A) 4%.

B) 3.5%.

C) 7%.

D) 8%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The times interest earned ratio is calculated as

A) Interest expense / Net income.

B) Net income / Interest expense.

C) (Net income + interest expense + tax expense) / Interest expense.

D) Interest expense / (Net income + interest expense + tax expense) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true for bonds issued at a discount?

A) The stated interest rate is greater than the market interest rate.

B) The market interest rate is greater than the stated interest rate.

C) The stated interest rate and the market interest rate are equal.

D) The stated interest rate and the market interest rate are unrelated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond issue with a face amount of $500,000 bears interest at the rate of 7%.The current market rate of interest is 8%.These bonds will sell at a price that is:

A) Equal to $500,000.

B) More than $500,000.

C) Less than $500,000.

D) The answer cannot be determined from the information provided.

Correct Answer

verified

Correct Answer

verified

True/False

When bonds are issued at a premium (above face amount),the carrying value and the corresponding interest expense increase over time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true for bonds issued at a premium?

A) The stated interest rate is less than the market interest rate.

B) The market interest rate is less than the stated interest rate.

C) The stated interest rate and the market interest rate are equal.

D) The stated interest rate and the market interest rate are unrelated.

Correct Answer

verified

Correct Answer

verified

Short Answer

Listed below are five terms followed by a list of phrases that describe or characterize the terms.Match each phrase with the best term placing the letter designating the term in the space provided. a.Bonds issued at face value b.Bonds issued at a discount c.Bonds issued at a premium d.Stated interest rate e.Market interest rate Phrases: _____ The true interest rate used by investors to value a bond. _____ The stated interest rate is more than the market interest rate. _____ The stated interest rate equals the market interest rate. _____ The stated interest rate is less than the market interest rate. _____ The rate quoted in the bond contract used to calculate the cash payments for interest.

Correct Answer

verified

Correct Answer

verified

True/False

Losses have the effect of reducing net income,while gains increase net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of a bond is equal to:

A) The future value of the face amount only.

B) The present value of the interest only.

C) The present value of the face amount plus the present value of the stated interest payments.

D) The future value of the face amount plus the future value of the stated interest payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following leases is essentially the purchase of an asset with debt financing?

A) An operating lease.

B) A capital lease.

C) Both an operating and a capital lease.

D) Neither an operating lease nor a capital lease.

Correct Answer

verified

Correct Answer

verified

True/False

When an issuer retires debt of any type before its scheduled maturity date,the transaction is an early extinguishment of debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

THA buys back the bonds for $196,000 immediately after the interest payment on 12/31/2015 and retires them.What gain or loss,if any,would THA record on this date?

A) No gain or loss.

B) $370 gain.

C) $4,000 gain.

D) $1,242 loss.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In each succeeding payment on an installment note:

A) The amount that goes to decreasing the carrying value of the note increases.

B) The amount that goes to decreasing the carrying value of the note decreases.

C) The amount that goes to decreasing the carrying value of the note is unchanged.

D) The amounts paid for both interest and principal increase proportionately.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

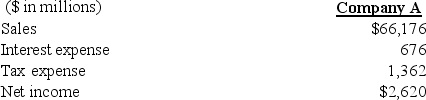

Selected financial data for Company A is provided below:  What is the times interest earned ratio for Company A?

What is the times interest earned ratio for Company A?

A) 6.9 times.

B) 3.9 times.

C) 0.3 times.

D) 97.9 times.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ordinarily,the proceeds from the sale of a bond issue will be equal to:

A) The face amount of the bond.

B) The total of the face amount plus all interest payments.

C) The present value of the face amount plus the present value of the stream of interest payments.

D) The face amount of the bond plus the present value of the stream of interest payments.

Correct Answer

verified

Correct Answer

verified

True/False

Bonds are the most common form of corporate debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In each succeeding payment on an installment note:

A) The amount of interest expense increases.

B) The amount of interest expense decreases.

C) The amount of interest expense is unchanged.

D) The amounts paid for both interest and principal increase proportionately.

Correct Answer

verified

Correct Answer

verified

True/False

The stated interest rate is the rate quoted in the bond contract used to calculate the cash payments for interest.

Correct Answer

verified

Correct Answer

verified

True/False

A callable bond allows the borrower to repay the bonds before their scheduled maturity date at a specified call price.

Correct Answer

verified

Correct Answer

verified

True/False

At the maturity date,the carrying value will equal the face amount of the bond.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 123

Related Exams