A) $28.50

B) $33.20

C) $31.50

D) $29.75

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reward-to-volatility ratio is given by ________.

A) the slope of the capital allocation line

B) the second derivative of the capital allocation line

C) the point at which the second derivative of the investor's indifference curve reaches zero

D) the portfolio's excess return

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which measure of downside risk predicts the worst loss that will be suffered with a given probability?

A) standard deviation

B) variance

C) value at risk

D) Sharpe ratio

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Historical returns have generally been ________ for stocks of small firms as (than) for stocks of large firms.

A) the same

B) lower

C) higher

D) none of these options (There is no evidence of a systematic relationship between returns on small-firm stocks and returns on large-firm stocks.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the 1926-2013 period the geometric mean return on Treasury bonds was ________.

A) 5.07%

B) 5.56%

C) 9.34%

D) 11.43%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 16% and a standard deviation of 20% and a Treasury bill with a rate of return of 6%. The slope of the capital allocation line formed with the risky asset and the risk-free asset is approximately ________.

A) 1.040

B) .80

C) .50

D) .25

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rank the following from highest average historical standard deviation to lowest average historical standard deviation from 1926 to 2017. I. Small stocks II. Long-term bonds III. Large stocks IV. T-bills

A) I, II, III, IV

B) III, IV, II, I

C) I, III, II, IV

D) III, I, II, IV

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 5% and a risky portfolio, P, constructed with two risky securities, X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 14%, and Y has an expected rate of return of 10%. To form a complete portfolio with an expected rate of return of 8%, you should invest approximately ________ in the risky portfolio. This will mean you will also invest approximately ________ and ________ of your complete portfolio in security X and Y, respectively.

A) 0%; 60%; 40%

B) 25%; 45%; 30%

C) 40%; 24%; 16%

D) 50%; 30%; 20%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following two investment alternatives: First, a risky portfolio that pays a 15% rate of return with a probability of 40% or a 5% rate of return with a probability of 60%. Second, a Treasury bill that pays 6%. The risk premium on the risky investment is ________.

A) 1%

B) 3%

C) 6%

D) 9%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The dollar-weighted return is the ________.

A) difference between cash inflows and cash outflows

B) arithmetic average return

C) geometric average return

D) internal rate of return

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

What is the VaR of a $10 million portfolio with normally distributed returns at the 5% VaR? Assume the expected return is 13% and the standard deviation is 20%.

A) 13%

B) -13%

C) 19.90%

D) -19.90%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have calculated the historical dollar-weighted return, annual geometric average return, and annual arithmetic average return. If you desire to forecast performance for next year, the best forecast will be given by the ________.

A) dollar-weighted return

B) geometric average return

C) arithmetic average return

D) index return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 5% and a risky portfolio, P, constructed with two risky securities, X and Y. The optimal weights of X and Y in P are 60% and 40%, respectively. X has an expected rate of return of 14%, and Y has an expected rate of return of 10%. To form a complete portfolio with an expected rate of return of 11%, you should invest ________ of your complete portfolio in Treasury bills.

A) 19%

B) 25%

C) 36%

D) 50%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most studies indicate that investors' risk aversion is in the range ________.

A) 1-3

B) 1.5-4

C) 3-5.2

D) 4-6

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would be considered a risk-free asset in real terms as opposed to nominal?

A) money market fund

B) U.S. T-bill

C) short-term corporate bonds

D) U.S. T-bill whose return was indexed to inflation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

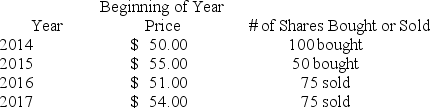

You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends.

What is the dollar-weighted return over the entire time period?

What is the dollar-weighted return over the entire time period?

A) 2.87%

B) .74%

C) 2.6%

D) 2.21%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you want to measure the performance of your investment in a fund, including the timing of your purchases and redemptions, you should calculate the ________.

A) geometric average return

B) arithmetic average return

C) dollar-weighted return

D) index return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the 1926-2013 period the Sharpe ratio was greatest for which of the following asset classes?

A) small U.S. stocks

B) large U.S. stocks

C) long-term U.S. Treasury bonds

D) bond world portfolio return in U.S. dollars

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess return is the ________.

A) rate of return that can be earned with certainty

B) rate of return in excess of the Treasury-bill rate

C) rate of return to risk aversion

D) index return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The complete portfolio refers to the investment in ________.

A) the risk-free asset

B) the risky portfolio

C) the risk-free asset and the risky portfolio combined

D) the risky portfolio and the index

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 89

Related Exams