A) Company HD has a lower equity multiplier than Company LD.

B) Company HD has more net income than Company LD.

C) Company HD pays more in taxes than Company LD.

D) Company HD has a lower times-interest-earned (TIE) ratio than Company LD.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Swensen Corp. had sales of $303,225, operating costs of $267,500, and year-end assets of $195,000. The debt-to-total-assets ratio was 27%, the interest rate on the debt was 8.2%, and the firm's tax rate was 37%. The new CFO wants to see how the ROE would have been affected if the firm had used a 45% debt ratio. Assume that sales and total assets would not be affected, and that the interest rate and tax rate would both remain constant. By how much would the ROE change in response to the change in the capital structure?

A) 2.08%

B) 2.32%

C) 2.57%

D) 2.86%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Safeco's current assets total $20 million, versus $10 million of current liabilities, while Risco's current assets are $10 million, versus $20 million of current liabilities. Both firms would like to "window dress" their end-of-year financial statements, and to do so they tentatively plan to borrow $10 million on a short-term basis and to then hold the borrowed funds in their cash accounts. Which statement below best describes the results of these transactions?

A) The transactions would raise Safeco's financial strength as measured by its current ratio but lower Risco's current ratio.

B) The transactions would lower Safeco's financial strength as measured by its current ratio but raise Risco's current ratio.

C) The transactions would lower both firms' financial strength as measured by their current ratios.

D) The transactions would improve both firms' financial strength as measured by their current ratios.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the CEO of a large, diversified firm were filling out a fitness report on a division manager (i.e., "grading" the manager) , which of the following situations would be likely to cause the manager to receive a better grade? In all cases, assume that other things are held constant.

A) The division's basic earning power ratio is above the average of other firms in its industry.

B) The division's total assets turnover ratio is below the average for other firms in its industry.

C) The division's debt ratio is above the average for other firms in the industry.

D) The division's inventory turnover is 6, whereas the average for its competitors is 8.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

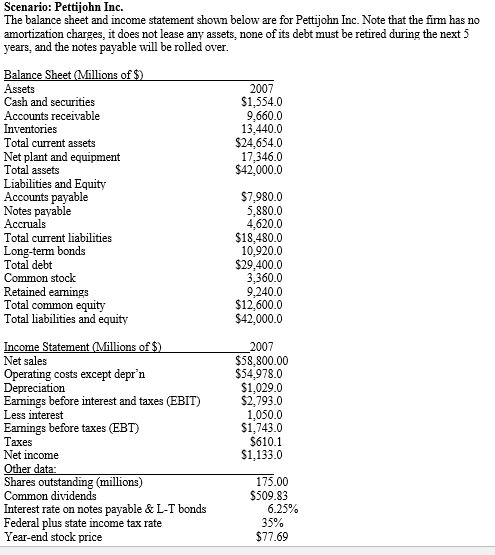

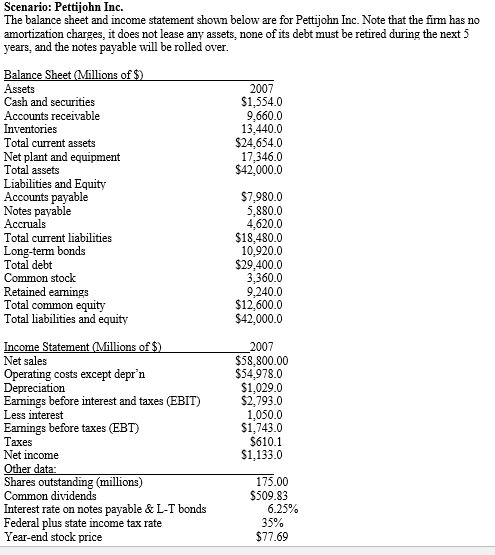

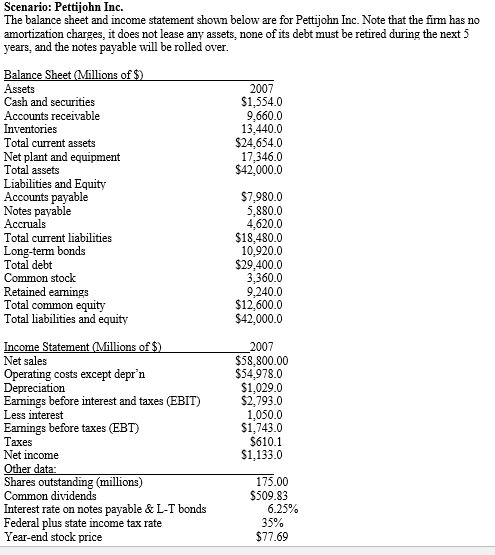

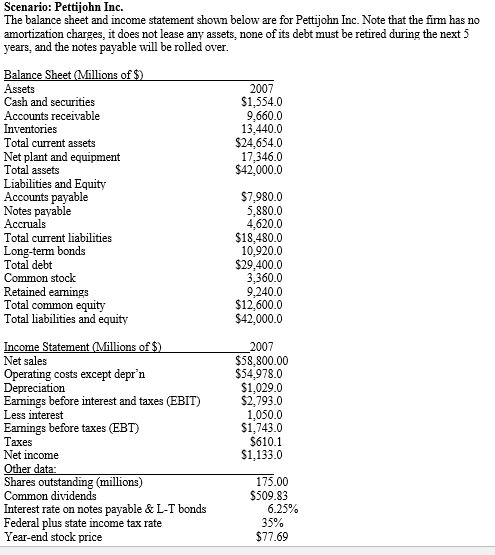

-Refer to Scenario: Pettijohn Inc. What is the firm's debt ratio?

