A) $684,600

B) $252,350

C) $258,000

D) $722,400

Correct Answer

verified

Correct Answer

verified

Multiple Choice

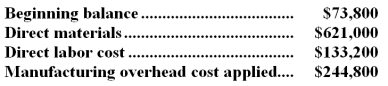

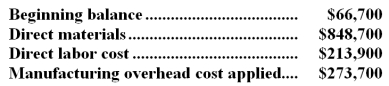

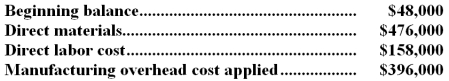

Jakubiak Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed to cost of goods sold at the end of the month.In January the company completed job J26E that consisted of 18,000 units of one of the company's standard products.No other jobs were in process during the month.The job cost sheet for job J26E shows the following costs:  During the month,the actual manufacturing overhead cost incurred was $252,360 and 17,000 completed units from job J26E were sold.No other products were sold during the month.

-The unadjusted cost of goods sold (in other words,the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for January is closest to:

During the month,the actual manufacturing overhead cost incurred was $252,360 and 17,000 completed units from job J26E were sold.No other products were sold during the month.

-The unadjusted cost of goods sold (in other words,the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for January is closest to:

A) $1,020,340

B) $999,000

C) $1,013,200

D) $1,072,800

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Harrell Company uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs.At the beginning of the year the company estimated its total manufacturing overhead cost at $400,000 and its direct labor-hours at 100,000 hours.The actual overhead cost incurred during the year was $350,000 and the actual direct labor-hours incurred on jobs during the year was 90,000 hours.The manufacturing overhead for the year would be:

A) $10,000 underapplied

B) $10,000 overapplied

C) $50,000 underapplied

D) $50,000 overapplied

Correct Answer

verified

Correct Answer

verified

Multiple Choice

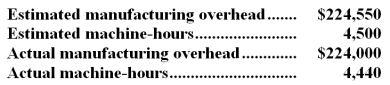

Acer Corporation,which applies manufacturing overhead on the basis of machine-hours,has provided the following data for its most recent year of operations.  The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year.

-The overhead for the year was:

The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year.

-The overhead for the year was:

A) $2,994 underapplied

B) $2,444 overapplied

C) $2,444 underapplied

D) $2,994 overapplied

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hudek Inc. ,a manufacturing company,has provided the following data for the month of July.The balance in the Work in Process inventory account was $20,000 at the beginning of the month and $10,000 at the end of the month.During the month,the company incurred direct materials cost of $50,000 and direct labor cost of $22,000.The actual manufacturing overhead cost incurred was $58,000.The manufacturing overhead cost applied to jobs was $56,000.The cost of goods manufactured for July was:

A) $138,000

B) $140,000

C) $130,000

D) $128,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

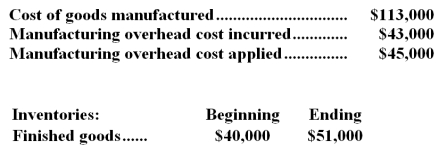

Minden Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed out to cost of goods sold at the end of the month.The company has provided the following data for June:  -The unadjusted cost of goods sold (in other words,cost of goods sold before adjusting for any underapplied or overapplied overhead) for June is closest to:

-The unadjusted cost of goods sold (in other words,cost of goods sold before adjusting for any underapplied or overapplied overhead) for June is closest to:

A) $102,000

B) $122,000

C) $100,000

D) $113,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

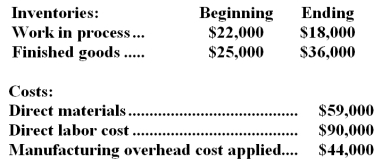

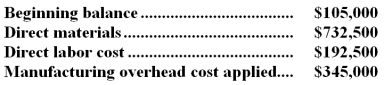

Roeschley Inc. ,which uses job-order costing,has provided the following data for June:  The unadjusted cost of goods sold (in other words,cost of goods sold before adjusting for any underapplied or overapplied overhead) for June is closest to:

