A) In general,a firm with low operating leverage also has a small proportion of its total costs in the form of fixed costs.

B) There is no reason to think that changes in the personal tax rate would affect firms' capital structure decisions.

C) A firm with a relatively high business risk is more likely to increase its use of financial leverage than a firm with low business risk,assuming all else equal.

D) If a firm's after-tax cost of equity exceeds its after-tax cost of debt,it can always reduce its WACC by increasing its use of debt.

E) Suppose a firm has less than its optimal amount of debt.Increasing its use of debt to the point where it is at its optimal capital structure will decrease the costs of both debt and equity.

Correct Answer

verified

Correct Answer

verified

True/False

A firm's capital structure does not affect its free cash flows as discussed in the text,because FCF reflects only operating cash flows,which are available to service debt,to pay dividends to stockholders,and for other purposes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The capital structure that maximizes the stock price is also the capital structure that minimizes the cost of equity from retained earnings (rS) .

B) The capital structure that maximizes the stock price is also the capital structure that maximizes earnings per share.

C) The capital structure that maximizes the stock price is also the capital structure that maximizes the firm's times interest earned (TIE) ratio.

D) If a company increases its debt ratio,this will typically increase the marginal costs of both debt and equity,but it still may reduce the company's WACC.

E) If Congress were to pass legislation that increases the personal tax rate but decreases the corporate tax rate,this would encourage companies to increase their debt ratios.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

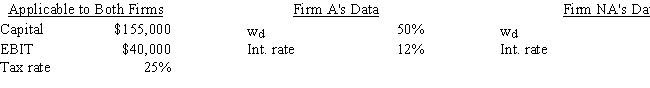

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical--they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Both companies are small,so they are not subject to the interest deduction limitation.Based on the following data,how much higher or lower is A's ROE than that of NA,i.e. ,what is ROEA - ROENA? Do not round your intermediate calculations.

A) 10.25%

B) 12.01%

C) 10.35%

D) 12.12%

E) 12.84%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? As a firm increases the operating leverage used to produce a given quantity of output,this

A) normally leads to an increase in its fixed assets turnover ratio.

B) normally leads to a decrease in its business risk.

C) normally leads to a decrease in the standard deviation of its expected EBIT.

D) normally leads to a decrease in the variability of its expected EPS.

E) normally leads to a reduction in its fixed assets turnover ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm is currently 100% equity financed.The CFO is considering a recapitalization plan under which the firm would issue long-term debt with an after-tax yield of 9% and use the proceeds to repurchase some of its common stock.The recapitalization would not change the company's total investor-supplied capital,the size of the firm (i.e. ,total assets) ,and it would not affect the firm's return on investors' capital (ROIC) ,which is 15%.The CFO believes that this recapitalization would reduce the firm's WACC and increase its stock price.Which of the following would be likely to occur if the company goes ahead with the recapitalization plan?

A) The company's net income would increase.

B) The company's earnings per share would decline.

C) The company's cost of equity would increase.

D) The company's ROA would increase.

E) The company's ROE would decline.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Longstreet Inc.has fixed operating costs of $670,000,variable costs of $2.75 per unit produced,and its product sells for $3.95 per unit.What is the company's break-even point,i.e. ,at what unit sales volume would income equal costs?

A) 558,333

B) 491,333

C) 686,750

D) 653,250

E) 446,667

Correct Answer

verified

Correct Answer

verified

True/False

Provided a firm does not use an extreme amount of debt,operating leverage typically affects only EPS,while financial leverage affects both EPS and EBIT.

Correct Answer

verified

Correct Answer

verified

True/False

It is possible for Firms A and B to have identical financial and operating leverage,yet for Firm A to have more risk as measured by the variability of EPS.This would occur if Firm A has more business risk than Firm B.

Correct Answer

verified

Correct Answer

verified

True/False

In a world with no taxes,Modigliani and Miller (MM)show that a firm's capital structure does not affect its value.However,when taxes are considered,MM show a positive relationship between debt and value,i.e. ,the firm's value rises as it uses more and more debt,other things held constant.