-Refer to Scenario: Pettijohn Inc. What is the firm's debt ratio?

A) 51.03%

B) 56.70%

C) 63.00%

D) 70.00%

Correct Answer

verified

Correct Answer

verified

True/False

Although a full liquidity analysis requires the use of a cash budget, the current and quick ratios provide fast and easy-to-use measures of a firm's liquidity position.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many countries, including Canada, have replaced Generally Accepted Accounting Principles (GAPP) with International Financial Reporting Standards (IFRS) . To date, the U.S. has not made this change. What is a major reason why the U.S. has made this decision?

A) There is a fear that such a move would distort the analysis of a firm's performance over time.

B) Moving to this new accounting standard would impose major financial costs on U.S. firms during the current period of poor performance and economic uncertainty.

C) U.S. companies are, by and large, unaffected by activities in other jurisdictions, and as such, the change in accounting practices would result in only minor adjustments to financial statements.

D) The change to IFRS practices would have a major affect on financial statements, but investors do not rely heavily on financial statement information in making future investment decisions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's new president wants to strengthen the company's financial position. Which action would make it financially stronger?

A) Increase accounts receivable while holding sales constant.

B) Increase EBIT while holding sales constant.

C) Increase accounts payable while holding sales constant.

D) Increase notes payable while holding sales constant.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which statement about accounts receivable is correct?

A) If a security analyst saw that a firm's DSO was higher than the industry average and was also increasing and trending still higher, this would be interpreted as a sign of strength.

B) If a firm increases its sales while holding its accounts receivable constant, then, other things held constant, its DSO will increase.

C) There is no relationship between the DSO and the ACP. These ratios measure entirely different things.

D) If a firm increases its sales while holding its accounts receivable constant, then, other things held constant, its days' sales outstanding will decline.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Considered alone, which of the following would increase a company's current ratio?

A) an increase in net fixed assets

B) an increase in accrued liabilities

C) an increase in notes payable

D) an increase in accounts receivable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to Scenario: Pettijohn Inc. What is the firm's ROE?

-Refer to Scenario: Pettijohn Inc. What is the firm's ROE?

A) 8.54%

B) 8.99%

C) 9.44%

D) 9.91%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Mason Inc. had a total assets turnover of 1.33 and an equity multiplier of 1.75. Its sales were $195,000 and its net income was $10,549. The CFO believes that the company could have operated more efficiently, lowered its costs, and increased its net income by $5,250 without changing its sales, assets, or capital structure. Had it cut costs and increased its net income in this amount, by how much would the ROE have changed?

A) 5.66%

B) 5.95%

C) 6.27%

D) 6.58%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to Scenario: Pettijohn Inc. What is the firm's total assets turnover?

-Refer to Scenario: Pettijohn Inc. What is the firm's total assets turnover?

A) 0.90

B) 1.12

C) 1.40

D) 1.68

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to Scenario: Pettijohn Inc. What is the firm's inventory turnover ratio?

-Refer to Scenario: Pettijohn Inc. What is the firm's inventory turnover ratio?

A) 4.38

B) 4.59

C) 4.82

D) 5.06

Correct Answer

verified

Correct Answer

verified

True/False

The times-interest-earned ratio is one, but not the only, indication of a firm's ability to meet its long-term and short-term debt obligations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant, which of the following alternatives would increase a company's cash flow for the current year?

A) Pay down the accounts payables.

B) Reduce the days' sales outstanding (DSO) without affecting sales or operating costs.

C) Pay workers more frequently to decrease the accrued wages balance.

D) Reduce the inventory turnover ratio without affecting sales or operating costs.

Correct Answer

verified

Correct Answer

verified

True/False

Significant variations in accounting methods among firms make meaningful ratio comparisons between firms more difficult than if all firms used similar accounting methods.

Correct Answer

verified

Correct Answer

verified

True/False

To take full advantage of the credit term provided, management should try to lengthen the average payables period with cautions.

Correct Answer

verified

Correct Answer

verified

True/False

Profitability ratios show the combined effects of liquidity, asset management, and debt management on operating results.

Correct Answer

verified

True

Correct Answer

verified

True/False

The inventory turnover ratio and days sales outstanding (DSO) are two ratios that are used to assess how effectively a firm is managing its assets.

Correct Answer

verified

True

Correct Answer

verified

Showing 1 - 20 of 110

Related Exams