The unadjusted cost of goods sold (in other words,cost of goods sold before adjusting for any underapplied or overapplied overhead) for June is closest to:

A) $186,000

B) $183,000

C) $197,000

D) $193,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Smothers Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed out to cost of goods sold at the end of the month.In June the company completed job Y52D that consisted of 23,000 units of one of the company's standard products.No other jobs were in process during the month.The job cost sheet for job Y52D shows the following costs:  During the month,the actual manufacturing overhead cost incurred was $274,850 and 4,000 completed units from job Y52D were sold.No other products were sold. The cost of goods sold that would appear on the income statement for June is closest to:

During the month,the actual manufacturing overhead cost incurred was $274,850 and 4,000 completed units from job Y52D were sold.No other products were sold. The cost of goods sold that would appear on the income statement for June is closest to:

A) $1,404,160

B) $242,850

C) $245,150

D) $1,403,000

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

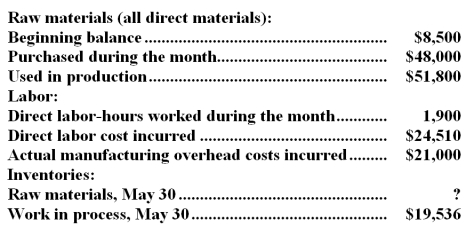

Dasilva Company had only one job in process on May 1.The job had been charged with $1,400 of direct materials,$6,192 of direct labor,and $5,712 of manufacturing overhead cost.The company assigns overhead cost to jobs using the predetermined overhead rate of $11.90 per direct labor-hour.During May,the activity was recorded:  Work in process inventory on May 30 contains $4,773 of direct labor cost.Raw materials consist solely of items that are classified as direct materials.

-The balance in the raw materials inventory account on May 30 was:

Work in process inventory on May 30 contains $4,773 of direct labor cost.Raw materials consist solely of items that are classified as direct materials.

-The balance in the raw materials inventory account on May 30 was:

A) $4,700

B) $43,300

C) $3,800

D) $39,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true? I.Overhead application may be made slowly as a job is worked on. II) Overhead application may be made in a single application at the time of completion of the job. III) Overhead application should be made to any job not completed at year-end in order to properly value the work in process inventory.

A) Only statement I is true.

B) Only statement II is true.

C) Both statements I and II are true.

D) Statements I,II,and III are all true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ashe Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed to cost of goods sold at the end of the month.In January the company completed job Z87W that consisted of 29,000 units of one of the company's standard products.No other jobs were in process during the month.The job cost sheet for job Z87W shows that the job's total cost was $1,850,200.During the month,17,000 completed units from job Z87W were sold.No other products were sold during the month.The unadjusted cost of goods sold (in other words,the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for January is closest to:

A) $1,850,200

B) $1,800,900

C) $1,084,600

D) $1,097,350

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paulson Company uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs.The company has provided the following estimated costs for next year:  Paulson estimated that 40,000 direct labor-hours and 20,000 machine-hours would be worked during the year.The predetermined overhead rate per machine-hour will be:

Paulson estimated that 40,000 direct labor-hours and 20,000 machine-hours would be worked during the year.The predetermined overhead rate per machine-hour will be:

A) $1.60

B) $2.10

C) $1.00

D) $1.05

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crumrine Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed to cost of goods sold at the end of the month.In January the company completed job A04F that consisted of 26,000 units of one of the company's standard products.No other jobs were in process during the month.The total manufacturing cost on job A04F's job cost sheet was $1,162,200.The manufacturing overhead for the month was underapplied by $3,120.During the month,18,000 completed units from job A04F were sold.No other products were sold during the month. -The unit product cost for job A04F is closest to:

A) $44.70

B) $64.57

C) $64.74

D) $32.30

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lewis Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed to cost of goods sold at the end of the month.In October the company completed job P70C that consisted of 25,000 units of one of the company's standard products.No other jobs were in process during the month.The job cost sheet for job P70C shows the following costs:  During the month,the actual manufacturing overhead cost incurred was $334,500 and 13,000 completed units from job P70C were sold.No other products were sold during the month.