Correct Answer

verified

Correct Answer

verified

True/False

Some people--including the former chairman of the Federal Reserve Board of Governors (Ben Bernanke)--have argued that one advantage of corporate debt from the stockholders' standpoint is that the existence of debt forces managers to focus on cash flow and to refrain from spending too much of the firm's money on private plane and other "perks." This is one of the factors that led to the rise of LBOs and private equity firms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the debt ratio will generally have no effect on which of these items?

A) Business risk.

B) Total risk.

C) Financial risk.

D) Market risk.

E) The firm's beta.

Correct Answer

verified

Correct Answer

verified

True/False

According to Modigliani and Miller (MM),in a world without taxes the optimal capital structure for a firm is approximately 100% debt financing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events is likely to encourage a company to raise its target debt ratio,other things held constant?

A) An increase in the corporate tax rate.

B) An increase in the personal tax rate.

C) An increase in the company's operating leverage.

D) The Federal Reserve tightens interest rates in an effort to fight inflation.

E) The company's stock price hits a new high.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following events would be most likely to encourage a firm to increase the amount of debt in its capital structure?

A) Its sales are projected to become less stable in the future.

B) The bankruptcy laws are changed in a way that would make bankruptcy more costly to the firm and its stockholders.

C) Management believes that the firm's stock is currently overvalued.

D) The firm decides to automate its factory with specialized equipment and thus increase its use of operating leverage.

E) The corporate tax rate is increased.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monroe Inc.is an all-equity firm with 500,000 shares outstanding.It has $2,000,000 of EBIT,and EBIT is expected to remain constant in the future.The company pays out all of its earnings,so earnings per share (EPS) equal dividends per share (DPS) ,and its tax rate is 25%.The company is considering issuing $3,000,000 of 9.00% bonds and using the proceeds to repurchase stock.The risk-free rate is 4.5%,the market risk premium is 5.0%,and the firm's beta is currently 1.05.However,the CFO believes the beta would rise to 1.25 if the recapitalization occurs.Assuming the shares could be repurchased at the price that existed prior to the recapitalization,what would the price per share be following the recapitalization? (Hint: P0 = EPS/rs because EPS = DPS. )

A) $34.47

B) $31.92

C) $33.20

D) $35.43

E) $26.81

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southwest U's campus book store sells course packs for $16 each,the variable cost per pack is $9,fixed costs to produce the packs are $200,000,and expected annual sales are 63,000 packs.What are the pre-tax profits from sales of course packs?

A) $281,970

B) $241,000

C) $216,900

D) $204,850

E) $219,310

Correct Answer

verified

Correct Answer

verified

True/False

The Modigliani and Miller (MM)articles implicitly assumed,among other things,that outside stockholders have the same information about a firm's future prospects as its managers.That was called "symmetric information," and it is questionable.The introduction of "asymmetric information" led to the development of the "signaling" theory of capital structure,which postulated that firms are reluctant to issue new stock because investors will interpret such an act as a signal that the firm's managers are worried about its future.Other actions give off different signals,and the end result is that capital structure is affected by managers' perceptions about how their financing decisions will affect investors' views of the firm and thus its value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have identical tax rates,total assets,total investor-supplied capital,and returns on investors' capital (ROIC) ,and their ROICs exceed their after-tax costs of debt,rd(1 - T) .However,Company HD has a higher debt ratio and thus more interest expense than Company LD.Which of the following statements is CORRECT?

A) Company HD has a higher net income than Company LD.

B) Company HD has a lower ROA than Company LD.

C) Company HD has a lower ROE than Company LD.

D) The two companies have the same ROA.

E) The two companies have the same ROE.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the optimal capital structure?

A) The optimal capital structure is the mix of debt,equity,and preferred stock that maximizes the company's earnings per share (EPS) .

B) The optimal capital structure is the mix of debt,equity,and preferred stock that maximizes the company's stock price.

C) The optimal capital structure is the mix of debt,equity,and preferred stock that minimizes the company's cost of equity.

D) The optimal capital structure is the mix of debt,equity,and preferred stock that minimizes the company's cost of debt.

E) The optimal capital structure is the mix of debt,equity,and preferred stock that minimizes the company's cost of preferred stock.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 88

Related Exams