A) Lending to the Federal government

B) Borrowing from the Federal government

C) Buying securities or assets from other nations

D) Selling securities or assets to other nations

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Foreign exchange rates refer to the:

A) Price at which purchases and sales of foreign goods take place

B) Rate of exchange of goods and services between two trading nations

C) Price of one nation's currency in terms of another nation's currency

D) Difference between exports and imports of a particular nation with another

Correct Answer

verified

Correct Answer

verified

Multiple Choice

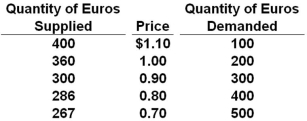

The table below shows the supply and demand schedules for the European euro.  Refer to the table above. Under a flexible exchange rate system, what will be the rate of exchange for one euro?

Refer to the table above. Under a flexible exchange rate system, what will be the rate of exchange for one euro?

A) $0.80

B) $0.90

C) $1.00

D) $1.10

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 152

Related Exams