-The unadjusted cost of goods sold (in other words,the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for October is closest to:

During the month,the actual manufacturing overhead cost incurred was $334,500 and 13,000 completed units from job P70C were sold.No other products were sold during the month.

-The unadjusted cost of goods sold (in other words,the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for October is closest to:

A) $715,000

B) $1,375,000

C) $1,270,000

D) $709,540

Correct Answer

verified

Correct Answer

verified

True/False

Job-order costing is used in those situations where units of a product are homogeneous,such as in the manufacture of sugar.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What document is used to determine the actual amount of direct labor to record on a job cost sheet?

A) Time ticket

B) Payroll register

C) Production order

D) Wages payable account

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A process cost system is employed in those situations where:

A) many different products,jobs,or batches of production are being produced each period.

B) where manufacturing involves a single,homogeneous product that flows evenly through the production process on a continuous basis.

C) a service is performed such as in a law firm or an accounting firm.

D) full or absorption cost approach is not employed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

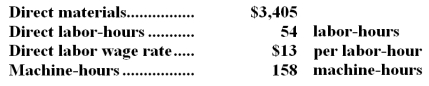

Job 607 was recently completed.The following data have been recorded on its job cost sheet:  The company applies manufacturing overhead on the basis of machine-hours.The predetermined overhead rate is $14 per machine-hour.The total cost that would be recorded on the job cost sheet for Job 607 would be:

The company applies manufacturing overhead on the basis of machine-hours.The predetermined overhead rate is $14 per machine-hour.The total cost that would be recorded on the job cost sheet for Job 607 would be:

A) $4,107

B) $6,319

C) $3,432

D) $4,863

Correct Answer

verified

Correct Answer

verified

Essay

Mauffray Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed to cost of goods sold at the end of the month.In February the company completed job M73U that consisted of 20,000 units of one of the company's standard products.No other jobs were in process during the month.The job cost sheet for job M73U shows the following costs:  During the month,the actual manufacturing overhead cost incurred was $358,200 and 19,000 completed units from job M73U were sold.No other products were sold during the month.

Required:

Determine the unadjusted cost of goods sold (in other words,the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for February.Show your work!

During the month,the actual manufacturing overhead cost incurred was $358,200 and 19,000 completed units from job M73U were sold.No other products were sold during the month.

Required:

Determine the unadjusted cost of goods sold (in other words,the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for February.Show your work!

Correct Answer

verified

11eaaee8_677a_d45e_933a_73f20e6bf9be_TB5186_00

Correct Answer

verified

Multiple Choice

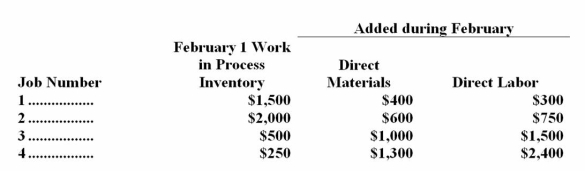

The Garnet Company uses a job-order costing system.The following data were recorded for February:  The beginning finished goods inventory was zero.Overhead is charged to jobs at the rate of 140% of direct labor cost.Jobs 1,2,and 3 were completed during February and transferred to finished goods.Job 3 has been delivered to the customer.

-The cost of goods sold during February was:

The beginning finished goods inventory was zero.Overhead is charged to jobs at the rate of 140% of direct labor cost.Jobs 1,2,and 3 were completed during February and transferred to finished goods.Job 3 has been delivered to the customer.

-The cost of goods sold during February was:

A) $5,100

B) $3,000

C) $12,120

D) $8,120

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 114

Related Exams